From the time we are little, we hear cautionary tales about the importance of saving and investing. Rarely, however, does someone ever take the time to explain the underlying reasons why. Instead of being motivated by the positives, many of us approach investing apprehensively —from a place of fear or confusion rather than confidence.

But confidence is key—especially in light of the current retirement landscape. More than any previous generation, it will be up to you to fund most of your retirement income. Even into the early 1980s, pensions (where employers fund a large investment plan to provide workers with guaranteed automatic monthly payouts in retirement based on each individual’s salary and years of service) remained by far the most common retirement plan.

Today, however, only 17% of private-sector workers have access to a pension.1 And for wealthy individuals, Social Security will probably replace only about 25% of the income they will need in retirement.2 This means nearly three-quarters of your retirement will need to be funded by your savings and investments. So, where do you begin?

When you’re first starting out, investing can feel a bit intimidating. It begs the question: ‘Why risk it?’ Why not just enjoy life to the fullest now, and deal with an unknown future when you get there? Also, it can be hard to motivate yourself to save and invest now for your retirement which could be 35+ years in the future.

While it’s true that you can avoid market risk by not investing, there are many other risks—such as inflation or the potential of outliving your assets—that can cause far more financial harm than short-term market setbacks. Put simply, investing serves as the engine that helps fund your lifestyle throughout your life and it can also help you provide a legacy for future generations.

Time and patience are your allies

You don’t need extensive financial knowledge or expertise to be a smart and savvy investor—just a commitment to follow a thoughtful plan. Start with a specific goal or two such as purchasing a home or financing the retirement you’ve always envisioned.

Write those goals down and include a specific monthly amount you want to save for each goal. This will help make them more tangible and motivate you to stay disciplined while investing (even a small amount) each month towards achieving them.

How does investing work so well? It’s all thanks to the power of compounding over time. Compounding is the process by which you earn a return not only on your original investment, but also on all the interest, dividends and capital gains your investment accumulates over time. It’s like the snowball effect—where your wealth grows exponentially.

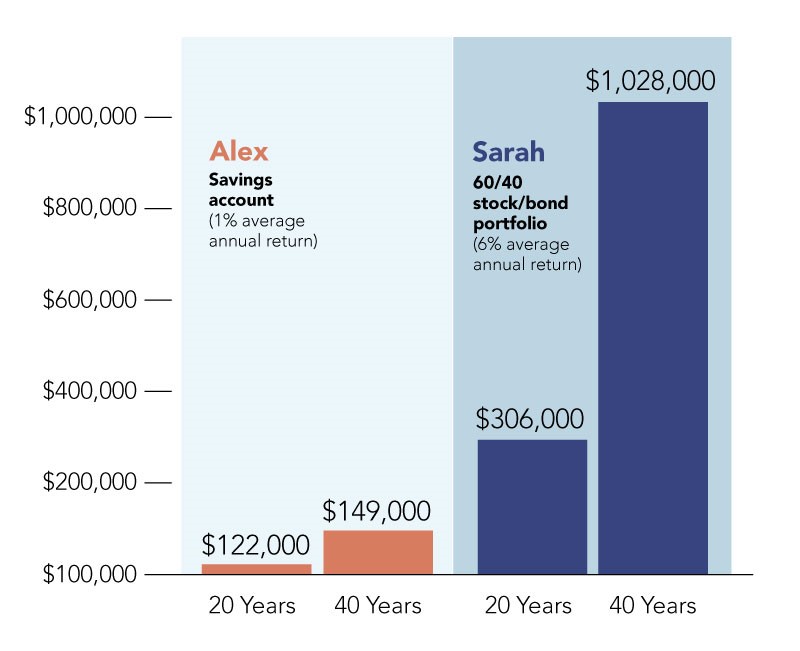

Hypothetical growth of $100,000 over time

Just take a look at how compounding can affect two different $100,000 portfolios. Uncomfortable with taking on any investment risk, Alex invests in an FDIC-insured savings account earning a 1% average annual return. Sarah, on the other hand, opts to invest in a moderate risk (60% stocks and 40% bonds) portfolio that provides a 6% average annual return.

After 20 years, Sarah’s investment would be worth 2.5x what Alex’s is worth. And after 40 years, Sarah would have more than a million dollars—nearly 7x the value of Alex’s savings account. While certainly the amount you are able to put away each month matters, the sooner you start matters even more. The longer the snowball has to run downhill, the more opportunity it has to get bigger.

Building your investment portfolio

With thousands of stocks, bonds, mutual funds and ETFs available, it’s easy to feel a bit confused and more than a little overwhelmed. How do you go about choosing the right investments for your particular goals and needs?

First, take some time to learn the fundamental differences between the various types of investments available to you:

- Stocks (or equities)—are securities that represent fractional ownership of a company. Shares of stock are traded on a public exchange and fluctuate in value based on the specific company’s current performance, and anticipated future performance, general economic conditions, and what other investors are willing to pay to own shares.

- Bonds (or fixed income)—are debt securities issued by a corporation or a governmental entity. In exchange for using your money, the borrower agrees to pay you back your principal plus interest according to a pre-determined schedule.

- Mutual funds—are investments where many investors pool their money into a diverse portfolio of stocks, bonds or other securities. The fund is managed by a professional money manager, and shareholders participate proportionally in the fund’s gains and losses.

- ETFs—exchange traded funds are similar to mutual funds in that they pool investor assets to buy a diverse portfolio of securities that typically track a particular index (like the S&P 500). But ETFs trade on an exchange like stocks do; making them generally easier, faster, and less expensive to buy and sell.

- Alternatives—non-traditional investments such as private equity, hedge funds, real estate and commodities help increase a portfolio’s diversification and potentially reduce volatility since they often don’t move in the same direction as traditional assets.

It’s important to understand that, over time, different asset classes (U.S. stocks, bonds, foreign markets, commodities and real estate) don’t always move in the same direction. When you diversify across asset classes and investment types, you help reduce your overall risk. In fact, the mix of investment types you select (asset allocation and diversification) has a far greater impact on the performance of your portfolio than the specific individual stocks and bonds you own.

6 keys to investing successfully

We all have different goals, time horizons, biases and fears. Accordingly, there’s no one-size-fits-all way to invest. But for those just getting started, these five basic rules should help:

- Have specific goals—don’t just invest to make money.

- Remember, that time is your greatest ally.

- Don’t let short-term setbacks derail long-term plans.

- Without taking on some risk, there’s little chance of reaching your goals. And the further away a goal, the more risk you can usually afford to take.

- Effective asset allocation and diversification can help to smooth out the ups and downs of the stock market.

- A trusted advisor can help quantify your goals and turn them into an action plan.

We’re here to help

Thoughtful investing takes time. Even the savviest investment decisions don’t deliver immediate results. So, stick with your plan and stay focused on the big picture—your long-term goals. Talk to your BLBB advisor today at 215-643-9100 about your needs, wants, and wishes. Together we can build a plan, or reevaluate an existing plan, and assess investment strategies.

1U.S. Bureau of Labor Statistics, National Compensation Survey, 2019

2Center on Budget & Policy Priorities, “Policy Basics: Top Ten Facts about Social Security,” August 2020