As expected, this negative news on the coronavirus front resulted in increased equity market volatility and caused the major US equity indices to trend downwards after approaching their February 2020 highs earlier this month. As we noted in prior updates, it is hard to conceive of a scenario where the development of an effective vaccine and/or medical treatment for Covid-19 occurs in record time and with no setbacks along the way, and where the US economy promptly and completely rebounds from the lockdowns with no lasting negative impacts or hiccups. As progress is made on the Covid-19 front, or as the economy shows additional signs of recovery, we would expect financial markets to move ahead. Conversely, when the economy stumbles, or there is negative news related to the virus, we would expect financial markets to respond somewhat negatively.

As we see it, the US economy and financial markets will eventually recover – just as they always have in the past when faced with numerous unprecedented and extremely disruptive events and situations. We believe in the strength of the US economy and the resilience and ingenuity of American workers and businesses. We also know that recovery will most likely come in fits and starts and with its own set of unanticipated challenges. The recovery process can be frustrating and discouraging, especially when the tidbits of good news seem to be immediately followed by bad news. But, if history serves as our guide, the global pandemic event and subsequent recovery period should, in retrospect, also turn out to be a period of great opportunity and positive change.

Of course, the global pandemic and subsequent economic fallout are not the only issues now weighing on financial markets. Increasing tensions between China and the US are also worrisome – particularly since they now spread beyond trade and encompass human rights and the treatment of Hong Kong. In an effort to stave off China’s recent exertion of authority over Hong Kong, the US Senate unanimously passed two bills designed to punish China and encourage China to allow Hong Kong to retain its autonomy. China recently revealed portions of the national security law it intends to impose upon Hong Kong. Unfortunately, it looks like this law will override Hong Kong’s independent legal system and impinge upon civil liberties. China also now finds itself in a dispute with India and, for the first time in 45 years, about 60 Indian and Chinese soldiers just died in skirmishes along the Indian/Chinese border. New Chinese construction activity in this disputed border area threatens to further escalate this conflict.

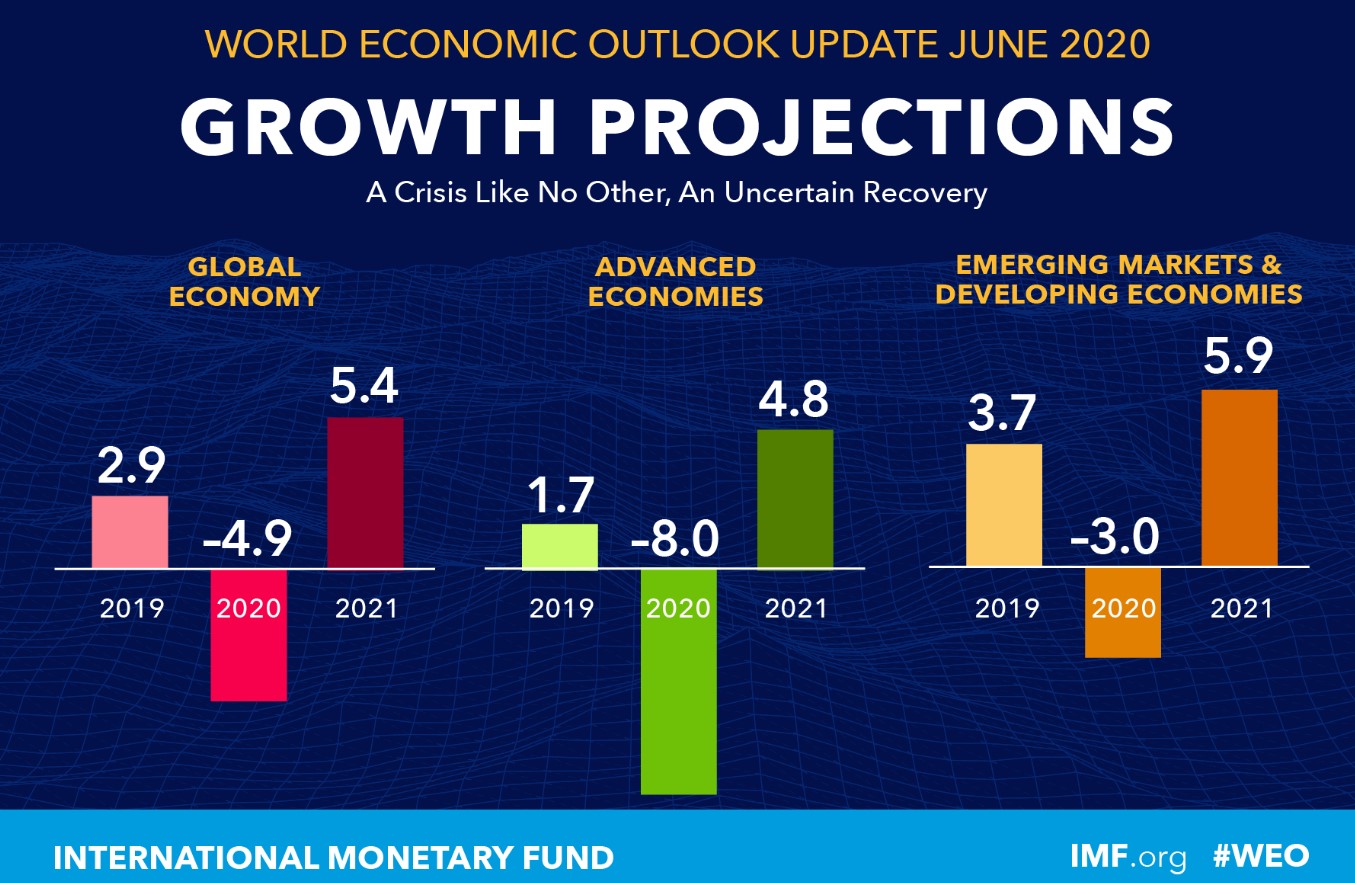

Also this month, the International Monetary Fund (IMF) released its updated “World Economic Outlook” in which it predicts global GDP will shrink by 4.9%. this year. Over the last two months, these projections worsened – in April, the IMF predicted global GDP would be -3% in 2020 and +5.8% in 2021. Extremely high levels of uncertainty, significantly reduced global trade, rising public debt levels, and the likelihood of ongoing social distancing requirements all contribute to this deteriorating outlook.

Over the last couple of weeks, there seems to be a growing realization that the road back to normalcy from the global pandemic might not be as easy or as quick as originally thought. It is possible additional monetary and/or fiscal stimulus may be necessary in the US and around the world. Fortunately, the governments and central banks of many economies are willing to be supportive during this difficult time. We urge investors to stay patient and not become discouraged. Behind the scenes, business owners, workers, banks and governments are all striving for an economic rebound and recovery while scientists and medical professionals from around the world are collaborating like never before to find a vaccine and effective treatments for Covid-19. Numerous human trials are well underway and a viable vaccine by early 2021 still looks to be a realistic goal.

If you would like to learn more about how we view the current situation, please reach out to your BLBB financial advisor.

As you may recall, the CARES Act offered a variety of Covid-19 financial relief options for taxpayers. This relief included a temporary waiver of the annual required minimum distribution (“RMD”) obligation that generally applies to retirement account (IRAs, 401Ks, 403Bs) owners who are over the age of 72 or who are the recipients of an inherited IRA.

There was some confusion about how this RMD relief might apply to RMDs that were taken earlier in the year before this waiver was announced. Usually, a retirement account distribution can be “undone” by returning the withdrawn funds to the retirement account within 60 days. However, many retirement account owners had already taken RMDs earlier in 2020 and more than 60 days before this new waiver was announced.

In order to correct this situation, the IRS announced in Notice 2020-51 that the usual 60-day window for returning RMDs will now be extended to August 31, 2020. The IRS further noted, that any RMD repayments are “not subject to the one rollover per 12-month period limitation and the restriction on rollovers for inherited IRAs.”

If you already took an RMD from your BLBB IRA account this year and you want to undo it, contact your financial advisor at your earliest opportunity for assistance. You may also want to check in with your tax advisor first before deciding how you will proceed to ensure that your decision is most beneficial to your specific tax situation.

Unfortunately, the coronavirus pandemic and ensuing lockdowns has resulted in high levels of economic stress for many in our community. Extremely high unemployment, coupled with the increased food needs of families and individuals who can no longer rely on regular food systems at safety net institutions like schools, summer programs, and workplaces, has substantially increased food insecurity. According to a recent Northwestern University report cited in Bloomberg, the coronavirus pandemic caused levels of food insecurity to double in the U.S. in April, and triple for families with children.

As businesses and institutions shift to reopening, there are still many people who are suffering – especially families with children. Most local summer programs have been cancelled and the families who rely on these programs are now without childcare assistance and much-needed food supplies. Even though in-person volunteer efforts are curtailed, there are still many ways you can help your neighbors who are struggling. Here is a list of area organizations helping with COVID-19 related food needs.