In summing up our Q2 Economic Update, we concluded that:

“While it’s encouraging to see the economy once again firing on all cylinders, the markets responding positively, and a number of favorable economic trends emerging, we’re watching developments very closely—not just for the specter of inflation, but because a number of factors all have the potential to significantly impact the U.S. economy over the balance of the year.”

That same cautious optimism continues to govern our current outlook, despite a wide range of potential storm clouds on the horizon which we are watching carefully. Thus far, the resilience of the U.S. economy has been nothing short of remarkable—and we see no imminent red lights flashing—but the following are some of the key variables we are tracking on your behalf.

Tax Policy Update

Recently, the House Ways & Means Committee officially released proposed tax law changes which are being considered as part of the fiscal 2022 budget reconciliation bill. While many of the proposals are in line with previous expectations (seeking to raise corporate tax rates, as well as income and wealth transfer taxes on the wealthiest Americans), there were some surprising additions. Key provisions of the proposed legislation that individual taxpayers should be aware of include1:

- An increase in the top marginal tax rate from 37% to 39.6%, and a lowering of the income threshold for that top bracket from $628,300 to $450,000 for a married couple filing jointly.

- A 3% surtax (separate from the current 3.8% net investment income tax) which would be imposed on individuals with a modified adjusted gross income (MAGI) in excess of $5 million as well as trust income and capital gains in excess of $100,000.

- An increase in the top capital gains tax rate from 20% to 25% for individuals with income in excess of $400,000.

- A return to the lifetime estate and gift tax exemption levels (around $6 million adjusted for inflation) that were in place prior to their doubling to $11.7 million under The Tax Cuts and Jobs Act of 2017.

- Individuals with more than $10 million total in retirement accounts and who are in the 39.6% income tax bracket would be prohibited from making additional contributions to any tax- advantaged accounts other than their employer-sponsored plan.

- Those with aggregate balances of more than $10 million in their retirement accounts would also be required to take annual RMDs (even if not yet of RMD age) that amount to ½ of the total account value that exceeds $10 million. And if your aggregate retirement account bal- ance exceeds $20 million, you’ll be required to distribute Roth assets until the balance falls below that threshold.

- Taxpayers with incomes in excess of $400,000 will also be prohibited from enacting a Roth IRA conversion on either their traditional IRAs or employer-sponsored plans.

- Any new grantor trusts established after the law is enacted would be subject to inclusion in the gross estate of the grantor. Existing grantor trusts would be grandfathered, but any new contributions made to those trusts would subject them to the new rule.

While these are still early days, and many of these provisions will likely be modified in the weeks to come, they provide insights that can help you and your BLB&B Advisor begin to prepare for— whether accelerating some 2022 income into this year, using the current lifetime gift exemption amount to gift assets before year-end, or exploring a Roth conversion before the window potentially closes.

We will continue to monitor the legislative process and keep you informed as these initial proposals firm up over the coming weeks.

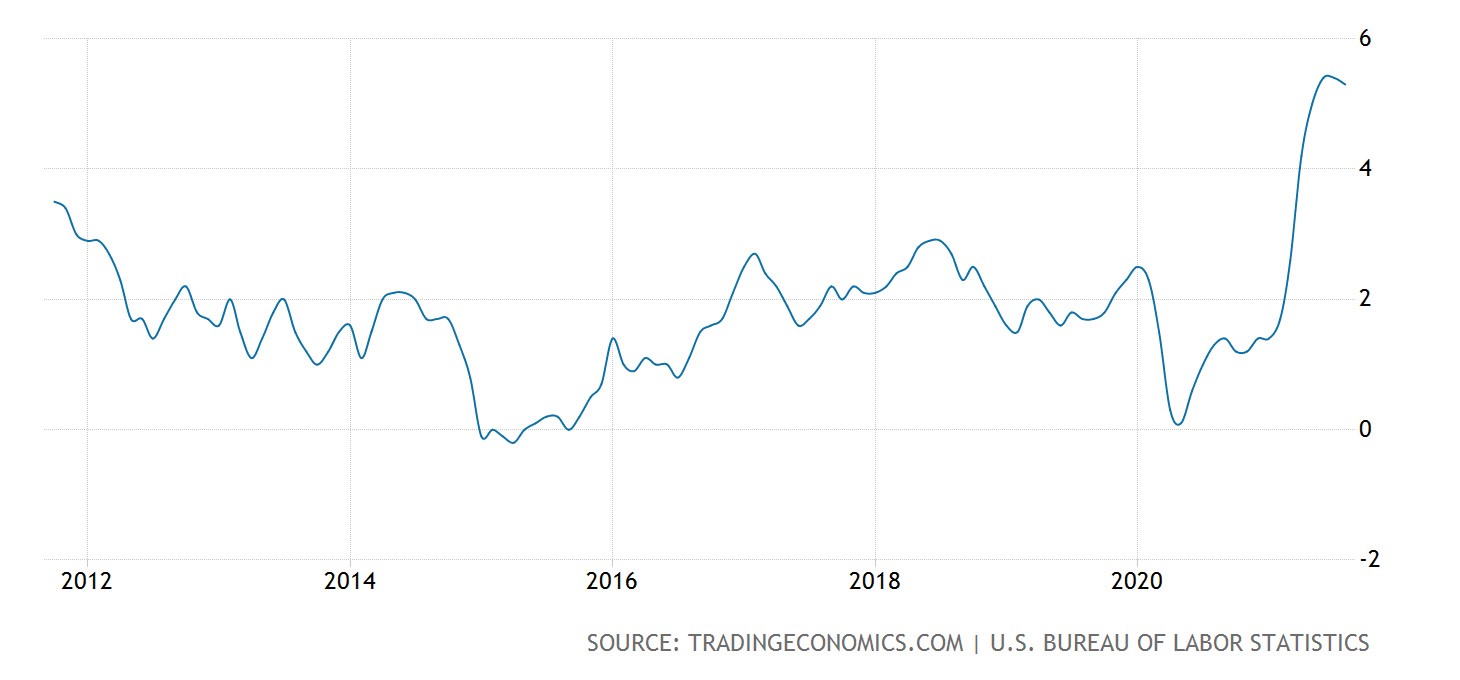

Tracking inflation

As discussed in last quarter’s update, we are also continuing to keep a close eye on inflation. After the July all-items Consumer Price Index (CPI) came in at an unexpectedly high 5.4% over the previous 12-month period, consumer prices in August ticked down slightly to an annual rate of 5.3% and just 4.3% excluding food and energy (both readings lower than consensus estimates)— helping to quell some of Wall Street’s growing concern.2

Annual U.S. Inflation Rate (Core CPI) August 2011 – August 2021

Yet whether this recent surge in inflation is transitory (a residual of the pandemic) or persistent still remains to be determined. Some of the most recent data gives us cause for continued concern:

- Wages at the lower end of the spectrum are rising at their fastest rate in over a decade.3

- Rising demand combined with ongoing pandemic-related delays and closures are extending transit times and dramatically driving up global shipping costs. Asia to U.S. ocean shipping rates are currently 5x higher than they were just one year ago, and Asia to Europe ocean shipping costs are 8x higher.4

- The Case-Shiller National Home Price Index is up 19.1% on a year-over-year basis, marking the largest annual gain in home prices since the index began in 1987. Also, as home prices rise, rents tend to follow suit (generally lagging by 12 – 18 months). Given that housing costs comprise about 40% of core CPI, there is at least some evidence that some inflationary pressures may not be so transitory.5

- The Producer Price Index (PPI) which tracks the selling prices received by domestic producers of goods and services was up 0.7% in August and 8.3% over the past year.6

- And according to The Conference Board, U.S. consumers now expect inflation to clock in at a +6.8% rate of growth a year from now.7

Despite these readings, the Federal Reserve has clearly signaled a willingness to tolerate a higher than desired rate of inflation—at least for a while—based on a belief that current pressures are temporary and will eventually begin to wane. Becoming too hawkish too quickly could stifle growth and ultimately prove more detrimental to achieving their dual mandate of a steady 2% inflation rate and full employment (i.e., an unemployment rate of around 4%). Doing nothing, on the other hand, could increase the potential for a messy combination of slow growth combined with rising prices (i.e., ‘stagflation’).

There is, however, some dissension appearing in the Fed ranks. At least five regional Fed presidents have recently voiced their concerns about maintaining a too dovish approach to rising inflation.

The labor market

August brought unexpectedly low hiring data—with employment increasing by just 235,000 for the month (less than half the average 586,000 monthly increase seen so far this year).8 Economists were expecting the August jobs number to come in at around 720,000, but, the prolific Delta variant likely weighed on hiring and kept some prospective employees from returning to the active workforce. In fact, there’s a growing concern that the Delta variant could further derail the

U.S. and global economic recoveries.

Despite the weaker than expected job creation data, wages continued to rise (up 0.60% in August from the prior month).8 Many employers have begun offering signing bonuses rather than higher hourly wages to prospective employees—a strategy that could help prevent wage-push inflation.

An end to stimulus

A number of COVID-relief programs either have or soon will be coming to an end:

- Federal unemployment benefits (implemented in response to the pandemic) expired in early September.

- The repayment pause on student loans was recently extended, but is set to expire on January 31st.

- The long-standing eviction moratorium was recently lifted, as well as the moratorium on foreclosure of federally-backed mortgage properties.

In addition, Federal Reserve Chairman Powell recently announced Fed plans to begin tapering back its $120 billion/month Treasury and mortgage bond buying program before the end of the year.9 The purpose of the program has been to help lower longer-term interest rates and encourage borrowing and spending. However, Powell also indicated no intention to begin increasing the federal funds rate, stating:

”We will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment and inflation has reached 2% and is on track to moderately exceed 2% for some time. We have much ground to cover to reach maximum employment, and time will tell whether we have reached 2% inflation on a sustainable basis.”

While the Fed agrees that the inflation mandate has been met, it believes the employment goals have not yet been met and need “substantial further progress” before it will begin increasing interest rates.

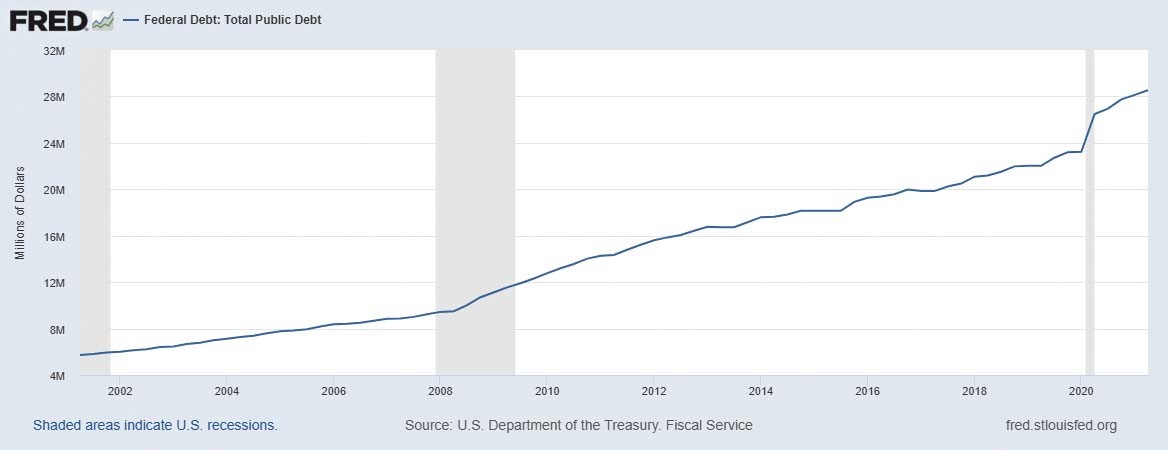

Is another debt crisis brewing?

The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations—including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments

Total Federal Debt (2001 to 2021)

In addition to the brewing debt crisis, uncertainty abounds surrounding the impact of the COVID Delta variant (and other future variants) on U.S. and global markets, the long-term implications our messy departure from Afghanistan will have on the global balance of power, and whether several of China’s largest real estate developers could be on the verge of default—a situation that could send ripples throughout world markets.

But perhaps one of the biggest unanswered questions remaining is whether the remarkably strong performance of the U.S. equity markets since mid-2020 has been reflective of reality, or simply a case of borrowing from future potential returns? If the latter, we very well may experience somewhat muted equity returns over the coming years.

Only time will tell whether the current levels of market growth are sustainable. In the meantime, we are keeping a close eye on all these potential headwinds in an effort to identify any storms that may be brewing. If you have any specific questions about our market views, opinions and expectations, or if you would like to talk about your personal financial situation, please reach out to your BLBB financial advisor at 215-643-9100.

1. Build Back Better Act: Details & Analysis of the $3.5 Trillion Budget Reconciliation Bill,” Tax Foundation, September 2021

2. “Consumer Price Index Summary,” Bureau of Labor Statistics, September 14, 2021

3. “Debate Seethes Ahead of Fed Meeting,” Bloomberg, September 21, 2021

4. “Shipping & Freight Cost Increases,” Freightos, September 2021

5. “S&P Dow Jones Indices Press Release,” August 31, 2021

6. “Producer Price Index News Release Summary,” Bureau of Labor Statistics, September 10, 2021

7. “The Conference Board Consumer Confidence Index®, August 31, 2021

8. “Bureau of Labor Statistics Employment Data News Release,” September 3, 2021

9. Fed Chair Jerome Powell Remarks, Jackson Hole Economic Policy Summit, August 2021