While You’re on Vacation This Summer, Your Portfolio Will Be Hard at Work

It’s that time of year again. Snowbirds are heading north, school is out, and families are spending quality time together. It’s also the season when, according to popular belief, financial markets cool down and traders follow the advice of the proverb that tells them to “sell in May and go away.”

It looks like they might have taken that advice. In early June, CNN reported on its website that investors were “exiting the stock market in droves,” selling more stocks than they bought for five consecutive weeks.1 CNN attributed this exodus to not only traders taking summer siestas, but also investors who are worried about the economy, interest rates, and the upcoming presidential election.

But CNN left out a few important facts.

The Stock Market Likes July

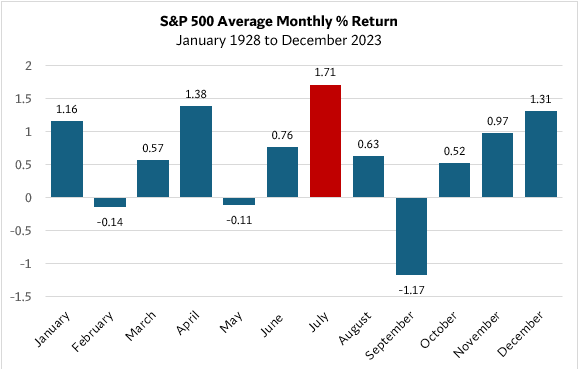

The notion that summer doldrums make the stock market less attractive is a myth. While it is true that July is historically the calmest month of the year, according to the CBOE Volatility Index (VIX), it also holds the distinction as producing the S&P 500 Index’s largest monthly gains, averaging 5% each July since the Index was created in 1928. Data also shows that the S&P 500 Index generally moves higher from the beginning of June through the end of August, rewarding investors who are disciplined participants throughout the summer months.2

The NASDAQ 100 Index (NDX) tells a similar story, with the best trading days of the year occurring in the first week of July and a strong track record of returns for the month. The NDX has posted positive returns every July for the past 16 years, gaining an average of 4.6% each time.3

If you have been investing for a while, you might be looking ahead a few months, just waiting for the other shoe to drop when the so-called September Effect kicks in and punishes the market. But keep in mind those drawdowns have historically been recaptured in months, not years. Since 1929, the average Bear Market, when the market declines 20% or more, has ended in 9.6 months.4

Of course, as we head into the latter half of 2024, anything can happen. For now, though, U.S. equity markets, as measured by the S&P 500 and the DJIA, continue trading close to the all-time levels they recently achieved. The S&P, for example, has been posting record-breaking highs on a regular basis, driven largely by strength in tech stocks. After losing ground in April, the S&P gained 4.8% in May and 4.3% in June, bringing total return to 15.3% for the first half of the year and 25.6% for the preceding 12 months.5

Lower Rates Lift Stocks

As you may recall several years ago, the Fed implemented an aggressive series of interest rate increases to stem the rapidly escalating inflationary pressures in the US economy. In June 2022, for example, the US inflation rate hovered around 9% despite the Fed initiating its first rate increase in years in March. Fairly rapidly, the Fed took the federal funds rate from 0% to a range of 5.25 – 5.50% where it has been since July 2023. As you may also recall, as interest rates rose bond prices fell ultimately resulting in 2022 turning out to be the worst year for the common 60% stock/40% bond asset allocation.

This time around, however, we are facing the opposite scenario as inflationary pressures in the US economy continue to recede and investors and economists anticipate a fed funds rate reduction could be in the offing before year-end. At its mid-June meeting, the Fed unanimously voted to continue holding rates steady for now but also issued a projection of 1 rate cut before year-end.

When interest rates fall, bond prices rise. One reason this occurs is that new bonds offer less attractive interest rates, or coupons, than bonds already on the market. Accordingly, investors bid up the prices of previously issued bonds bearing higher coupon rates. Often, the prices of bonds in this type of scenario will even exceed the usual par value of $1000 per bond. In anticipation of an upcoming rate increase, short term treasury bonds yields have already begun to pull in slightly.

Lower interest rates have broad implications for the economy and financial markets, including these three possible consequences investors should be aware of this summer.

- First, lower rates reduce the cost of borrowing for U.S. businesses, since they can issue new corporate bonds at lower prevailing interest rates. This improves corporate balance sheets as companies refinance their debt and it may improve the attractiveness of those companies enough to boost their stock valuations. It’s the law of supply and demand: A limited supply of stocks and strong demand in the market buoys prices.

- Second, investors could become disenchanted with lower interest rates offered by U.S. Treasury bonds and decide they would be better off investing in “risk assets,” i.e., the stock market. Treasury bonds are considered “risk-free” investments because they are backed by the full faith and credit of the U.S. government, which has a long history of not defaulting on its debts. For the last couple of years, Treasuries have been attractive investments offering around 5% – 5.5% in yield for very low risk. Depending upon the state of the US economy and the Fed’s response in the coming 6 – 18 months, however, the relative attractiveness of Treasuries could very well shift.

- U.S. investors have more than $6 trillion stashed away in low-risk money market funds, which is an all-time high. If rates are cut and yields on those funds slip substantially below their current level of roughly 5%, investors could start dipping their toes into the higher risk equity market for more appealing return potential. Even a trickle of that amount flowing into the stock market could contribute to a rising tide that lifts all boats.

So, when will interest rates start to recede? Canada became the first G7 country to cut its policy rate in early June. The Bank of England, on the other hand, announced on June 20, 2024, it would continue to hold its interest rate steady at 5.25% although also acknowledged the rising likelihood of a rate cut in the coming few months. In the U.S., the most recent signals from the Fed indicate there is likely to be one rate reduction later in 2024, followed by more aggressive easing in 2025. Inflation is moving in the right direction, with the Consumer Price Index essentially flat and core CPI, which eliminates food and energy, increasing just 0.16% in May versus April. This brought year-over-year inflation to 3.3%, still well above the Fed’s long-term target rate of 2.0% but getting closer. So, it was no surprise when the Federal Open Market Committee decided to leave its target policy rate at 5.25% to 5.50% at its June meeting. The FOMC’s next meeting is July 30 and 31.

Buying Low, Selling High

Nobody wants to be stuck in a down market during the summer or any other time of year, especially if you are nearing retirement. But, in the unlikely event the scenarios outlined above fall to materialize and the market hits a speed bump this summer, there is a consolation prize. Long-term investors can practice the art of buying low. The old expression that “stocks are on sale” might not be completely reassuring, but it is appropriate for investors who work with experienced financial advisors and understand its potential advantages.

Instead of attempting to time the market, dollar cost averaging invests a fixed amount in a security, several securities, or the entire market, at regular intervals regardless of what the market is doing at the time. The same amount buys more shares when stock prices fall and fewer shares when prices rise. Dollar cost averaging removes emotion from investing and reduces the risk of dramatic losses that can occur when lump sums are invested all at once. The flipside is that it forfeits the potentially higher returns that are possible if you invest large sums at just the right time—a feat that is rarely accomplished, even by professional portfolio managers.

Beware of Misinformation

In addition to sensational news reports about financial markets, this summer could also deliver up a barrage of disinformation aimed at influencing the outcome of the presidential election in November. Advancements in technology and artificial intelligence allow bad actors to create video and audio clips that look and sound authentic but are actually “deepfakes.” To make matters worse, social media platforms and news providers continue to use sophisticated algorithms to feed consumers a steady diet of opinions and perspectives that fall squarely into alignment with their own personal views. They create echo chambers that repeat the same narratives over and over again in different ways, making us feel good about our chosen candidate and keeping us hooked. But they do little to broaden our understanding of the candidates’ policy proposals or their stance on complex economic and social issues. Fortunately, though, history shows that presidential elections, regardless of which candidate wins, generally have a negligible effect on financial markets.

No one can accurately predict what the coming months will bring to our financial markets. But we can offer three suggestions with some degree of confidence.

- Let your portfolio continue working for you this summer.

- Consume information carefully, especially when it comes to the market and elections.

- Enjoy some rest and relaxation if you can. You deserve it.

See you in September.

1 CNN Business June 5, 2024.

2 The Motley Fool August 3, 2023. Toronto Globe and Mail, July 29, 2023.

3 Business Insider/Yahoo Finance, June 6, 2024.

4 Kiplinger / Ned Davis Research, May 22, 2024.

5 S&P Dow Jones Indices July 1, 2024.