Laura W. Brewer, Esq.

Principal, Financial Advisor

lbrewer@blbb.com

Just about two months ago, on March 8, we sent out a mid-quarter economic update. Our decision to do so was precipitated by a flurry of issues hitting US and global financial markets all at once – Russia’s invasion of Ukraine, rapidly rising inflation, heightened financial market volatility, the ongoing pandemic and associated supply chain disruptions, and the imminent prospect of tightening monetary policy. Fast forward to May 11, and we find ourselves still plagued by these same economic and geopolitical issues and with no end in sight. As you would expect, this has many investors spooked and, on some particularly ugly days, has them rapidly exiting the financial markets. The Volatility Index (VIX), which measures the amount of volatility in US equity markets, has been on the rise since early January. While it is nowhere near the all-time high level reached at the start of the pandemic in March 2020, it is higher than it has been for most of the last few years and higher than it was for the nine years prior to the pandemic. In other words, we are used to a low volatility world and this extended period of heightened volatility is more than a little uncomfortable for most investors.

Accordingly, we are writing to you again in an attempt to help you put recent events in perspective and hopefully soothe frayed nerves.

First off, as we noted in our March update (and it bears repeating here), attempting to time the market is usually the wrong decision. There are a number of reasons why including:

1. There are a plethora of data illustrating that missing just a few days in the markets can, and usually will, negatively impact your portfolio’s performance over time. For example, according to a recent CNBC article,1 over the last 20 years, the S&P 500 has provided investors an average annual return of 6%. However, those investors who missed the 20 best trading days in the market over the last 20 years have an average annual return of just 0.1%! It’s better to stay invested and ride out the inevitable bumps along the way rather than attempt to time markets by jumping in and out every time things get dicey. Also, keep in mind we are talking about your investable assets and not your emergency fund, your savings account, or any other money you expect to need in the coming 1 – 2 years.

2. Volatility is just a normal and healthy part of the investing process and something investors must be willing and able to tolerate at least to some degree.

3. Oftentimes, the best days in US equity markets follow on the heels of some of the worst performing days. When an investor gives into their nerves and jumps out of the market on a terrible down day, they not only lock in their losses but also will most likely miss the market rebound because they are sitting in cash. In effect, those who follow this path often find they have sold at the low and repurchased at the high – the exact opposite of what an investor wants to do!

Second, while the volatility we are now experiencing is unnerving, it is far from unprecedented. For example, since the start of the year, and particularly over the last month, we’ve seen a number of wild swings – up 1000+ points one day in the DJIA and then down 1000 or so points a day or two later. In the moment, it feels like we’ve never been in this scary place before. But, we have – many times.

So far this year, the S&P 500, on 3 different trading days, has been down more than 3%. Market history can help put this recent extreme volatility in perspective. For example, similar levels of US equity market volatility occurred on 5 days in 2018, 2 days in 2015, 6 days in 2011, and 5 days in 2010. Also, during recent bear market years (2008, 2009, and 2020), we had an average of 17 trading days with >3% declines.2 The takeaway here is that while it’s unpleasant to be in the midst of a volatile, unpredictable, and negatively trending market, history tells us this volatility eventually will subside and the markets will recover.

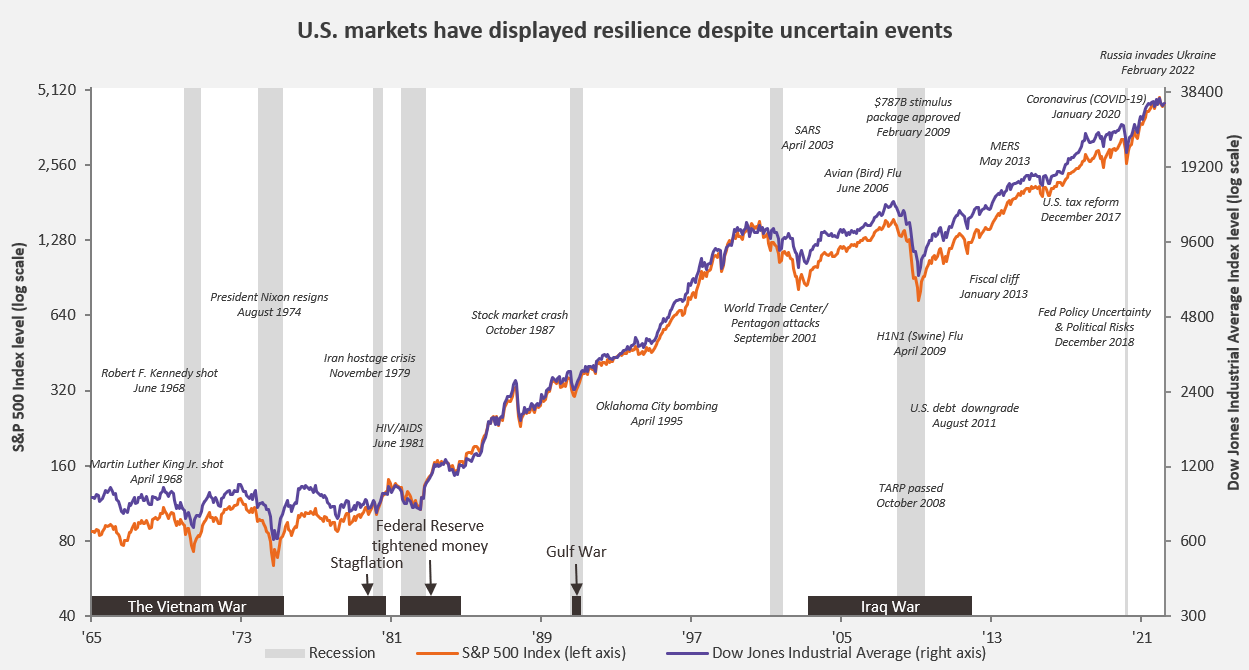

Third, US financial markets have a long and successful history of coping with domestic and international events of all sorts (wars, terror attacks, nuclear threats, disease, famine, coups, financial meltdowns, leadership/regime changes, etc.). This chart of the S&P 500 illustrates just some of the challenging events it has faced over the years and how it has responded.

Source: Wells Fargo Investment Institute and Bloomberg

It is quite clear that while our financial markets are not impervious to what is happening around them they are amazingly resilient and over time recover and advance.

Fourth, and for only the 2nd time in over 4 decades, the US stock and bond markets are both trending downwards almost as if they are in lockstep with each other.3 The S&P 500 is off 16.75% since the start of the year while the Bloomberg US Aggregate Bond Index is down just about 10%. It’s been an uncomfortable experience for many investors to see what they thought was their “safe” asset class (bonds) drop at the same time and almost to the same extent as their “risky” asset class (stocks). Rising interest rates spurred on by the Fed as it tries to reduce inflationary pressures building in the US economy are primarily to blame for the significant drop in bond prices since the start of the year. Given recent US inflation data and growing expectations that a higher than normal inflation rate will stick around for longer than originally anticipated, bond yields are on the rise and prices for bonds that were already issued but with lower yields are falling.

Fifth, keep in mind the US economy and financial markets are now grappling with how to begin unwinding the overly accommodative monetary policies which date back to the start of the financial crisis about 15 years ago. At the start of the financial crisis in 2007, the Federal Reserve’s balance sheet was just shy of $1 trillion. Now, 15 years later, the Fed’s balance sheet is hovering around $9 trillion. During this time period, the Fed heavily relied upon quantitative easing to support the US economy during the financial crisis and again during the pandemic. More specifically, the Fed injected significant amounts of money into the US economy in an attempt to restore order to the US financial system, prevent the US economy from falling into a deeper recession or depression, and to eventually stimulate the US economy.

Now, with a balance sheet that is 9X higher than it was 15 years ago and an economy plagued by soaring inflation, the Fed has embarked upon a program to increase interest rates and reduce its balance sheet. This has investors nervous. They are worried the Fed will either act too slowly and fail to adequately control inflation or act too quickly and aggressively thereby stunting economic activity and causing the US economy to fall into a recession. The prospect of a period of stagflation (an unpleasant combination of high inflation and slow economic growth) is also a possible concern.

Fortunately, it appears the prospect of a recession is probably not as dire as some pundits would have us believe. Economies usually do not have an unemployment rate well below 4% when they are entering a recession. Similarly, the most recent Leading Economic Index data projects 3% US GDP growth in 2022 – yet another sign we are probably not about to enter a recessionary period.4

At this point, you may be wondering what, if anything, you can do? We have some thoughts:

1. If you are feeling worried or nervous, please let us know! Your BLBB financial advisor is here to help you through this rough patch (215-643-9100). They can serve as a voice of calm and reason amidst all the alarming news headlines and will talk with you about your asset allocation mix and reassess your risk tolerance. They can also help you update your financial plan and keep you on track.

2. If you do not already have an adequately funded emergency or reserve account, consider establishing one. In times of significant volatility and market upheaval, like now, having a liquid account that is invested in a money market or high yield savings account (and thus not really subject to any volatility) can serve several purposes: (a) this money acts as a hedge in down markets because it does not fall in value when the stock or bond markets are falling; (b) it is a readily accessible source of funds should you unexpectedly need money during a bad market; (c) it enables you to keep your investable assets invested so that they have the opportunity to recover in value when markets rebound; and (d) it provides peace of mind.

3. Don’t get caught up in the moment. Rather, try to take a more expansive and longer-term view of what is happening and why.

4. Take a deep breath and recognize it’s ok to feel nervous or worried about what is happening. In fact, it would be a little odd if you didn’t feel this way! But, also keep in mind that based on our historical perspective, we are confident it won’t always be like this and these issues will pass.

If you are not yet receiving our newsletters, subscribe here.

Not working with a BLBB Financial Advisor already? Click here to connect with us.

1https://www.cnbc.com/2022/04/22/stocks-are-dropping-what-should-you-do-.html

2 https://www.edwardjones.com/us-en/market-news-insights/stock-market-news/stock-market-weekly-update

3https://www.wsj.com/articles/stocks-and-bonds-are-falling-in-lockstep-at-pace-unseen-in-decades-11651551170

4https://www.conference-board.org/topics/us-leading-indicators

©2025 BLB&B Advisors, LLC. - PRIVACY POLICY – SITE USE POLICY – DISCLAIMER – ADV Part 2A – FORM CRS