Featured Articles

Featured Articles

Election years tend to make investors fidgety like there’s opportunity or danger on the horizon and something must be done about it. But caution is advised as we approach Election Day this November. In most cases, politics have no place in the portfolios of long-term investors.

Here are five reasons politics and portfolios make such “strange bedfellows”:

1.The Economy Rules

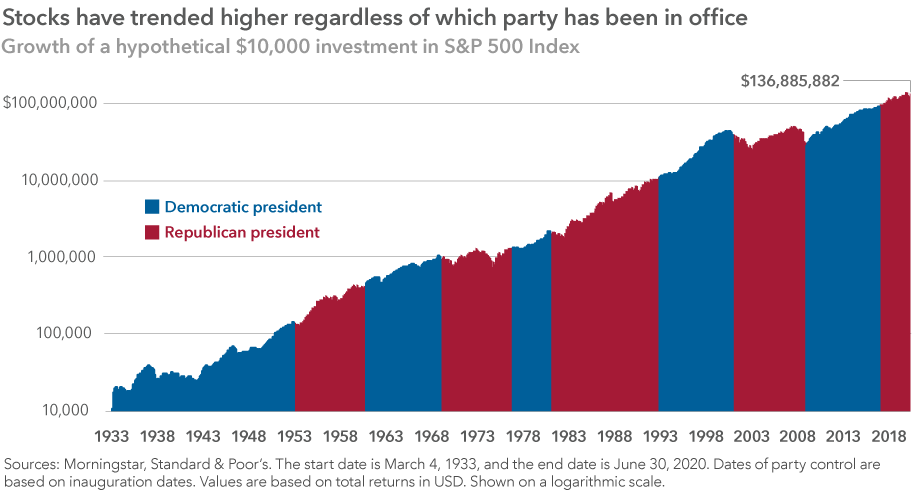

In the early 90s, Bill Clinton’s campaign advisor James Carville famously said, “It’s the economy, stupid.” His admonition still holds merit today, as witnessed by the fact that it is republished in newspaper headlines just about every election season. History shows that presidential elections have a weaker, less direct relationship with financial market returns than geopolitical developments, corporate earnings, and hard U.S. economic data such as inflation, employment, and GDP. Election cycles do tend to spark volatility in the markets, but it is usually temporary, and then markets revert to their long-term patterns (see chart).

2. Congress is Critical

The success of any president’s platform rests largely on the shoulders of Congress, typically boosted when one political party controls both the executive and legislative branches of government. Although this situation happens often, single-party control is usually temporary, according to the Pew Research Center.1 There has been just one presidency since 1969 where a single political party retained control past the midterm elections that followed. That was in the late 1970s during President Jimmy Carter’s term in office, when fellow Democrats controlled the House and Senate during the 95th and the 96th Congress.

3. The Market Shifts

History also shows that financial markets tend to be relatively weak in the first half of the year following a presidential election year as investors adopt a wait-and-see attitude until uncertainty over the new president’s economic platform subsides.2 When the likelihood of those policies gaining traction becomes clearer, the market typically strengthens. Of course, past performance is no guarantee of future results, and any number of factors can disrupt the pattern, including the Fed’s action or inaction. There are also countless other theories about election cycles and their effect on market returns, many of which reach conflicting conclusions. In our view, none are convincing enough to justify timing the market.

4. Promises Are Broken

When one candidate appears to be the strong frontrunner in a presidential race, it can be tempting to take campaign promises at face value and run with them—getting ahead of the market by investing heavily in one sector, industry, or asset class that might benefit from that candidate’s platform. However, promises are made to be broken, even when there is a sincere effort to keep them. Two of the most memorable but unkept campaign promises are George H. W. Bush’s 1988 statement “Read my lips: No new taxes” and Barack Obama’s pledge, “If you like your health care plan, you can keep it."

5. Seeing Is Not Believing

The upcoming presidential election marks the first time U.S. voters and investors will be confronted with artificial intelligence (AI) tools that are sophisticated enough to produce realistic looking (but fake) videos of candidates doing and saying unflattering things. The Franklin Templeton Institute calls these deepfake videos “weaponized misinformation.”3 As these technologies become more readily available, foreign interests will almost certainly use them to influence voters. So, it is increasingly important to consume political news with a healthy degree of skepticism. You can’t believe everything you see, read, or hear.

Don't hesitate to engage with your BLBB financial advisor about the intersection of portfolios and politics.

1 https://link.edgepilot.com/s/fe3c732f/ra6gvkFTJ0Kvy7UiQK5HnQ?u=https://www.pewresearch.org/short-reads/2021/02/03/single-party-control-in-washington-is-common-at-the-beginning-of-a-new-presidency-but-tends-not-to-last-long/

2https://link.edgepilot.com/s/f5e92f8d/Q2Zsl_A9CEacd6VnwZ-cwA?u=https://www.barrons.com/articles/secret-stock-market-election-years-55b112cd

3 https://link.edgepilot.com/s/df36118d/rshIX-JSkEOvS9ls7ftEcg?u=https://www.franklintempleton.com/articles/2024/strategist-views/consider-this-2024-elections