Quarterly Economic Review 4th Quarter 2024

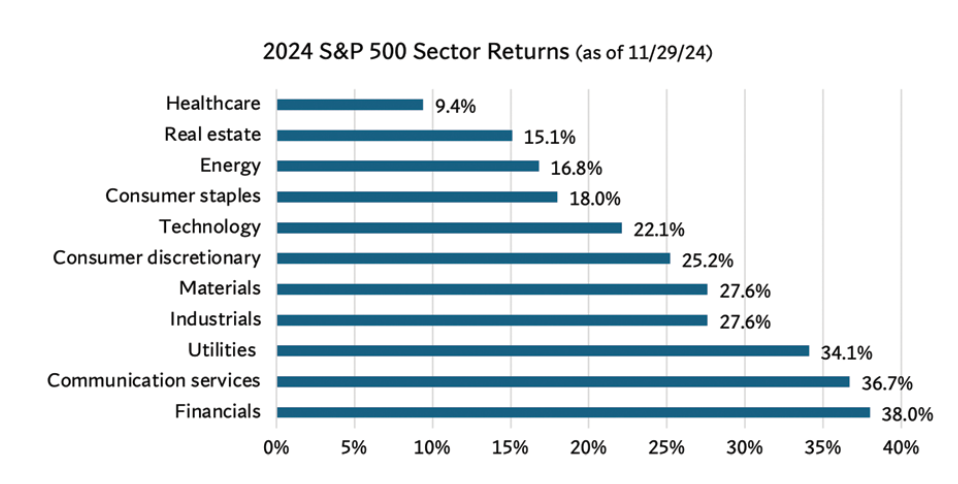

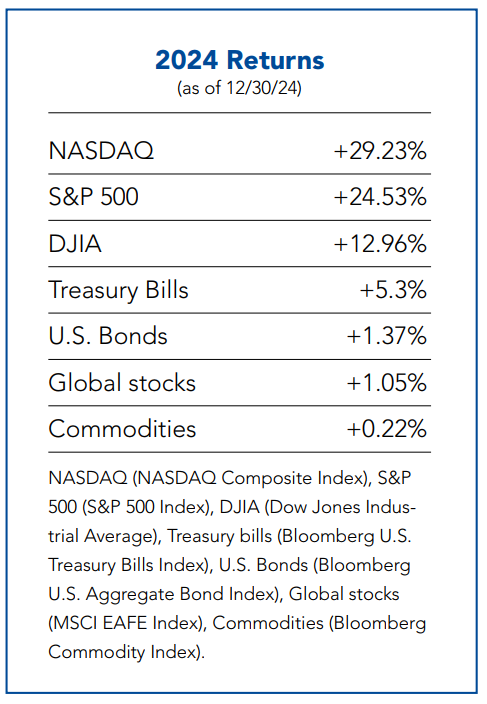

As we close out the year, we take this opportunity to reflect on 2024 and look ahead to what may be in store in 2025. By almost all accounts, and as illustrated in the chart below, 2024 was a good year for financial markets and the U.S. economy.

Source: S&P Dow Jones Indices U.S. Sector Dashboard

The S&P 500 gained about 23% between 1/1/24 and 12/30/24 and even briefly crossed over the 6000 level in early to mid-December. This was only the fourth time in the past century the S&P 500 achieved such exceptional gains in two consecutive years. Throughout the year, this key equity market index exhibited strength and surprisingly low volatility even in the face of major events like the withdrawal of President Biden from the election, uncertainties around the Federal Reserve’s next interest rate moves, and the expansion of the war in the middle east.

One of the key reasons for U.S. equity market strength in 2024 was the strong economy. The U.S. Gross Domestic Product (GDP), a key measure of economic activity, appears set to clock in a robust 2.7% growth rate for 2024 and a respectable 2% for 2025.1 Healthy employment data, strong consumer demand, and ongoing wage growth were all contributors to our strong economy in 2024.

Despite the relative market calm and strength during what was a fairly tumultuous year for national and international news, the latter part of December did feature some unexpected volatility. While the traditional “Santa Claus” rally was stingy at best early on in December, it disappeared mid-month immediately after the Federal Reserve announced its monetary policy decision. This decision included brief commentary suggesting 2025 would likely feature fewer interest rate cuts than originally anticipated. In a weird twist, strong economic activity in the U.S. (a good thing) was at least partially responsible for this decision. Although the Fed reduced the benchmark federal funds rate by 25 basis points on December 18, bringing its target range down to 4.25% - 4.50%, after the meeting, Chairman Powell hinted there will be fewer cuts in the coming year. He further noted, policymakers will be “more cautious as we consider further adjustments.”

The Fed is always attempting to balance key variables and economic goals including maintaining decent economic growth (around 2 – 2.5% GDP growth), a reasonable unemployment rate (around 4 – 4.5%), and a manageable inflation rate (2%). For now, anyways, the Fed is not willing to aggressively reduce interest rates in 2025 because the risks of doing so in such a strong economic environment include a potential return to a higher inflationary environment.

Recent inflation data in the U.S. has some concerned the Fed’s inflation reduction efforts–which were so effective in quickly reducing inflation from the 9% rate experienced in the summer of 2022–have now stalled.2 In fact, inflation ticked up slightly in December’s data release (from 2.6% to 2.7%) while the core inflation rate (excludes food and energy prices) has been stuck at 3.3% since August. Overall, while energy and fuel oil prices have moderated over the last 12 months, the costs of shelter, medical care, and services have risen between 3.7% and 7.1% during this same time frame.3 There is also some concern inflation could reaccelerate in 2025; particularly if significant tariffs are imposed on many imported goods and/or aggressive deportations result in a labor shortage.

As you would expect, the U.S. equity market slumped following the Fed’s decision with the sharpest declines seen in the Dow Jones Industrial Average. This rate cut, despite inflation remaining above target, raises an important question about the Fed’s strategy. Standard & Poor’s suggests the continued easing is a preventative measure designed to keep economic growth from stalling rather than an attempt to supercharge spending.

One positive note is that consumer spending remains healthy, which reduces the risk of a recession in 2025 to about 25%, according to the S&P. Supporting this optimistic outlook, consulting giant McKinsey & Company reported that consumer confidence rebounded to pre-pandemic levels in the fourth quarter, encouraged by rising wages and the results of the November elections.

Cash on the Sidelines Means Caution

Another potential driver of financial market performance in 2025 is the massive amount of cash still sitting on the sidelines at the end of 2024. Relatively attractive yields on “cash

management” instruments like short-term U.S. Treasuries, CDs, and high-yield savings accounts have investors still holding onto more liquid investments than usual. It is likely their higher “cash” holdings also reflect a certain level of caution. In November, investors had $7 trillion in money market funds while corporate coffers swelled to $4.4 trillion, both record highs.4

Warren Buffett is also cautious. His core holding, Berkshire Hathaway, held $277 billion in cash and short-term U.S. Treasuries in early December—its largest cash position ever. One possible reason for this defensive posture is the steep valuations seen in U.S. stocks today. The S&P 500 Index’s P/E ratio has increased by 25% over the past two years, according to Goldman Sachs.

Forecasts for More Modest Returns

Immediately after the November elections, on 11/6/24, U.S. equity markets surged. The NASDAQ and Dow Jones Industrial Average both had their 4th-best daily point gains in history while the S&P 500 had its 6th-best one day point gain.5 In the wake of that initial burst of enthusiasm, however, has come a dose of reality as the potential for trade wars and some other less than friendly to business policies could be imposed in 2025. That being said, many market prognosticators are still predicting 2025 could be another good year in U.S. financial markets. The Goldman Sachs equity team, for example, recently issued a broader, long-term outlook that calls for 10% annual returns from U.S. stocks and steady economic growth in 2025.6

Similarly, JP Morgan is projecting that the average 60/40 stock and bond portfolio will return an average of 6.4% per year over the next 10 to 15 years, driven by capital investment, advances in artificial intelligence, automation, and fiscal activism (government tax and spend policies).7

Geopolitical Issues from China to DC

There is a deep interconnection in global markets today, as demonstrated when a rate decision in Japan was one of the catalysts that triggered a sharp U.S. stock market decline in August.

Accordingly, we pay close attention to a number of major economies, including China's economy— the world's second largest after the U.S. For one, youth unemployment has reached sky-high levels, with 16.1% of Chinese adults aged 16-24 unemployed as of November. While this rate may have eased a little since then, it remains uncomfortably high. Such widespread unemployment among young people has the potential to sew the seeds of discontent and possibly devolve into social upheaval.

Closer to home, Republicans have secured control of the White House and Congress for at least the next two years, which could lift some of the regulatory pressure on corporations and extend current tax laws. But narrow majorities in the House and Senate mean that passing meaningful legislation will most likely take an unusual level of cooperation.

And while we are monitoring the threat of U.S. tariffs, which could lead to a full-blown trade war, it is not clear if those threats are sincere or simply a form of saber rattling.

The larger issue is our country’s soaring debt, which now stands at roughly $33 trillion. You can only kick the can down the road for so long and the time is nearing to begin addressing this “elephant in the room”.

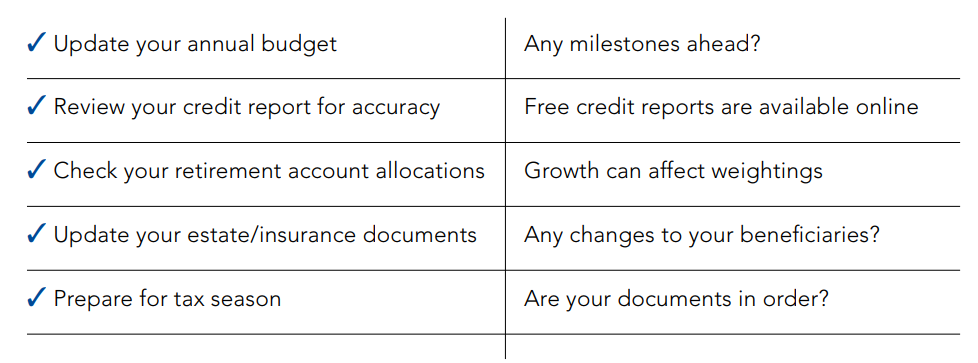

Consider a Quick Financial Checkup

The new year will undoubtedly bring new challenges and new opportunities for growth. To start off on the right foot, consider performing a quick spot check on your finances. Your BLBB advisor is always available to help:

Working Together in 2025

- https://www.conference-board.org/research/us-forecast

- https://www.bankrate.com/banking/federal-reserve/latest-inflation-statistics/

- https://www.bls.gov/news.release/cpi.nr0.htm

- Reuters and Bloomberg

- https://www.investors.com/news/stock-market-forecast-2025-donald-trump-dow-jones-sp500-nasdaq/

- Goldman Sachs, November 26, 2024

- JPMorgan press release October 21, 2024