Quarterly Economic Review 3rd Quarter 2025

Economically, the U.S. currently finds itself in something of a tug-of-war.

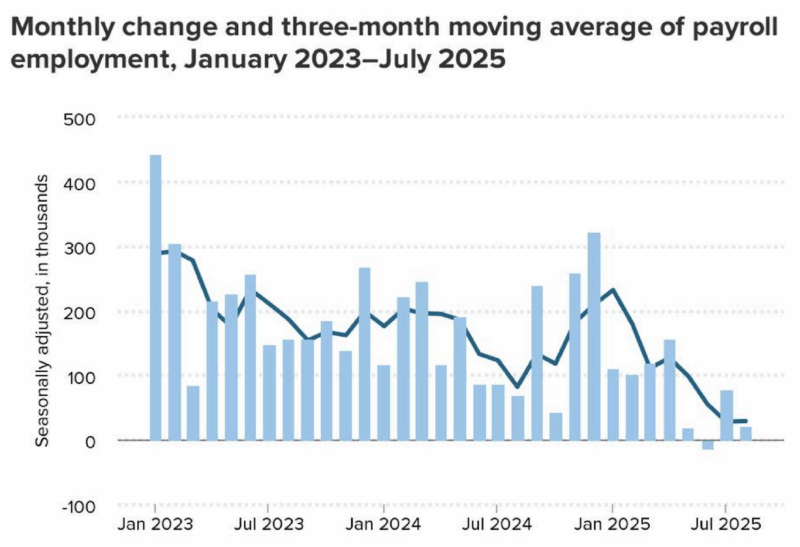

On one hand, the latest jobs data (released on September 9th) shows the U.S. economy added fewer jobs (22,000) than expected in August – with the unemployment rate holding steady at 4.3%.1 However, downward revisions to annual data indicate the economy added nearly a million fewer jobs (from April 2024 through March 2025) than previously reported. This suggests the U.S. labor market may be weaker than initially thought.

Source: Economic Policy Institute analysis of Bureau of Labor Statistics current employment data, September 5, 2025.

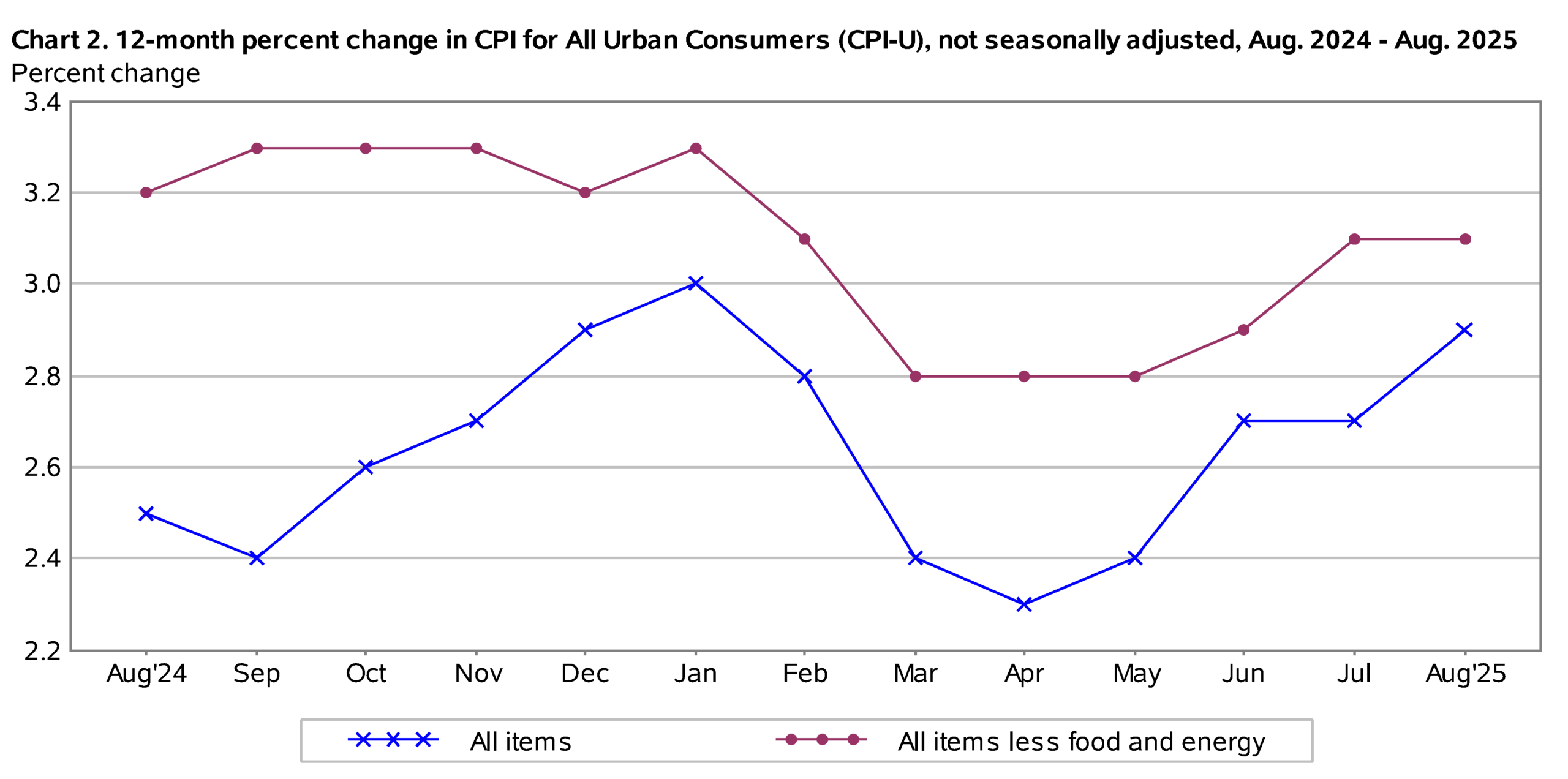

At the same time, the latest Personal Consumption Expenditures (PCE) price index rose to 2.9% in July – the highest level since February signaling persistent inflationary pressures above the Fed’s 2% target. July’s Consumer Price Index (CPI) came in at a year-over-year rate of 2.9%.2

The Fed challenge

This mixed bag poses a difficult challenge for the Federal Reserve which has a "dual mandate" from Congress to achieve both stable prices AND maximum employment, primarily by adjusting interest rates.

- Stable Prices: to achieve price stability, the Fed aims to keep inflation at a target rate, which it has set at 2% per year, measured by the PCE price index.

- Maximum Employment: the Fed’s other goal is to maintain the highest level of employment the economy can sustain without generating excessive inflation.

The dilemma for policymakers? Cutting interest rates could help drive employment, but might also worsen inflation. Holding interest rates steady, on the other hand, while helping to tamp down inflation could potentially push the economy into recession – despite continuing solid GDP growth:

- Real gross domestic product (GDP) increased at an annual rate of 3.8% in the second quarter of 20253

- The Atlanta Fed is now projecting real GDP growth of 3.9% as of October 1, 20253

Given these conflicting signs, the Fed is expected to continue its cautious approach to making monetary adjustments – despite growing political pressure from the Trump administration to drastically lower rates. The latest 25 basis point rate cut following the September 17 meeting now brings the target fed funds rate down to a range of 4.00%-4.25% (with the possibility of one additional 25 basis points cut coming before the end of the year).

Overseas, we’re seeing a similar lack of economic clarity. While the International Monetary Fund is projecting an upwardly revised 3.0% rate of global growth for 2025 and a 3.1% growth rate for 2026 (reflecting stronger financial conditions and fiscal expansion), China’s industrial production is grew 5.2% year-over-year in August 2025. This is the slowest pace of growth since last November – driven by a spate of interruptions due to extreme weather.

Three key economic issues on the horizon

A number of notable economists have begun expressing concerns about the U.S. economic outlook, highlighting a number of risks that lie ahead. They are cautioning that the long-term impact of recent policy changes (including tariffs and immigration reforms), as well as escalating global geopolitical tensions, are just beginning to be ascertained. At BLBB, we will be carefully monitoring and assessing the following:

- Trade and Tariff Impacts: Higher tariffs are expected to start adversely impacting real GDP growth throughout the second half of 2025 and into 2026, as the costs continue working their way through the supply chain. On the plus side, businesses are gaining increased clarity on tariff policies to help them navigate more effectively. But as their existing inventory stores are depleted, margin pressures are likely to rise as are consumer prices.

- Economic Outlook Concerns: Some forecasts project significant economic headwinds for 2026, with a potential GDP decline of 1.7% and broad sectoral declines. Adding to the challenge is an expectation that long-term interest rates may stay elevated, with 10-year Treasury yields remaining above 4.5% through 2026.

- Policy Uncertainty: Here at home, the U.S. economy continues striving to adjust to sweeping economic policy changes and unpredictable tariffs. In addition, divergent global growth paths are creating additional economic planning complexity.

Keeping a close eye on India

Earlier in the year, as part of their “America First” campaign, the Trump administration imposed a 25% tariff on a wide range of goods imported from India. Effective August 27th, those tariffs were doubled to 50% in retaliation for India's continued purchases of discounted Russian oil.

Rather than forcing India to back away from Russia, however, the recent move seems to have driven the two nations even closer. Bilateral trade between India and Russia reached a record $68.7 billion for the year ended March 2025. And on September first, just days after the latest tariffs, Prime Minister Modi and President Putin held a bilateral meeting to reaffirm their “special and privileged strategic partnership".

Why is this a significant concern for the U.S.? India boasts the world's largest consumer market and is projected to soon be the world's third-largest economy. It’s a market that presents enormous future growth opportunities for U.S. businesses. Furthermore, India's economy is expected to continue growing at one of the fastest rates globally – making the country both a highly attractive destination for U.S. investment and a major source of investment capital coming into the U.S. economy. While not as closely watched as China or Russia, India is a critical player on the world’s economic stage – presenting three significant challenges:

- Strategic Partnership at Risk: The escalating tariffs are straining what was previously a warm U.S.-India relationship – potentially pushing India (a key democracy partner in countering China's influence in the Indo-Pacific region) closer to Russia.

- Counterproductive to Ukraine Goals: The growing geopolitical friction comes amid Trump's efforts to secure a ceasefire in Ukraine; making India's continued support for Russia especially problematic for U.S. foreign policy objectives.

- Economic Diversification: India is using the current disharmony to diversify away from dependence on the U.S., which could have long-term implications for American economic and strategic influence throughout South Asia.

In effect, these tariffs appear to be backfiring strategically. Not only are they strengthening the very Russia-India partnership the U.S presumably wants to weaken, but they’re also having a negative impact on America's broader Indo-Pacific strategy which relies heavily on Indian cooperation.

Looking abroad

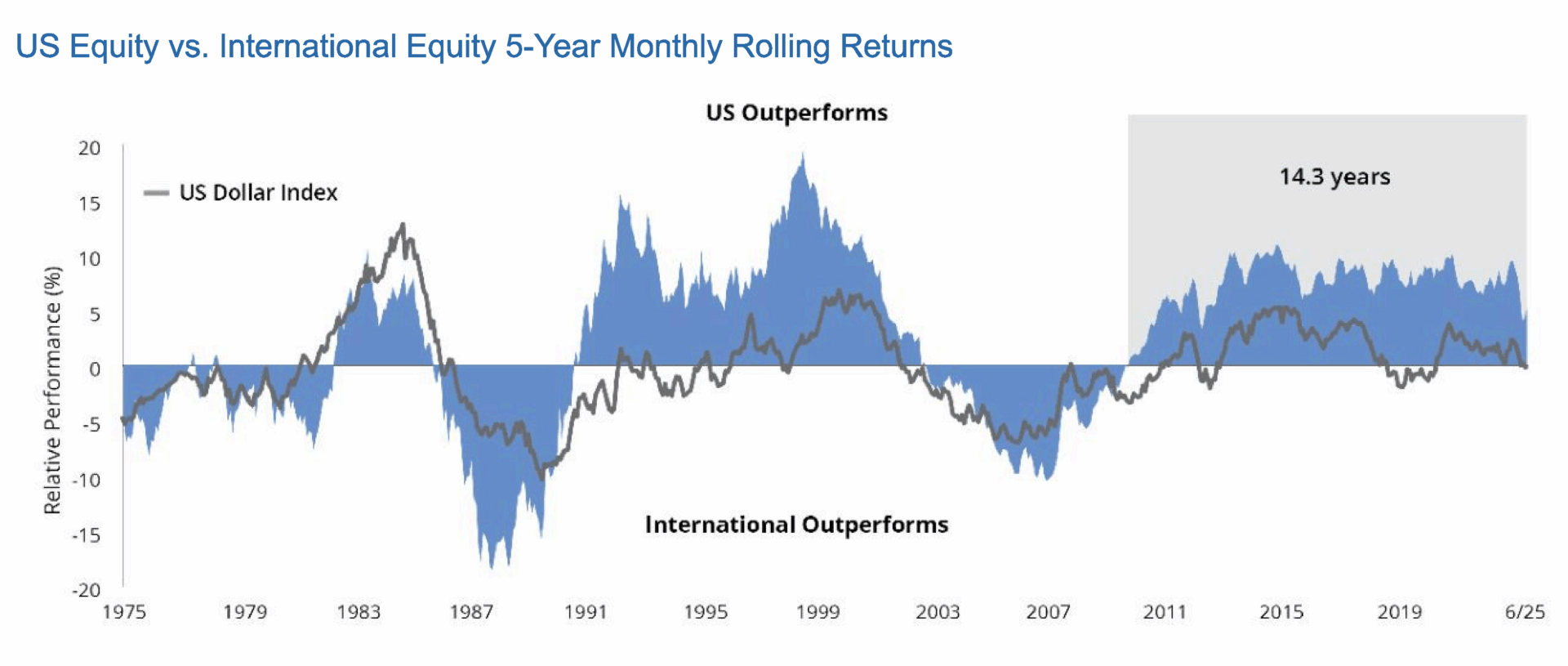

Non-U.S. stocks have outperformed the S&P 500® so far this year, as international markets have shown strength relative to the U.S. market. This represents a notable shift, as the U.S. stock market has been consistently outperforming international stocks for the past 14 years.

Much like the U.S. stock market, the Q4 outlook for international stocks presents a mixed picture. On the plus side, there are strong strategic and tactical reasons why international stocks have become increasingly attractive to investors including surprising resilience to the U.S. tariff escalation in tandem with ongoing uncertainty surrounding economic policy here at home.

The same persistent backdrop of policy uncertainty and geopolitical risks, however, also ramps up the potential for increased macroeconomic volatility during the latter part of the year. The consensus among major investment firms suggests that while international stocks have performed well relative to U.S. markets this year, Q4 may see continued volatility driven by ongoing trade policy uncertainty and geopolitical tensions. However, many analysts see this as potentially creating opportunities for investors willing to navigate the increased volatility.

Despite the ongoing U.S. trade policy upheaval which has put deglobalization and market shifts into overdrive, our team generally expects Western economies to slow during the next several months but rebound in 2026.

We’re here for you!

As always, BLBB will continue to closely monitor economic and geopolitical developments as they unfold and inform you of any critical issues that we feel could impact your investment portfolio. Of course, if you’re feeling concerned or wish to discuss any changes to your current circumstances, we encourage you to reach out to your BLBB financial advisor (215-643-9100).

We are here to help review and stress test your financial plan, explore whether any adjustments may be warranted, and/or discuss where we see the markets heading over the coming months and years.

2 Bureau of Labor Statistics, CPI Report, September 11, 2025

3 GDP Now, Federal Reserve Bank of Atlanta, October 1, 2025

Investment advisory services are provided by BLBB Advisors, a Pennsylvania-based investment advisor registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Additional information about BLBB is available in our current disclosure documents which are available on BLBB’s website (www.blbb.com) or the SEC’s public disclosure database (IAPD) at www.adviserinfo.sec.gov.

This content is intended for informational purposes only and should not be construed as personalized investment advice. Please consult with your financial adviser before making any investment decisions.

Certain information contained herein may be historical in nature while other responses may represent forward-looking statements. There are no guarantees that historical events will or may, repeat themselves. Forward-looking statements reflect the judgment of BLBB Advisors as of the date of publication and are subject to change without notice. They are not guarantees and involve risks, uncertainties, and assumptions that are difficult to predict.

BLBB’s investment approach incorporates, among other things, asset allocation and portfolio diversification. While these strategies are designed to limit risk, there is no guarantee that such strategies alone, or in combination, will guarantee against a loss of principal.

[View Quarterly Economic Review]

Subscribe to Our Newsletter

Click below to receive our latest insights on a variety of financial topics