Quarterly Economic Review 2nd Quarter 2022

Inflation, Recession, and the Federal Reserve’s Quest for a Soft Landing

Watch the nightly news. Read any newspaper. Visit a financial website. No matter where you turn lately, the most pressing topic of the moment is inflation. This is certainly understandable as the rapidly rising costs of goods and services impact every one of us. From filling up your gas tank to doing your weekly grocery shopping, we are all directly and quantifiably impacted by the significantly higher costs of even the most basic and necessary items we all regularly purchase.

On June 10th, the US Bureau of Labor Statistics released its May Consumer Price Index (CPI) data which showed an 8.6% year-over-year rise in the rate of inflation — the highest level recorded in more than 40 years.1 This came on the heels of a substantial jump in another key inflation measure, the Producer Price Index (PPI). In April, the monthly measure of the change in prices received by domestic producers of goods and services continued to tick up—with prices coming in 11% higher than a year ago.2

Unfortunately, rather than just one culprit, there are a multitude of factors (led by food and fuel costs) working in tandem to drive these elevated levels. COVID-related and Ukraine war-related supply chain disruptions are continuing to cause product shortages and disrupt global trade. The war in Ukraine is also helping to drive energy prices and raise the specter of looming global food shortages. Additionally, the cost of shelter is rising at its fastest pace in more than 30 years while energy prices are up more than 40% over the past year; led by a 106% surge in fuel oil prices.

What does all this data mean to the average worker? Unfortunately, many Americans are already reporting that inflation is beginning to cause them meaningful financial stress. One key reason for this is that recent wage increases are no longer keeping pace with the overall rate of inflation. In fact, U.S. workers have actually seen their effective hourly wages decrease by 3% year-over-year as a result of this recent surge in inflation.3

Peak or plateau?

While some economists strongly believe the worst is behind us on the inflation front, the latest robust PPI data suggests that a longer period of sustained or even higher inflation may be in store. There is now little question that both Treasury Secretary Yellen and Federal Reserve Chairman Powell underestimated inflation’s staying power when, earlier this year, they repeatedly asserted that U.S. inflation was nothing more than a small, transitory, and easily manageable problem. Secretary Yellen even admitted as much a few weeks ago, publicly stating she was “wrong about the path inflation would take.”4

At this point, it seems the more relevant question is: When and at what level will inflation peak—and will the Federal’s Reserve’s efforts to tame inflation ultimately cause the U.S. economy to slide into recession?

Most economists define a recession as two or more successive quarters of negative economic growth. In Q1, U.S. GDP fell by 1.5%. This was due, in large part, to expected slowing after a strong 6.9% increase in Q4 2021 GDP. However, a resurgence of COVID infections around the country and world (primarily China) also played a role in cooling US economic growth earlier this year. While the Q2 consensus estimate is for modest positive 2% or so growth (avoiding an official recession in the short term), an increasing number of market analysts are forecasting a growing likelihood that the U.S. will slip into recession sometime later this year or early in 2023. While it will take time to see how things play out and develop, it is important to keep in mind that recessions are a natural (albeit unwelcome) part of the US economy.

A recent May 2022 survey of CEOs by The Conference Board found that more than 60% of CEOs now believe a recession will occur at some point in the coming 12-18 months. And, we are already seeing some small signs that consumers (and by extension the economy) are beginning to feel the pain of inflation. Ford Motor Co., for example, recently noted a steady increase in auto loan delinquencies. Overseas, the World Bank has sharply curtailed their expectations for global growth in 2022—from a 4.9% annual growth projection in January down to a current 2.0% annual growth projection. By way of comparison, global growth was 5.7% in 2021.5

So, what exactly would the impact of a recession be on the stock market? On average, the S&P 500® falls 33% during a typical recession. That means the 24% drop we’ve thus far experienced in 2022 has already priced in a 72% probability of recession.6 While the additional downside potential appears to be modest at this point in time, the larger than normal number of major uncertainties impacting financial markets right now suggest volatility will remain elevated and that markets will be more unpredictable than usual for the foreseeable future. It helps to keep in mind a basic tenet of financial markets – they abhor uncertainty. However, as various issues begin to resolve themselves – such as the midterm elections in November – market volatility should recede.

Soft or hard landing?

In June, the Federal Reserve increased the Fed Funds rate by 75bps (the largest single rate increase since 1994). The consensus estimate is that we should see another 75bp rate hike in July, a 50bp hike in September, 25-50bps in November and 25bp in December. This would lift the rate into a range of 3.25%-3.50% by year-end (well above the Fed’s stated 2% target).7 At the same time, the Fed is also escalating its quantitative tightening efforts which are designed to reduce its astounding $8.9 trillion balance sheet. Together, these strategic moves are intended to slow US economic growth and pull enough money out of the U.S. economy to help tame inflation. This is what economists often refer to as an economic ‘soft landing.’ Ideally, the Fed succeeds in its mission and gradually tames inflation and slows US economic growth without overdoing it.

The widespread fear, however, is that because the Fed initially underestimated the inflation problem, they very well may act TOO aggressively to tame it—raising rates too much and too quickly, thereby throwing the economy into recession (a ‘hard landing’). It remains to be seen whether or not the Fed will be able to successfully navigate all the potential pitfalls and challenges.

Other factors that will likely play into (and probably complicate) the Fed’s decision-making process and impact their likelihood of success include:

- Whether or not supply chain disruptions can be curtailed: product shortages due to supply chain disruptions have been a significant driver of current inflation. The periodic shutdowns of major global ports due to COVID outbreaks, along with an ongoing labor shortage in the U.S. transportation industry, continue to cause problems—from farmers not being able to purchase enough feed for their livestock, to empty supermarket shelves, and sporadic product shortages (e.g., baby formula, computer chips, etc.).

- Whether wages can keep pace and major layoffs be avoided: while the U.S. employment picture remains healthy and robust, as mentioned earlier, wages are steadily slipping behind the current rate of inflation and reducing consumer purchasing power. Additionally, we’re starting to see signs of an employment slowdown—with recent announcements of layoffs at Tesla, Ford, Netflix, Coinbase, and Redfin, along with hiring freezes announced at Uber and Meta (Facebook).8

Furthermore, other concerns include a cooling domestic housing market, the upcoming midterm elections (which look to be highly contentious), the humanitarian and economic costs of the ongoing war in Ukraine, and coordinated interest rate hikes among central banks around the world. In other words, it is a potential minefield that is going to require near flawless execution by the Fed to successfully navigate.

The bear is here

At the time of this writing (6/27/2022), most major U.S. equity indices are now in or near bear market territory (down 20% or more from their recent highs). Year-to-date, the Dow is down 13%, the S&P 500 is down 18%, and the NASDAQ is off 26% as technology and other high growth sectors have taken the brunt of the pain.

With fixed income yields rising quickly, bond prices have also been sinking (keep in mind that as yields rise, prices fall)—setting up a rather unique environment where the performance of stocks and bonds have very much been in sync. The yield on the 10-year bond is nearly double the yield from just a year ago, and, at the short end of the yield curve the divergence is even greater. In fact, the 2-year U.S. Treasury briefly inverted (the 2-year yield exceeding the 10-year yield) in mid-June.

On the mortgage front, U.S. mortgage rates are now back to levels last seen in 2008. The average rate on a 30-year fixed mortgage is now 5.78%. Also, in May the number of housing starts fell for the second month in a row; dropping 14.4% from April and 3.5% year-over-year—driven by declines in construction of both single-family and multi-family new homes.

As rates continue to rise, we expect to see sustained pressures on the U.S. housing market which may have a cumulative effect on sales later in the year.

Looking Ahead – Volatility and Sector Rotation

With so much market uncertainty and nervousness (both here and abroad), the likelihood of heightened near-term or even sustained volatility will be elevated. But this is by no means unprecedented. If you think back to the 2007 – 2009 financial crisis, we experienced a 2+ year period of higher volatility during that upheaval.

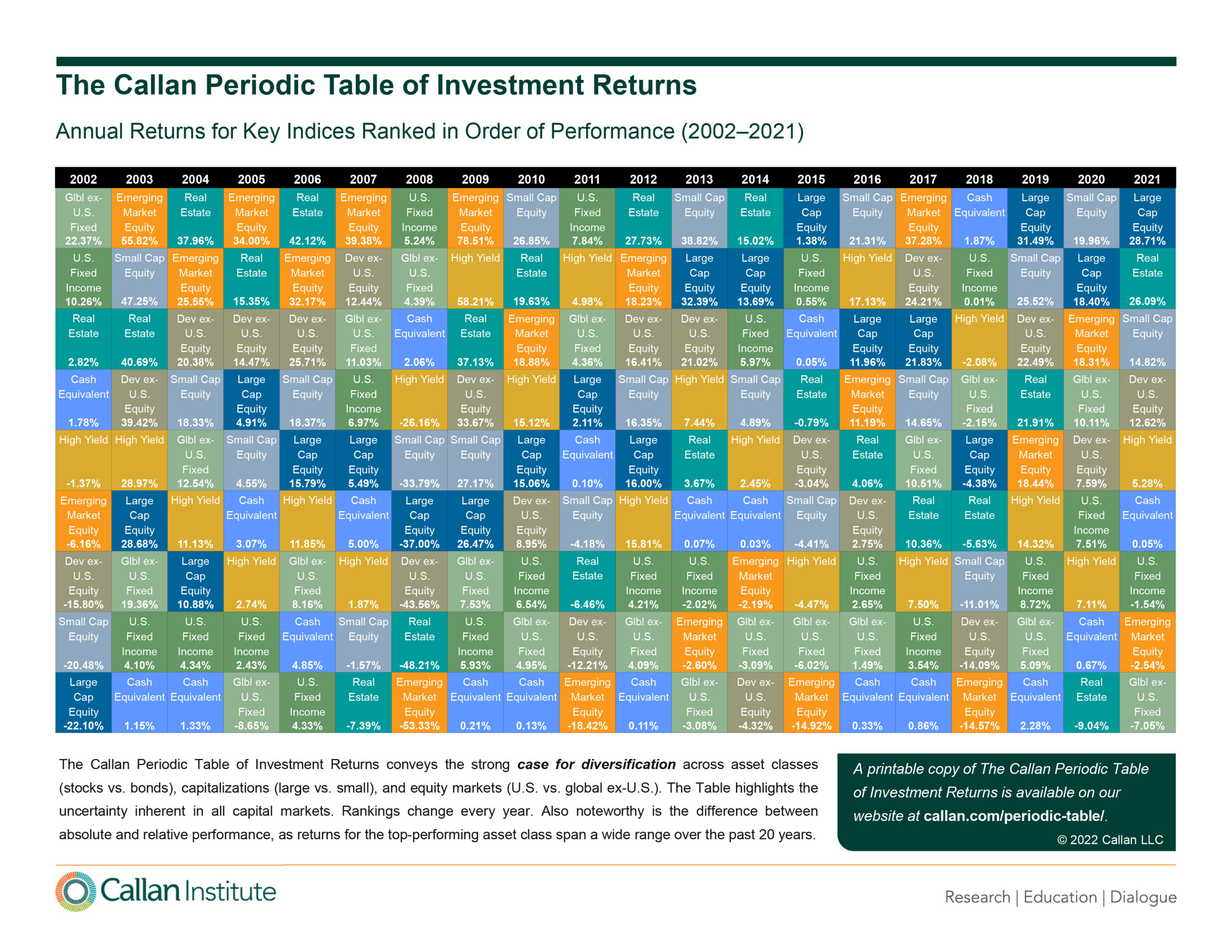

Looking ahead, we also think it is quite possible U.S. equities may deliver more muted returns over the next couple of years. Keep in mind that U.S. large caps were the top performing asset class in 2019 (+31.49%) and 2021 (+28.71%), as well as the second best performer in 2020 (+18.40%). Similarly, U.S. small caps were the top performer in 2020 (+19.96%) and the second best in 2019 (+25.52%), and the third best in 2021 (+14.82). On a historical basis, these were unusually outsized returns.

As the following table clearly depicts, the same asset classes rarely outperform year after year:

Markets and sectors gather headwinds or tailwinds and rotate in and out of favor. As a result, various asset classes rise and fall. Therefore, the likelihood of U.S. equities sustaining the extraordinary returns we have become accustomed to over the last few years seems remote. We believe that maintaining a thoughtfully and well-diversified portfolio can help investors weather some of the inevitable bumps and volatility that may come in the weeks and months ahead.

Overall, we remain hopeful that a soft landing may yet be achievable, but vigilant in our preparations for the volatility that may lie ahead. As always, if you have any specific questions about our market views, opinions, and expectations, or if you would like to talk about your personal financial situation, please reach out to your BLBB financial advisor at 215-643-9100.

1 U.S. Bureau of Labor Statistics, CPI Summary, June 10, 2022

2 https://www.bls.gov/ews.release/ppi.nr0.htm

3 https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html

4 https://www.reuters.com/markets/us/yellen-says-shewas-wrong-about-inflationpath-biden-supports-fed-actions-2022-05-31/

5 https://www.worldbank.org/en/news/press-release/2022/06/07/stagflation-risk-rises-amid-sharpslowdown-in-growth-energymarkets

6 Factset, Bloomberg, Refinitiv, SG Cross Asset Research/US Equity Strategy, June 21, 2022

7 https://www.kiplinger.com/economic-forecasts/interest-rates

8 https://www.yahoo.com/video/10-companies-recently-announced-layoffs-192741407.html