Quarterly Economic Review 1st Quarter 2022

Invasion, inflation, and interest rates

Quarterly updates always run the risk of containing information which—between the time of writing and the date of publication—quickly becomes outdated and/or rendered irrelevant. Perhaps, never has this been more true than in the midst of the current, incredibly fluid, global crisis brought about by Russia’s invasion of Ukraine.

While 2022 began with a brief glimmer of positivity (both the DJIA and the S&P 500™ posted new all-time highs on the first and second trading days of the year), that positivity quickly gave way to a number of formidable challenges and concerns including a surge of the Omicron COVID variant, rampant inflation, and associated monetary policy uncertainties. Then, on February 24th, war descended on Kyiv, Kharkiv, Mariupol, and other Ukrainian cities.

While the long-term economic impact of these recent events remains to be seen, we have identified a number of key concerns associated with each that we are closely watching.

Turmoil in Eastern Europe

In and of themselves, the geo-political ramifications of Russia’s Ukraine invasion are potentially staggering:

- Escalation remains a very real concern. Might Russia’s ‘empire building’ aspirations extend beyond Ukraine to NATO member nations such as Poland, Lithuania, Latvia and/or Estonia? And if faced with continued strong Ukrainian resistance, might Putin consider the use of chemical, biological, or tactical nuclear weapons?

- There may be a tipping point. Faced with unprecedented sanctions from a unified Western world, along with the prospect of being mired in an ‘unwinnable’ war, will the Russian public, the nation’s oligarchs, or key government and military leaders rise up in opposition?

- Others may become emboldened. The sheer brazenness of Russia and the ensuing global chaos it unleashed could inspire other nations such as Iran or North Korea to attempt their own acts of aggression, or offer cover for China to further clamp down on Taiwan.

Add to this the global economic impact that could ensue:

- Humanitarian costs will be heavy. Already we’re seeing millions of Ukrainian war refugees as well as a growing stream of dissidents fleeing Russia. Depending on the duration, severity, and scope of this conflict, we could witness a humanitarian crisis that rivals or even exceeds Syria’s.

- European dependence on Russian oil. Both the U.S. and UK are banning the importation of Russian oil (a minimal economic impact since Russian oil constitutes only about 3% of U.S. imports and 8% of UK imports). For EU nations, though, this poses a far greater challenge. More than a quarter of their oil imports and nearly half (45%) of their natural gas imports currently come from Russia. Finding alternative sources will take considerable time. A major escalation in hostilities, however, could force their hand and in turn ignite further inflation along with a possible recession.

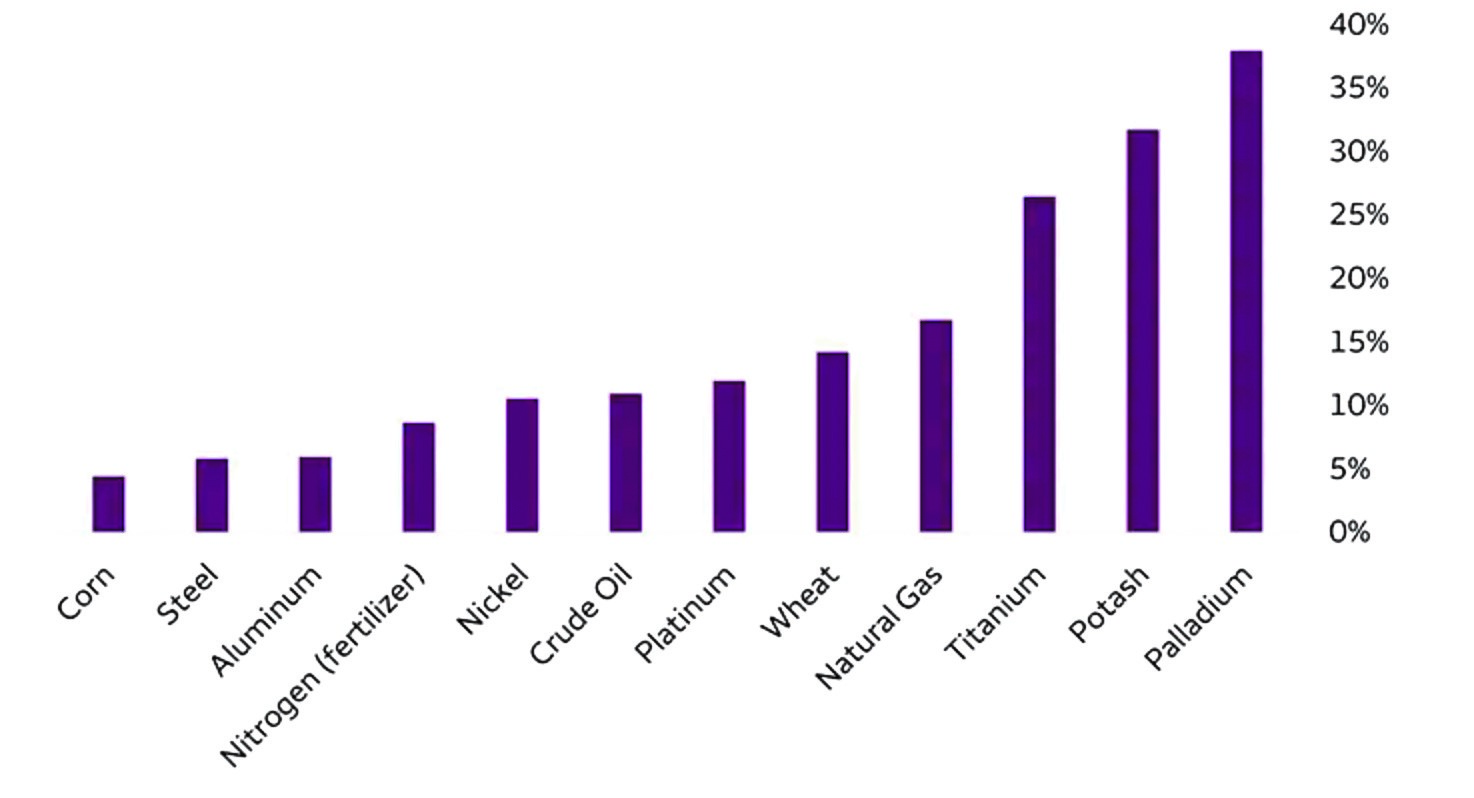

- Expect precious metals volatility. As the chart depicts, Russia, Ukraine, and Belarus combined make up a massive percentage of the precious metals market—responsible for nearly 40% of the world’s palladium, 28% of all titanium, and about 15% of the global supply of platinum and nickel (the latter essential to the production of lithium-ion batteries). It’s a recipe for extreme volatility. Look no further than recent nickel trading on the London Metal Exchange. Recently, the price of nickel doubled in just a couple of hours. And on several

other occasions, trading has had to be halted in an effort to maintain an orderly market. - Potential Disruptions in the Export of Agricultural Products. Ukraine is the 4th largest exporter of corn and the 6th largest exporter of wheat in the world. Most of their wheat goes to Egypt and Turkey while most of their corn goes to China and the rest of Europe. Russia is also a major exporter of wheat and other agricultural products, however, western sanctions and recently-imposed Russian export bans will interrupt the usual flow of these commodities.1

Depending on how the coming weeks and months progress, the war in Ukraine could ultimately prove to be nothing more than an economic ‘bump in the road’ for most established economies and financial markets. However, if the conflict further escalates, this “bump” could evolve into a large pothole with the potential to derail global growth and inject recessionary pressures into the world economy. Already, economic forecasters are suggesting the U.S. economy has a 33% chance of going into recession in the coming 12 months while the EU faces a 50% chance of doing so.2

Rapidly Rising inflation and the Fed’s response

As we write this update, the U.S. Consumer Price Index (CPI) stands at 7.9%—the highest reading recorded in more than 40 years. In part, this has been driven by rapidly rising commodity prices; particularly oil (up about 38% year to date) and natural gas (up about 37% year to date).3 But, as anyone who’s recently been to the supermarket can attest, food prices have also soared in recent months.

Why does inflation act as such a drag on economic growth? It’s a case of ‘opportunity cost.’ The more you’re forced to spend on feeding your family and fueling your home and car, the less you have left over for discretionary purchases (e.g., dining out, buying clothes, vacations, or home repairs); activities that help to drive the economy. Even though there has been a meaningful upward surge in wages (which is adding additional inflationary pressure), at the moment, wage growth is failing to keep pace with inflation—thereby reducing the average worker’s purchasing power.

Federal Reserve Governor Christopher Waller recently acknowledged in a CNBC interview that “inflation is raging” and more aggressive interest rate increases coupled with a reduction in the Fed’s balance sheet may soon be needed to begin taming inflation. Currently, the consensus estimate is for seven interest rate hikes over the course of 2022, culminating in a Fed Funds rate of around 2.0%. The first of these increases since late 2018 was just announced (a 25 basis points increase rather than the expected 50 basis points). In its guidance, the Fed noted that while the economic implications of the Russia-Ukraine conflict are highly uncertain, over the near term it’s “likely to create additional upward pressure on inflation and weigh on economic activity.”

[box] Inflation tends to be a global issue. Along with the U.S., many other countries are taking steps to actively address inflation—including the Bank of England which raised its key interest rate for the 3rd time just a day after the Fed’s Open Market Committee raised the Fed Funds rate. [/box]

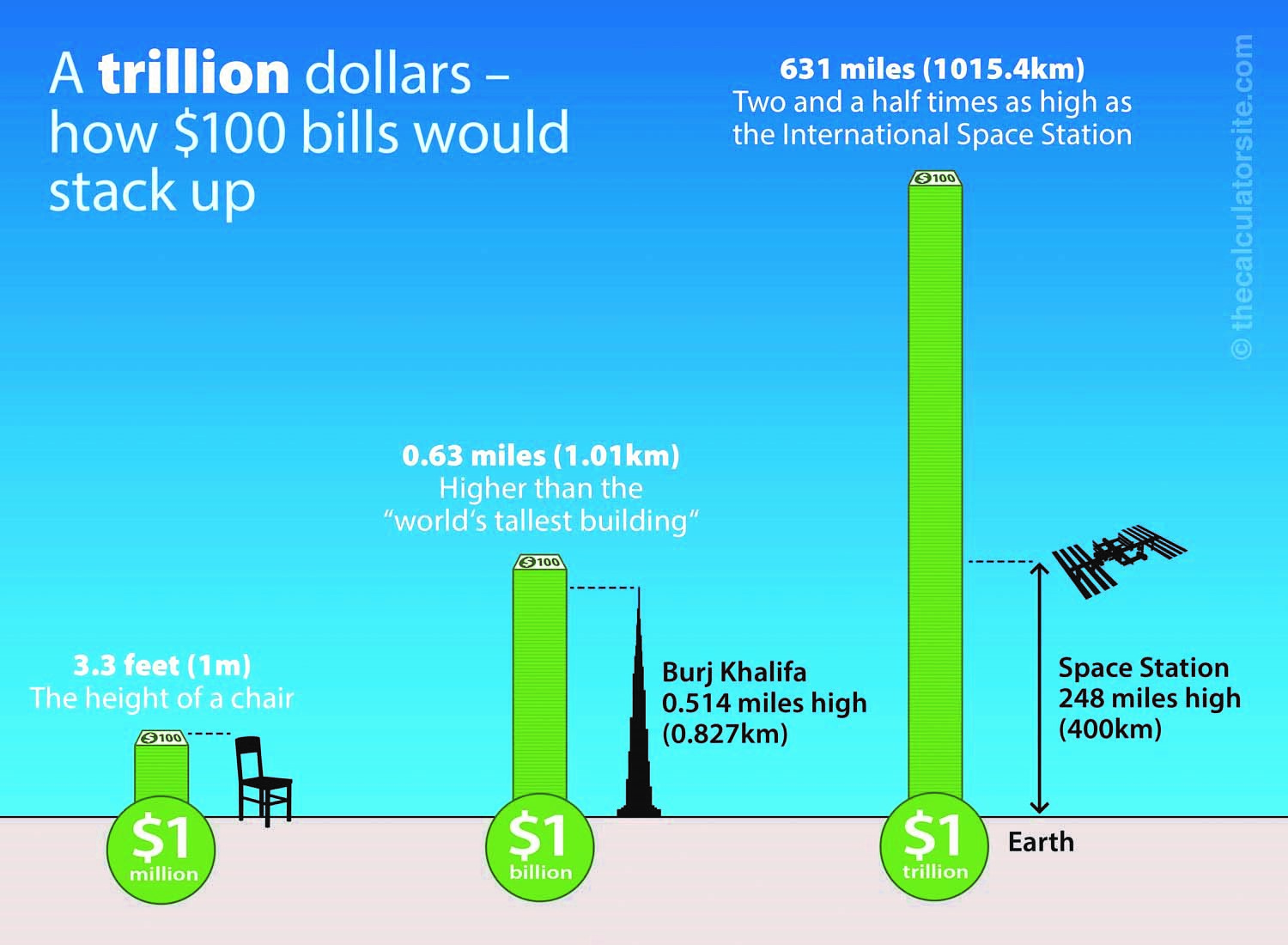

We also expect the Fed to soon begin the process of slowly reducing its massive balance sheet of U.S. treasury securities (which currently stands at $8.9 trillion). By way of comparison, at the beginning of the 2007 financial crisis, the Fed’s balance sheet held less than $1 trillion. That’s $8 trillion in additional spending over the last decade and a half—a mind-boggling injection of liquidity into the capital markets!4

Other economic factors

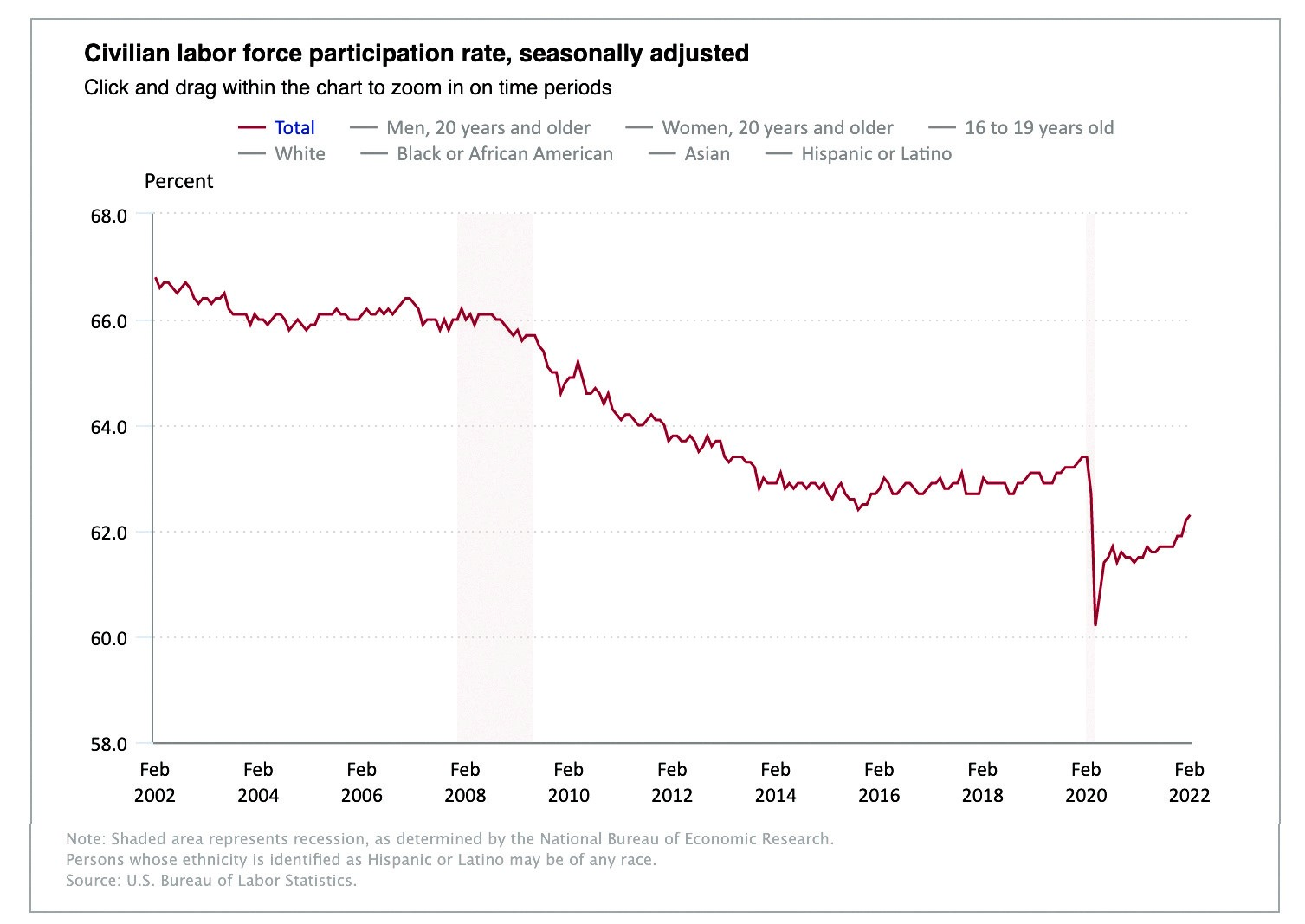

The U.S. unemployment rate now stands at just 3.8% (almost back to pre-pandemic levels). No doubt, however, you’ve seen articles or heard reports about ‘The Great Resignation’—the unprecedented post-COVID quit rate of workers. The labor force participation rate remains well below pre-pandemic levels as you can see in the following chart:

Currently, there are nearly two open jobs for each unemployed U.S. worker. Not only does this situation fuel wage growth (and in turn inflation), it adversely impacts the ability of countless businesses to operate at maximum capacity which has a trickle-down negative effect on the economy.

On the COVID front, China is now experiencing its largest covid outbreak since Wuhan—a development that’s negatively impacting activity at major Chinese ports all along the Pearl River, including the world’s 4th largest container terminal (Shenzhen’s Yantian port). There are currently 34 ships waiting to dock there (compared to just 7 this time last year). In tandem with U.S. labor shortages and other logistical issues raised by the war in Europe, we could be looking down the barrel of another period of supply chain disruption.

Yet despite these many and various potential storm clouds on the horizon, all is not doom and gloom. The U.S. economy recovered faster from the pandemic recession than anyone could have possibly anticipated. We seem to have bypassed any lingering COVID-induced economic hangover. And perhaps most importantly, much of the current inflation we’re dealing with appears to be attributable to temporary global events—with longer-term indicators suggesting that (thus far) inflation doesn’t appear to have established deep roots in the economy. As a result, we remain cautiously optimistic but vigilant.

Your BLBB advisor is available to discuss this commentary and any other questions you may have (215-643-9100).

1 https://www.fb.org/market-intel/ukraine-russia-volatile-ag-markets#:~:text=In%20addition%20to%20the%20significant,of%20the%20globe’s%20wheat%20exports

2 https://www.cnbc.com/2022/03/15/forecasters-sees-growing-chance-of-a-recession-as-fed-hikes-rates-this-year-to-fight-inflation.html

3 “Why Are Gasoline Prices So High? Ukraine-Russia War Sparks Price Increases Across U.S.,” Wall Street Journal, March 16, 2022

4 Federal Reserve Statistical Release (https://www.federalreserve.gov/releases/h41/current/h41.htm), March 24, 2022