Politics and Portfolios

Many years ago, in a Berkshire Hathaway shareholder letter, Warren Buffett famously wrote “We will continue to ignore political and economic forecasts, which are an expensive distraction for many businessmen and investors…we will neither try to predict these nor to profit from them.” It was sage advice then, and continues to be sage advice today.

Historically, the party occupying the White House has had very little impact on the overall performance of financial markets. In fact, according to a recent Vanguard study, since the late 1800s a traditional 60/40 stock and bond portfolio has delivered an 8.4% average annual return during Democrat administrations and an 8.3% return under Republican presidents.1

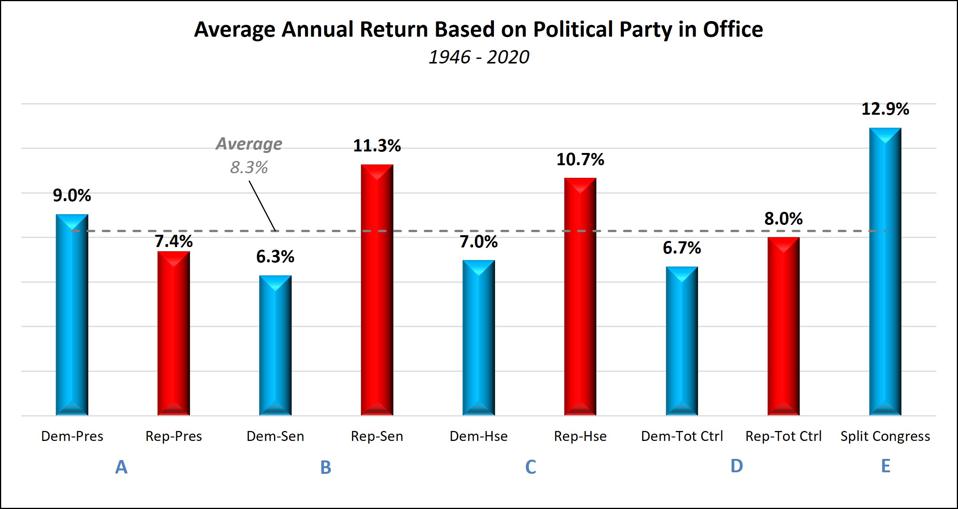

And regardless of the party in the White House, as the chart below shows, markets have typically performed best under a divided Congress (where one party holds the House while the other holds the Senate) as will be the case over the next two years.

Source: “Stock Performance And The Political Party In Power: An Historical Look At The Past 75 Years,” Forbes, January 2021

Unfortunately, far too many investors continue to let politics influence their investment portfolio strategy – assuming excess risk when ‘their team’ is in power, or leaving too much cash on the sidelines when the ‘other guys’ hold the reins. The economy, however, is far bigger and more complex than any single person or party. Markets are driven by a multitude of factors and the collective action of millions of individual and institutional investors (and increasingly by pre-programmed algorithms).

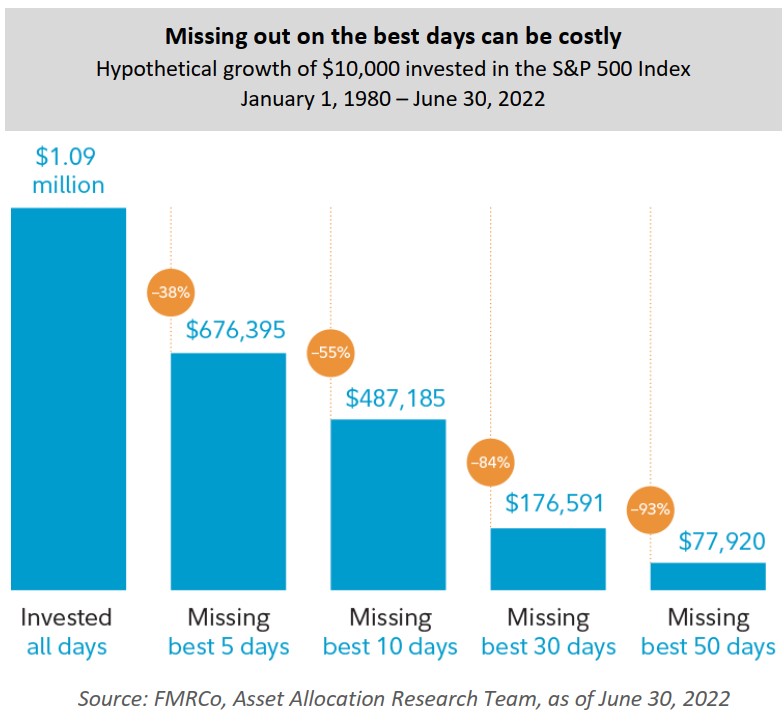

But, by far the greatest determinant to long-term investing success (as you’ve probably often heard), is time IN the market – committing to stay invested through all the periodic highs and lows as well as all the shifting political winds.

Trying to time the market (buying low and selling high) is a sure-fire recipe for long-term investment disappointment. Consider a hypothetical $10,000 investment made forty years ago and tracking the S&P 500® index. That investment today would be worth more than $1 million. But if you missed out on the best five days of market performance, your investment would only be worth roughly $650,000 (a 38% reduction). The more days missed, the lower the return.2

Instead of moving in and out of the market based on politics, you’ll have a far better chance for success by staying invested and relying on diversification, asset allocation and risk management to help reduce your portfolio volatility.

A modest impact on sectors

The one place where politics may potentially exert some modest impact on your portfolio is in the area of sector concentration. History shows that certain sectors tend to perform better depending on which party is in control. Under Republican administrations, increased defense spending tends to bode well for the aerospace/defense sector, and deregulation efforts generally provide a boost to the financial, energy and technology sectors. Conversely, Democrat administrations often increase spending on infrastructure (good news for materials and construction firms), alternative energy and healthcare – which can help buoy pharmaceutical and biotech firms, hospitals and insurers. But politics is merely one of many factors that impact a given sector’s performance.

Domestic and global economic drivers including inflation, Fed monetary and interest rate policy, supply chain disruptions, the conflict in Ukraine, and corporate valuations are likely to have a far greater effect on stock market performance than whichever party is occupying the White House or controlling the legislative levers.

Yes, markets will respond in the short-term to political developments. Yes, volatility will periodically rear its head. And yes, some companies, industries and sectors may perform better under one or the other party. But overall market performance will be driven far more by economic realities than political uncertainties. Think instead of your long-term financial plan as a ‘politics-free zone!’

Given the current highly-charged political atmosphere, removing emotion from your investment decisions may prove more valuable than ever. Instead of viewing the investment world through red- or blue-colored glasses, you’ll be far better served looking at it through the green lens of profitability. Aside from considering a few sector allocation adjustments and periodically rebalancing your portfolio to maintain its target asset allocation, taking no action (letting the long-term power of market growth and compounding do their work) is very often the best action.

Have specific questions or concerns about whether your portfolio is properly positioned for what lies ahead post-election? Talk to your BLBB Advisor (215-643-9100).

1 “How do midterm elections impact your investment portfolio?” Vanguard, December 2020

2 “6 Tips to Navigate Volatile Markets,” Fidelity Viewpoints, August 2022