Quarterly Economic Review 4th Quarter 2023

Perception or Reality? Investor Uneasiness Could Be Prophetic

If you feel like the U.S. financial markets had a terrible year in 2023, you are not alone. Some people call it a crisis of confidence, others blame it on the uncertainties surrounding interest rates, inflation, and the surging US debt situation. No matter how you label it, this perception does not seem to add up when compared to hard data: Gross Domestic Product (GDP), for example, was up 4.9% in the third quarter of 2023 and is expected to be up about 2.4% for all of 2023 (despite earlier predictions of negative growth).1 The S&P 500 Index ended the year with major “Santa Claus rally – up about 16% following the October lows and up over 24% for the year. Similarly, about 82% of all companies in this index exceeded earnings expectations in the third quarter.

So why are so many investors still mired in a malaise? The co-CEOs of Ariel Investments, which specializes in value investing, offered this explanation in a piece published on the Wall Street Journal’s website on December 5. “Scores of share prices have been lackluster as company fundamentals have been eclipsed by macroeconomic conjecture,” wrote Mellody Hobson and John W. Rogers Jr.2

The economic conjecture they are referring to, of course, is the uncertainty around interest rates. Rates continued to rise, consumers still felt the lingering effects of inflation at the supermarket checkout counter, and the media relentlessly hammered these issues home. Financial markets do not like uncertainty and neither do individual investors.

Reversing the 2022 Curse

This view of a lackluster economic environment in 2023 might also be more understandable if we look back to the U.S. equity market’s performance in 2022, when the S&P 500 Index lost more than 18%. While it might seem logical to assume that a positive return of 18% the following year would bring a portfolio back to where it started, the reality is that it would need to gain almost 22% to get back to square one. A loss of 50% in one year would require a gain of twice as much—positive 100%—to recoup your losses. Also, even though the latter portion of 2023 featured a surprisingly robust equity market rally, it was somewhat concentrated in certain mega-cap stocks like Apple, Microsoft, Nvidia, and Amazon.

These statistics support our long-held belief that it is important to remain disciplined while the market recovers in order to capture its best days and minimize portfolio drawdowns as much as possible. To that end, we continue to believe in the power of diversification, assembling portfolios of asset classes with uncorrelated return profiles or patterns that are not closely aligned.

Extending Bond Maturities

As we look forward to 2024, we continue to favor a combination of short-term Treasuries and select investment-grade corporate bonds that mature somewhere in the range of five to seven years, allowing us to lock in more attractive yields without taking on unnecessary credit risk. This positioning on the yield curve also addresses the reinvestment risk associated with shorter-term bonds, since the Fed will eventually reverse course and start easing monetary policy (reducing rates) again at some point down the road. In the meantime, we have been harvesting tax losses from bonds purchased early in the Fed’s tightening cycle and using the proceeds to buy bonds with longer durations and more attractive coupons.

While many market-watchers are anticipating a reversal of the Fed’s tightening cycle in 2023, this expectation seems premature. Fed chairman Jerome Powell explained in his December 13 statement that rates are likely near their peak for this cycle as the Fed pursues its target rate of 2% inflation but that the economy continues to throw curveballs at forecasters.3 Another rate hike is not out of the question, especially given that inflation often peaks twice before settling down for longer stretches. “We are prepared to tighten policy further if appropriate,” Powell said.

While interest rate reductions could begin as early as the first half of 2024, upcoming economic data and conditions, the election, and various geo-political conditions will most likely weigh heavily upon interest rate decisions in the coming year. The Federal Reserve next meets on 1/31 – 2/1/24 and then again in late March. We should have more clarity around the state of the US economy and the Fed’s intentions following these meetings.

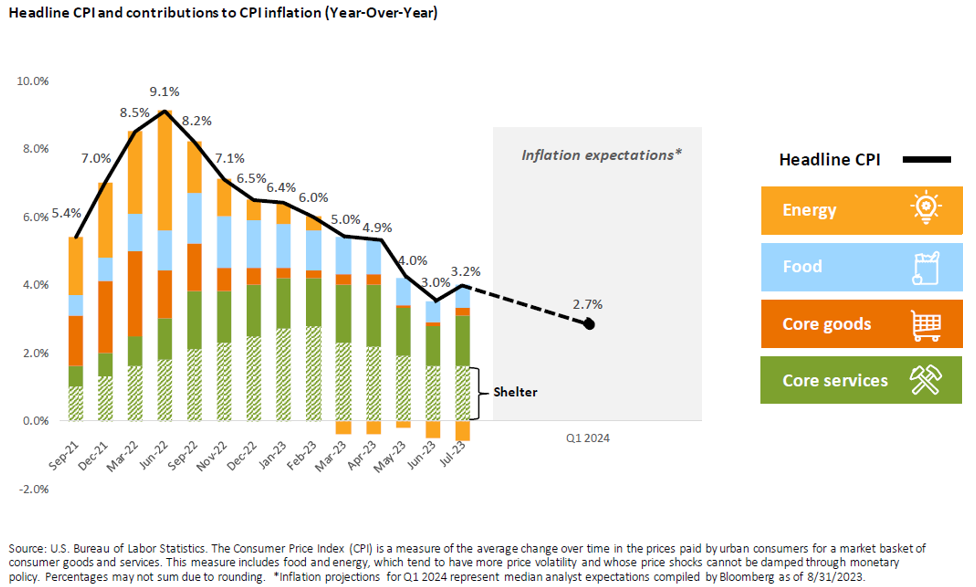

One key measure of inflation is personal consumption expenditures, which increased 0.1% from October to November, but declined by -0.1% when food and energy are removed.4 Another gauge is the Consumer Price Index, often referred to as headline inflation, which also increased 0.1% in November but rose 0.3% without food and energy (see chart).5 The road to disinflation will be a bumpy one.

Broadening Non-U.S. Equities

In the equity portion of portfolios, we are selectively increasing our allocation to large cap stocks from developed markets outside the U.S. in anticipation of improving fundamentals in those markets. Sam Stovall, the chief investment strategist at the Center for Financial Research and Analysis, told CNBC recently there is compelling evidence U.S. large cap stocks are overvalued compared to U.S. small cap stocks and developed market large cap stocks overseas.

“We’ve had almost 10 years of international stocks not performing, but there’s also something called reversion to the mean,” he explained.6 The investment company MFS voiced a similar sentiment in a December web piece that called international large caps the forgotten asset class.7 “Investor allocations to the international value asset class are at historically low levels, driven largely by an under allocation to non-U.S. equities and intensified by ongoing concentration risk in U.S. benchmarks,” the authors wrote.

By some estimates, U.S. stocks were 30% to 40% more expensive than their European counterparts in December—the widest gap in 15 years. The S&P 500 Index was trading at a price-to-earnings ratio of 21.87 and the MSCI Europe Index was trading at 13.8, both based on projected earnings, as of November 30.8

Guarding Against Overconfidence

Another issue we are mindful of is the large concentration of S&P 500 returns coming from high-flying tech stocks, which have been doing much of the market’s heavy lifting. As of 12/16/23, the so-called Magnificent 7 (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla) were responsible for 76% of the S&P 500 Index’s total gains in 2023.9 This dominance could be rattled by a shakeup in the broader tech industry, stricter U.S. government regulations, a trade war between the U.S. and China that interrupts supply chains, or any number of other variables.

We are also monitoring the unusual level of calmness in this uncertain market environment. In mid-December, the CBOE Volatility Index (VIX) was at its lowest level since the start of the Covid-19 pandemic in early 2020, which seems surprising in light of the Fed’s aggressive tightening and the large number of unknowns swirling around the economy and markets. Wall Street’s so-called fear index also indicated that investors expected the late December Santa Claus rally to extend into 2024. With U.S. equity valuations at such lofty levels, it appears Wall Street is factoring in a best-case scenario for the economy and markets. Let’s hope Wall Street is right. In the meantime, we will be watching earnings reports and economic indicators for any signs that corporate profits might come under pressure and weigh on stock valuations.

Avoiding the Potholes Ahead

There is one glaring wild card in play for 2024 that doesn’t seem to be attracting much attention. The U.S. government’s debt, when measured as a percentage of GDP, was more than 120% at the end of 2Q23. That’s down from its all-time high of 129% in 2022 but still formidable enough to possibly throw a wrench into the gears of the U.S. economy.10 Raising taxes is one possible solution, but this approach can only go so far, since higher tax rates can actually discourage employees from earning bigger paychecks and stifle corporate productivity. Two appropriations bills that are funding the U.S. government are scheduled to expire on January 19 and February 2, raising the possibility that Congress could yet again kick the can down the road or reach a stalemate that shuts down government agencies. At some point, financial markets will have to start pricing in this unsustainable deficit.

Other unknowns include geopolitical factors such as the U.S. presidential elections in November, ongoing military conflicts in Ukraine and the Middle East, Taiwan’s presidential election on January 13, and escalating trade tensions between the U.S. and China. In late December, the Biden administration was reportedly considering raising tariffs on electric vehicles imported from China, which are already subject to a 25% tariff. Direct military intervention by U.S. forces anywhere in the world would undoubtedly shake the economy and rouse investors out of their long winter naps.

Cautious Optimism in 2024

If it still feels like the economy and markets are shaky in 2024, despite indications to the contrary, your gut instincts might actually be ahead of the curve.

It was only a few short months ago that the chairman of the Fed issued a warning that “…the full effects of our tightening have yet to be felt.” In addition to increasing the cost of borrowing for individuals, the Fed’s policy also translates into higher interest payments for corporations that issue debt for improvements, expansion and sometimes even payrolls. In order to tame inflation, the Fed is constraining the amount of cash individuals and companies have to spend and invest. We will continue to feel the aftereffects for the next 18 months or longer.

“Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” Powell said in mid-December. “The extent of these effects remains uncertain.”

If you would like to learn more about how we view recent events and what we think may play out in the coming months and year, please do not hesitate to reach out to your BLBB financial advisor (215-643-9100).

1 https://www.conference-board.org/research/us-forecast

2 https://www.wsj.com/finance/investing/stock-market-2023-lessons-investing-2cedd44f

3 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20231213.pdf

4 https://www.bea.gov/news/2023/personal-income-and-outlays-november-2023

5 https://www.bls.gov/news.release/pdf/cpi.pdf

6 https://www.cnbc.com/2023/09/25/large-us-companies-outperformed-other-investments-over-last-20-years.html

7 https://www.mfs.com/en-ch/investment-professional/insights/equity/international-large-cap-value-forgotten-asset-class.html

8 https://www.msj.com/market-data/stocks/peyields;https://www.spglobal.com/spdji/en/indices/equity/sp-500-top-50/#overview

9 https://markets.businessinsider.com/news/stocks/stock-market-outlook-magnificent-7-tech-stocks-outperform-sp-493-2023-11

10 https://fred.stlouisfed.org/series/GFDEGDQ188S