All eyes on inflation

We’ve been carefully watching the uptick in inflation over the past year—from a 3.2% historic annual average rate to the mid-5% rates that marked much of 2021. Most recently, we’ve seen inflation spike even higher; topping 6.2% in October and 6.8% in November (the highest rate recorded since 1982) driven in large part by surging prices for food, energy, and housing. The November 2021 Producer Price Index (a measure of wholesale prices) was up 9.6%—the highest on record.

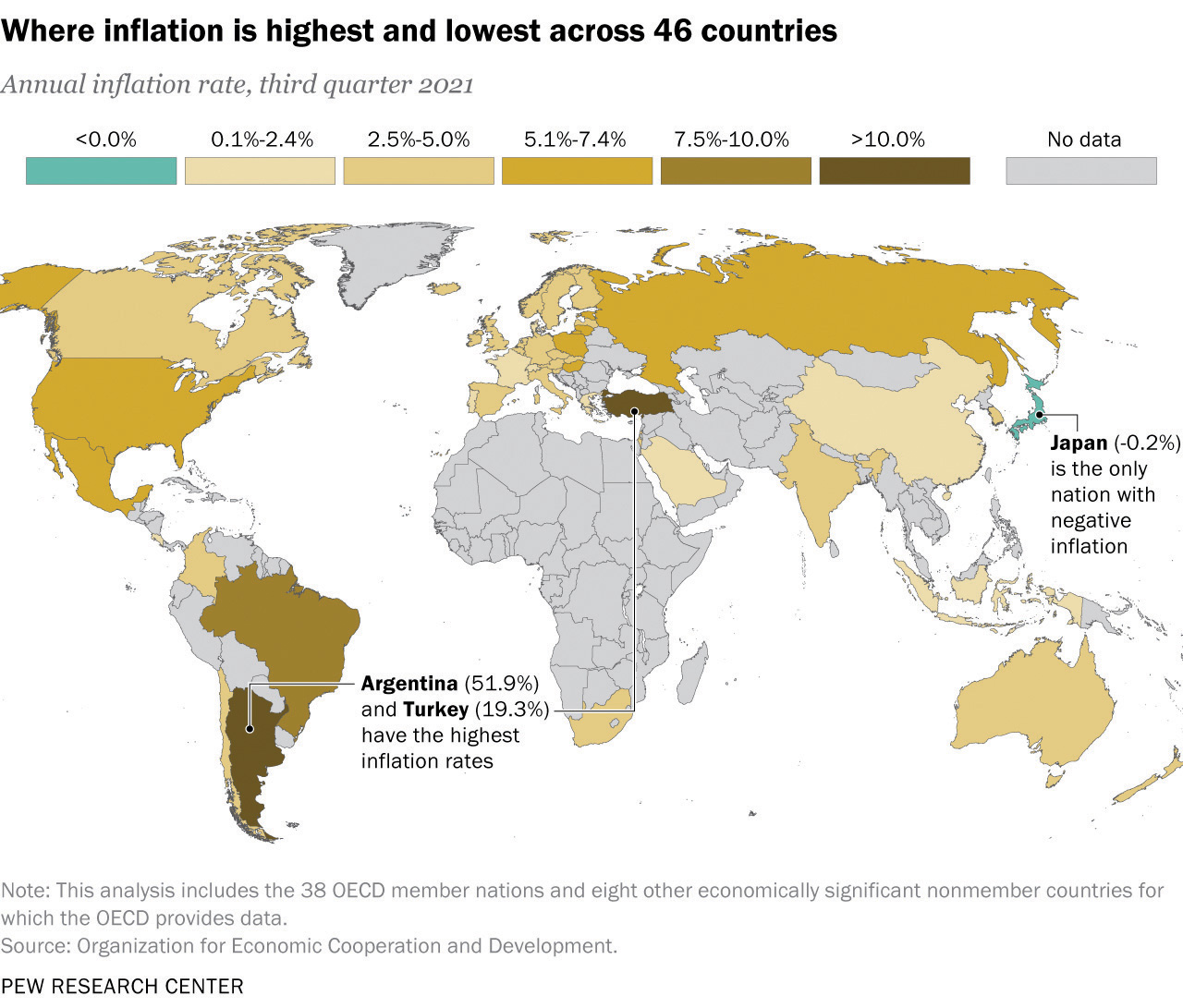

And, inflation is by no means solely a challenge here at home. Rates have been steadily climbing around the globe. In fact, a recent study conducted by Pew Research Center found that the 2021 Q3 inflation rate compared to the 2020 Q3 inflation rate was measurably higher in 39 of 46 (85%) economically significant countries.

More and more, it’s looking likely that a higher-than-normal rate of inflation may linger longer than originally expected—both here and abroad. According to a recent article in the Wall Street Journal, “strong consumer demand for goods in the West, ongoing port congestion in the U.S., shortages of truck drivers and elevated global freight rates” should continue to constrain the economic recovery over the short term.1

Wage increases are also fueling significant inflationary pressures. During the 3rd quarter, U.S. wages rose by 1.5%—the largest quarterly increase recorded in 20 years. Over the past year (September 2020 through September 2021), compensation costs for workers in private industry have soared 4.1%2 as employers shoulder the burden of higher salaries and rising benefits costs to attract and retain workers.

Employees are also switching jobs at a higher than usual pace as more flexible ‘work-from-home’ arrangements create greater job mobility. Eventually, however, these higher costs get passed along to consumers; helping to further fuel inflation.

Add to that new concerns regarding the Omicron COVID variant as well as an increased risk of extreme weather conditions, and there’s cause for concern—especially with the current annual inflation rate outpacing the return potential of most moderate-risk investments.

But by far, strong consumer demand for goods coupled with significant supply chain bottle-necks and disruptions have been the principal driver of higher costs. Therefore, as these issues gradually resolve themselves over the coming months, we expect it will provide some much-needed inflation relief. As the Chicago Federal Reserve noted in its most recent ‘Beige Book’ released on December 3rd, “wider availability of some inputs, notably semiconductors and certain steel products, led to easing of some price pressures.”

Energy costs fueling the rise

U.S. gasoline prices have soared more than 50% higher than they were this time a year ago. And according to the U.S. Energy Information Administration,3 Americans will also likely face an additional financial strain heating their homes this winter—with the EIA predicting a:

• 43% cost increase for oil heat • 6% cost increase for electricity

• 30% cost increase for natural gas • 54% cost increase for propane heat

Coal stockpiles in the U.S. are currently at their lowest level since March 1978. In fact, there’s some concern that our coal supply may not be sufficient to get us through to the spring. Thankfully, however, the nation’s decreased reliance on coal for electricity generation should help mitigate any potential negative impact.

While the Biden Administration continues to strongly advocate for greater government investment in renewables/clean energy to help steadily reduce our reliance on fossil fuels, the reality is that roughly 80% of our nation’s energy consumption remains fossil fuel dependent. Any meaningful transition to clean energy will likely take years—if not a decade or longer.

A strong employment outlook

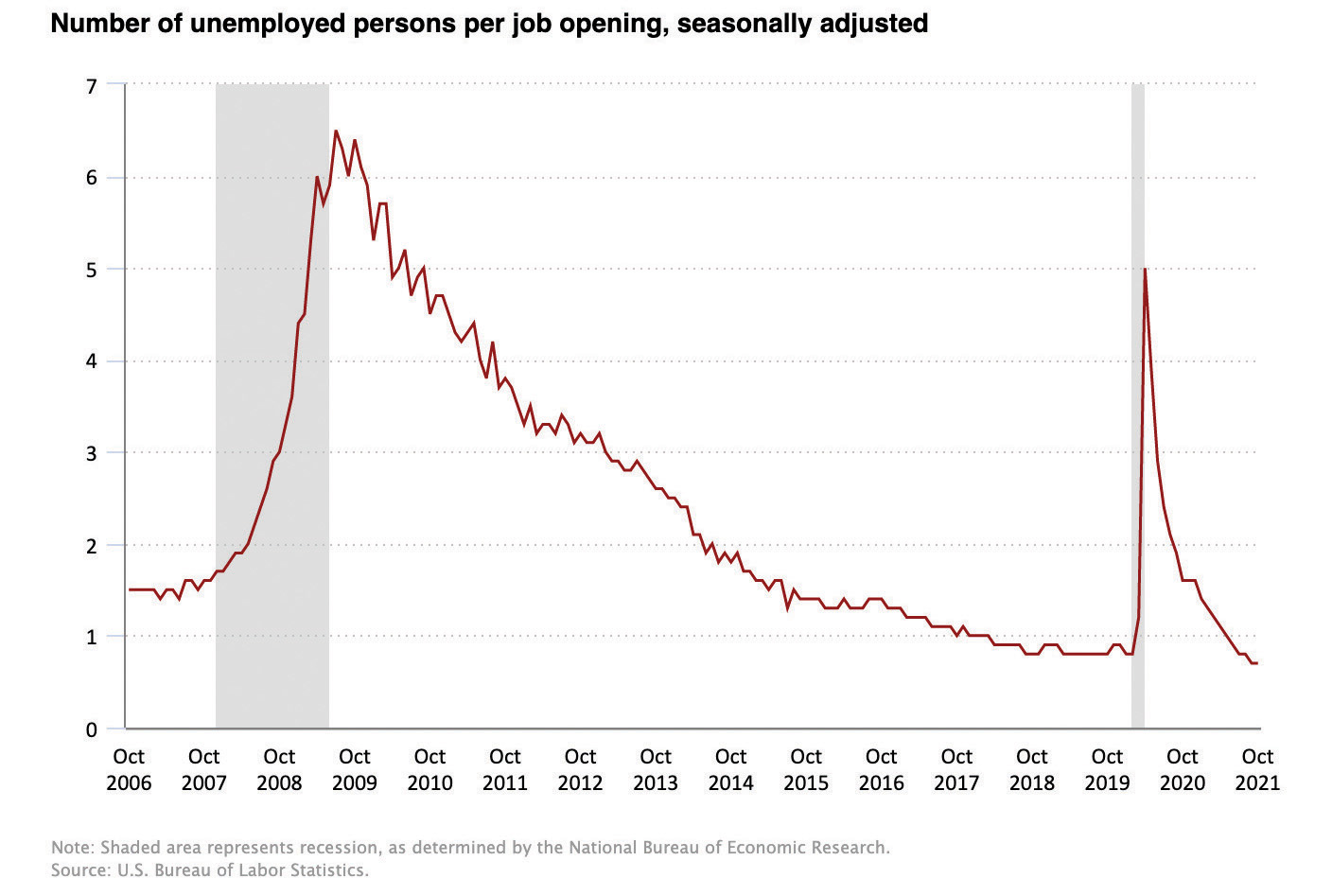

The U.S. unemployment rate fell to 4.2% in November (nearing the pre-pandemic low of 3.6%). Still, the number of long-term unemployed (those out of work for a half-year or longer) stands at 2.2 million—more than twice the number from February 2020. Additionally, there are nearly 6 million Americans who want a job but aren’t actively looking for work—almost a million more people than in February 2020.4

It appears as though there may be a growing mismatch between the skills and education of those seeking employment and the requirements of the jobs that are available. A lack of reliable, quality childcare may also be hampering a return to work for many in this current environment. Still, there are currently 10.4 million job openings in the U.S.—more jobs than unemployed people.

Reading the Fed tea leaves

In light of these inflationary pressures, the financial industry will be paying particularly close attention to both the actions and guidance coming out of the Federal Reserve over the coming months. Most anticipate a significant shift from a more ‘dovish’ to ‘hawkish’ monetary policy approach.

During its November meeting, the Fed announced its intention to begin tapering monthly bond purchases—a program implemented in early 2020 to inject money into the U.S. economy to help offset some of the economic impacts of COVID. After initially buying trillions of dollars of U.S. Treasury bonds and mortgage-backed securities, they eventually slowed the pace to around $120 billion per month since June 2020.

Given recent speeches by some Federal Reserve governors and Fed Chairman Powell, it also seems possible that interest rate increases may be coming earlier and more often than originally anticipated. At its most recent mid-December meeting, the Fed increased its monthly taper amount to $30 billion from $15 billion. Also, although the Fed left the federal funds rate unchanged for now, it is now expected the Fed will introduce at least three rate hikes in 2022 along with a further $30 billion reduction in asset purchases beginning in January. The Fed also revised its expected ‘median rate path’ to factor in several rate hikes in 2022, followed by three in 2023, and four in 2024.

Given this expectation that the Fed will need to raise rates in 2022, shorter-term U.S. interest rates have steadily risen over the past few months, while longer-term rates have pulled back a bit due to growing fears that tightening monetary policy may adversely impact longer-term economic demand.

The 2-year Treasury bond rate (short end of the curve) has been rising steadily for the last 3 months in anticipation of the Fed having to raise rates in 2022.

2-Year U.S. Treasury Yield Curve

Other variables we’re watching

We’re continuing to keep an eye on the Delta and Omicron (as well as potential future) variants of COVID to gauge any potential economic impact they may have. While it remains too early to tell, at this point it appears that the newest Omicron variant may be more transmissible but less lethal. As infection rates begin to climb again, however, it could have a sobering impact on the travel and hospitality industries—particularly international travel.

On the tax front, it seems less and less likely that many of the Biden Administration’s more impactful income and estate tax proposals will come to fruition in the short term. Nevertheless, with tax rates set to revert back to inflation-adjusted pre-TCJA (Tax Cuts and Jobs Act) levels when that law sunsets at the end of 2025, clients may want to consider implementing strategies to take advantage of this window of opportunity.

In addition, as of the time we are writing this update, it appears likely that Biden’s proposed $1.75 trillion social spending/climate/tax bill known as the “Build Back Better Act” will not make it out of the Senate before year-end. If this Act fails to pass in 2021, one of the most immediate ramifications would be an end to the enhanced child tax credit which is up to a $300 monthly payment some families have been receiving for each child they have.

Overseas, while US–China relations showed positive indications of thawing following November’s virtual summit between the two nations’ presidents, tensions again look to be on the rise due

to both the American diplomatic boycott of the 2022 Beijing Winter Olympics, as well as growing conflict over China’s policies towards Taiwan, Hong Kong, and Tibet. Similarly, already tense US-Russia relations are becoming further strained as a result of Russian military troop movements on the border with Ukraine and increasingly aggressive rhetoric from Moscow aimed towards Kyiv.

Lastly, we’re preparing for potentially significant composition shifts in the S&P 500® coming sometime in Q1 of 2022. As a few current Technology stocks (e.g., Visa, Mastercard, and PayPal) are moved to the Financial sector, and other tech stocks including ADP and Paychex move to Industrials, overall sector weightings may see a meaningful shift.

Cautious optimism

As we look ahead to 2022 projected equity market returns, we remain cautiously optimistic—buoyed by an expectation for the pandemic to finally start receding as both vaccination rates and acquired immunity numbers steadily climb around the world. The current healthy pace of economic growth appears likely to continue which, in turn, should help to drive positive performance.

Keep in mind, however, that our economy still faces many issues and challenges (above and beyond COVID) including inflation, a massive government debt, and a wide range of highly contentious and polarizing social issues. As a result of these many unknowns, there seems to be a growing consensus on Wall Street that 2022 returns may be somewhat muted compared to 2021.

If you have any specific questions about our market views, opinions and expectations, or if you like to talk about your personal financial situation, please reach out to your BLBB financial advisor at 215-643-9100.

1 “Supply-Chain Problems Show Signs of Easing,” Wall Street Journal, November 21, 2021

2 U.S. Bureau of Labor Statistics, Employment Cost Index, September 2021

3 U.S. Energy Information Administration, Winter Fuels Outlook, October 2021

4 U.S. Bureau of Labor Statistics, The Employment Situation, November 2021

©2024 BLB&B Advisors, LLC. - PRIVACY POLICY – SITE USE POLICY – DISCLAIMER – ADV Part 2A – FORM CRS