Quarterly Economic Review 3rd Quarter 2023

Lifted For Longer: Higher Rates Shake Stocks, Buoy Bonds

The Federal Reserve’s aggressive campaign to tame inflation took a step back in August as top-line prices ticked up 0.6% for the month and 3.7% for the year compared to the same periods in 2022. One of the main contributors to this increase in the U.S. Consumer Price Index (CPI) was gas prices, which were up 10.6% in August versus a month earlier. Fuel prices are still modestly lower than they were a year ago, but there are several fuel-related variables in play that could affect the economy and financial markets through the end of the year.

As most consumers know from personal experience, gas, and food prices often fluctuate significantly from month to month and year to year. This is why economists remove retail fuel and grocery prices to calculate “core” inflation (aka core CPI). Core CPI increased 0.3% in August which slowed the annual rate of inflation down to 2.4% for the year compared to 5.0% this time last year. Prices are still increasing, but at a slower rate (i.e., decelerating).

The persistence of core inflation demonstrates how influential fuel prices can be for the U.S. economy, even when “prices at the pump” are removed from the equation. According to a September 13 statement from the White House, the increase in core CPI between July and August “appears to be mostly explained by an unusually large upswing” in airfares, since commercial airlines are particularly sensitive to fuel prices. In fact, just about every private and publicly owned company that manufactures or distributes tangible goods usually passes higher fuel costs along to consumers, which contributes to inflation.

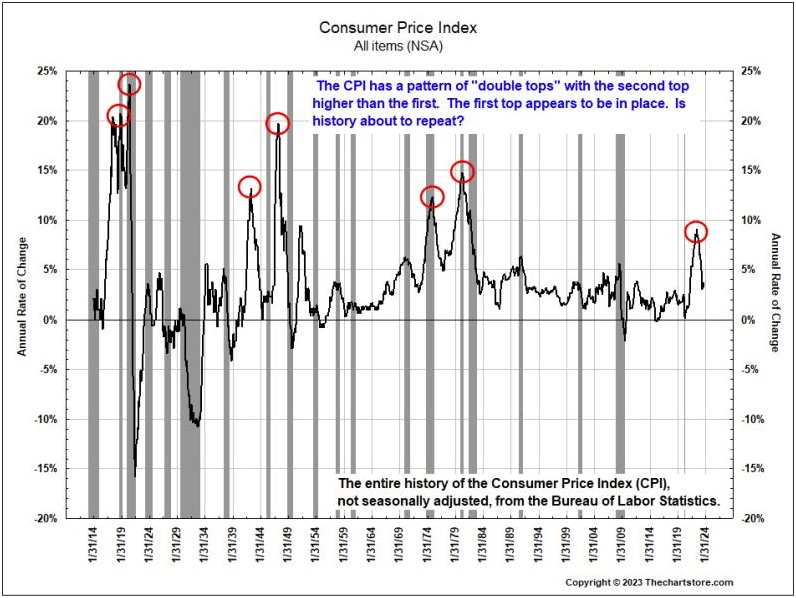

It is also worth noting that it is not uncommon for inflation to peak, recede, and then peak again before settling into a moderate level (see chart).

Finding Goldilocks: Just the Right Rate

Some amount of inflation is considered good for the economy. The Federal Reserve Open Market Committee (FOMC) targets an ideal inflation rate of roughly 2% a year to pursue its dual mandate of ensuring “stable prices and moderate long-term interest rates.” The other half of its mandate is promoting maximum employment, which is hovering near historic highs. However, the unemployment rate ticked upward by 0.3% in August—the exact same increase posted by core CPI. The Bureau of Labor Statistics reported that unemployment continued to trend downward in healthcare, leisure and hospitality, social assistance, and construction but increased in two sectors that are highly sensitive to fuel prices: transportation and warehousing. In total, the unemployment rate ended the month at 3.8%, making August the 19th consecutive month unemployment has remained below 4%.

Considering this mixed bag of data, the FOMC voted on September 20 to hold the federal funds rate steady at a target of 5.25% to 5.50%. The committee also signaled its intention to maintain this benchmark lending rate at its 22-year high well into 2024 and beyond, with the possibility of another hike (most likely 25 basis points, or one quarter of one percent) widely anticipated before the end of 2023. In other words, we can expect interest rates to remain lifted for longer.

In fact, Fed Chairman Jerome Powell said the Fed doesn’t expect inflation to subside back to its 2% target range until 2026.

“We have covered a lot of ground, and the full effects of our tightening have yet to be felt,” he said after the FOMC’s September meeting. He added that consumer spending remains “particularly robust,” despite the Fed’s efforts to cool inflation by hiking interest rates and constraining consumer demand. Thus, the Fed finds itself in a precarious position, faced with the balancing act of raising rates aggressively enough to prevent the economy from overheating, but not enough to drag the U.S. economy into a recession. “We see the current stance of monetary policy as restrictive, putting downward pressure on economic activity, hiring, and inflation,” Powell explained. “In addition, the economy is facing headwinds from tighter credit conditions for households and businesses.”

Powell stressed that the Fed is acutely aware of the hardships its monetary policy is having on consumers as policymakers pursue the formidable task of maintaining interest rates at a level that is not too hot and not too cold. The FOMC meets again in early November and mid-December.

Investor Confidence: A Crack in the Armor

When interest rates rise, the cost of borrowing goes up, potentially leading to higher interest expenses and lower profits on corporate balance sheets. This can affect investor sentiment and stock prices, particularly for companies that rely heavily on debt financing for capital improvements, expansion, and acquisitions. The good news for shareholders is that forward-thinking management at many U.S. companies refinanced their debt and extended maturities on their bonds while rates were still extremely low.

The pullback in late September was an anomaly for the U.S. stock market in 2023, which has been unusually calm, with the exception of a spike in March triggered by the Silicon Valley Bank scare. Before the FOMC’s most recent announcement, the CBOE Volatility Index (VIX), was at its lowest level since the Covid pandemic rattled markets in early 2020. The VIX measures the expected volatility of the U.S. stock market over the next 30 days, based on how investors are buying and selling short-term option contracts (puts and calls). A peek beneath the surface of this “fear index,” however, suggests that trouble could be brewing. More call options tied to the VIX were bought and sold in June than any other month in history, suggesting that large, institutional traders are anticipating turbulence.

The S&P 500 Index was down 3.64% at the end of the third quarter versus June 30, but still up 11.7% year-to-date.

Warning Signs: Oil, China and Debt

As mentioned, one of the deciding factors for the U.S. economy and financial markets could be the price of oil. A dramatic slowdown in the Chinese economy is likely to weaken global demand and suppress prices in the U.S. over the long term. China is the world’s second largest economy, behind the U.S., and its manufacturing capabilities have been driving global growth for decades. The country rebounded quickly after Covid-related shutdowns and other business restrictions were lifted.

But the odds of a slowdown in the Chinese economy may have increased in recent months, as China confronts a deteriorating housing market, a slump in export activity, currency devaluation, and an unemployment rate among young workers so dismal that the government isn’t releasing data. Major investment banks have cut their forecasts for China’s economic growth, indicating that the country will fall well short of its 5.5% target for Gross Domestic Product (GDP) growth and sparking the social unrest that followed, as well as the potential for “contagion” that infects other economies around the world.

Closer to home, tens of millions of student loan borrowers were required to start making monthly payments averaging between $200 and $300 on October 1. The resumption of payments is good news for lenders, who have been in limbo since the Department of Education imposed its moratorium on payments in March of 2020. But the implications for retailers are not as rosy, since roughly $100 billion will be siphoned from the pockets of young consumers who might otherwise spend those funds on big-ticket goods that create jobs and buoy the U.S. economy.

The Fed’s recent tightening is also weighing on the U.S. housing market, as homeowners cling to low-interest-rate mortgages, inventory dries up, and lenders become much more selective (a move that historically has been associated with recessions). Although the Fed doesn’t have a direct role in setting mortgage rates, many banks adjust their prime rates based on the target level of the federal funds rate. “Lingering recession worries and the need for banks to build up capital levels in an environment of changing regulations have led to what is called a decreasing supply of credit,” wrote Morningstar equities strategist Eric Compton in an August blog post.

Mortgage rates are likely to remain relatively high for the foreseeable future.

Until recently, most consumers appeared to be shaking off concerns that these headwinds might push the U.S. into a recession. Household debt increased 0.1%, or $16 billion, to $17.06 trillion in the second quarter of 2023, according to the Federal Reserve Bank of New York. Average hourly earnings outpaced inflation growth in August, up 4.5% compared to the same month last year, and consumer balance sheets remained generally strong.

But consumer confidence is shaky. Following back-to-back increases in June and July, the Conference Board’s Consumer Confidence Index slipped in August as consumers voiced persistent concerns about inflation—especially prices at the supermarket and the gas pump. With winter approaching, financial markets and the U.S. economy are likely to feel the pinch if the supply of crude oil further tightens this heating season and prices hit $100 a barrel, as some commodity experts are predicting. Saudi Arabia took an additional 1 million barrels of crude oil off the market each day this summer, and Russia recently cut off most diesel and gasoline exports. An expansion of the United Auto Workers strike from 12 to 38 locations is also a concern as the economic impact of this strike worsens. Current estimates suggest that as of 9/25/23, economic damage caused by the strike exceeds $5 billion.1 As for the looming possibility of a government shutdown, Congress just passed a temporary spending bill which essentially kicks this issue down the road for 47 days, until early November.

The Upside: Rising Rates Buoy Bonds

On the positive side, one of the most profound effects of the current monetary policy cycle is that it is breathing new life into a bond market that has been lackluster for decades. Bond yields now offer income-oriented investors a viable alternative to dividend-paying stocks. In late September, the S&P U.S. Aggregate Bond Index2 yielded almost 5.4% and the 2-Year U.S. Treasury note yielded 5.12%. This is the highest yield for the 2-year Treasury since 2006 and well above its long-term average of 3.18%. U.S. Treasury bonds are considered one of the lowest-risk investments in the market because they are backed by the full faith and credit of the U.S. government, which guarantees the return of principal investment upon maturity. The chances of the U.S. breaching that guarantee and defaulting on Treasury bond interest payments are slim, but always a possibility, and the consequences would likely be catastrophic for global financial markets.

Over time, bonds also have demonstrated the ability to preserve capital and reduce risk in equity-heavy portfolios because they enhanced diversification and performed well when the stock market was stumbling. There are exceptions, of course, including the inability of bonds to protect equity investors in 2022. But we believe the widely reported death of the 60/40 portfolio (60% stocks and 40% bonds) has been greatly exaggerated.

Following decades of declining bond yields and turbulent equity markets, U.S. investors had a record $5.6 trillion stashed in money market funds in late August, up 18% from the start of the year. Money market funds invest in short-term, high-quality bonds and cash equivalents and provide investors with relatively low-risk income without locking up their cash for extended periods. Much of that money could start to come off the sidelines now that high-quality government and corporate bonds are once again living up to their “fixed income” name—especially for investors who will buy and hold to maturity.

We are approaching this new landscape with cautious optimism, generally favoring a combination of short-term Treasuries and select, investment-grade corporate bonds that mature somewhere in the range of five to eight years. In our view, stretching out to this range on the yield curve with high-quality corporates offers the potential to lock in attractive yields while managing credit risk. It also addresses the reinvestment risk associated with shorter-term bonds, since we expect the Fed to eventually reverse course and start easing monetary policy again at some point in the future.

What’s Ahead: Storm Clouds, Then Sunshine

It appears all but certain that the global economy will continue to wrestle with inflation and relatively high interest rates for the foreseeable future, which will suppress global economic growth through the fourth quarter of 2023.

Therefore, the threat of a moderate recession continues to hang over the U.S., as consumer spending joins a lingering housing market slump that has been exacerbated by rising interest and mortgage rates, a drawdown of sizable cash balances, and pressure on household budgets from tighter credit conditions that affect mortgages, auto loans, and credit card rates. Inflation should cool along with the economy as tighter supplies of food and fuel, and elevated rents contribute to a bumpy path toward disinflation.

But we also expect the winding down of central bank interest rate hikes to lay the groundwork for a sustained recovery in global economic growth, possibly beginning in the second half of 2024.

Contributions from China are likely to be muted, since its economy rests heavily on consumer spending and the country is grappling with unbalanced, but generally slowing, economic growth. The stronger possibility, in our view, is that the U.S. economy rises to the occasion and spearheads a rebound.

As Warren Buffett said, “Never bet against America.”

In this uncertain environment, we strongly prefer “time in the market” over timing the market, with diversified portfolios that match your unique preferences, tolerance for risk, and time horizon. Your BLBB advisor is available to answer any questions or discuss any concerns you may have (215-643-9100).

1https://www.investors.com/news/auto-workers-strike-hits-11-days-economic-cost-is-spiraling/#:~:text=The%20strike%20by%20the%20United,auto%20

workers%20of%20%24107%20million

2It is not possible to invest directly in an index. The S&P U.S. Aggregate Bond Index measures the performance of publicly issued U.S. dollar denominated investment-grade debt, including U.S. Treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational,

federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs.

Sources

CPI and inflation:

https://www.whitehouse.gov/cea/written-materials/2023/09/13/the-august-2023-consumer-price-index/#:~:text=Headline%20Consumer%20Price%20Index%20(CPI,the%20price%20of%20retail%20gasoline

https://www.whitehouse.gov/briefing-room/statements-releases/2023/09/13/statement-from-president-joe-biden-on-august-consumer-price-index/

https://www.bls.gov/news.release/pdf/empsit.pdf

Treasury yields:

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

FOMC statement:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20230920a.htm

S&P 500 lowest close since June:

https://www.morningstar.com/news/marketwatch/20230921490/sp-500-on-pace-for-lowest-close-since-june-as-investors-brace-for-higher-rates-for-longer

Consumer debt:

https://www.newyorkfed.org/newsevents/news/research/2023/20230808

Crude oil $100 a barrel:

https://www.marketwatch.com/story/oil-is-going-to-trade-above-100-a-barrel-says-veteran-commodity-trader-mark-fisher-67536a6d

VIX lowest in years:

https://finance.yahoo.com/news/wall-streets-biggest-fear-gauge-has-been-quiet-thats-likely-about-to-change-093051731.html

VIX call options traded hands:

https://www.wsj.com/articles/the-stock-market-isnt-as-calm-as-it-seems-3713180c

Mortgages stuck:

https://www.morningstar.com/markets/when-will-mortgage-rates-go-down

Consumer Confidence:

https://www.conference-board.org/topics/consumer-confidence

S&P Aggregate Bond Index:

https://www.spglobal.com/spdji/en/indices/fixed-income/sp-us-aggregate-bond-index/#data

2-Year Treasury Yield:

https://ycharts.com/indicators/2_year_treasury_rate#:~:text=Basic%20Info,a%20maturity%20of%202%20years

U.S. debt:

https://www.cnbc.com/2023/09/19/united-states-national-debt-tops-33-trillion-for-first-time.html