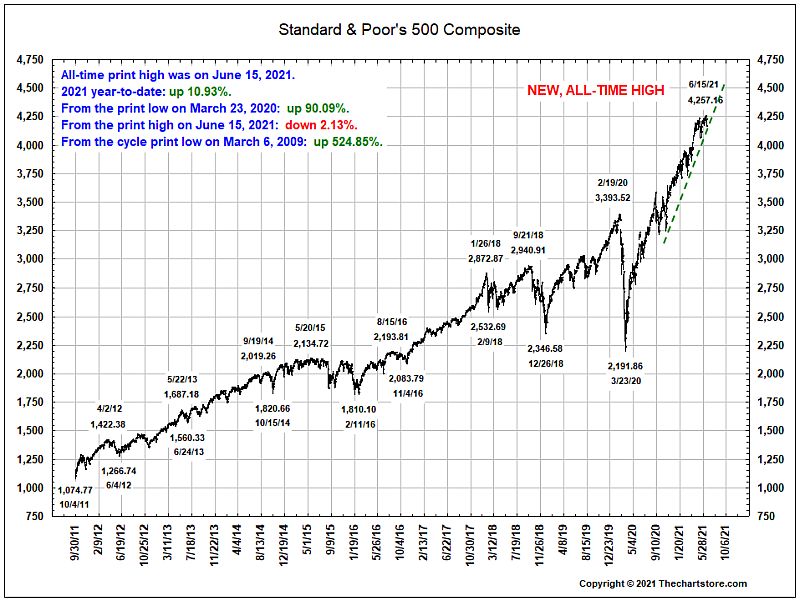

Let’s start with the good news! The U.S. economy is in full recovery mode. Every major domestic equity index is well into positive territory on a year-to-date basis—many periodically flirting with setting new all-time highs during the quarter. In fact, since its early-pandemic low in March 2020, the S&P 500® has soared more than 90% in just over a year.1

As is often the case with any sustained rally, however, a cyclical rotation of top performers has been occurring. While much of last year’s climb was driven by large cap tech stocks, U.S. small caps have been fueling much of this year’s growth (outperforming their mid cap and large cap brethren)—although U.S. large caps showed signs of a resurgence this quarter. Similarly, one of last year’s biggest laggards (Energy) has been the S&P’s standout sector thus far in 2021—up more than 39%, while Technology has only gained about 7% on the year. Other strong sectors thus far in 2021 include financials, real estate, materials, and industrials.2

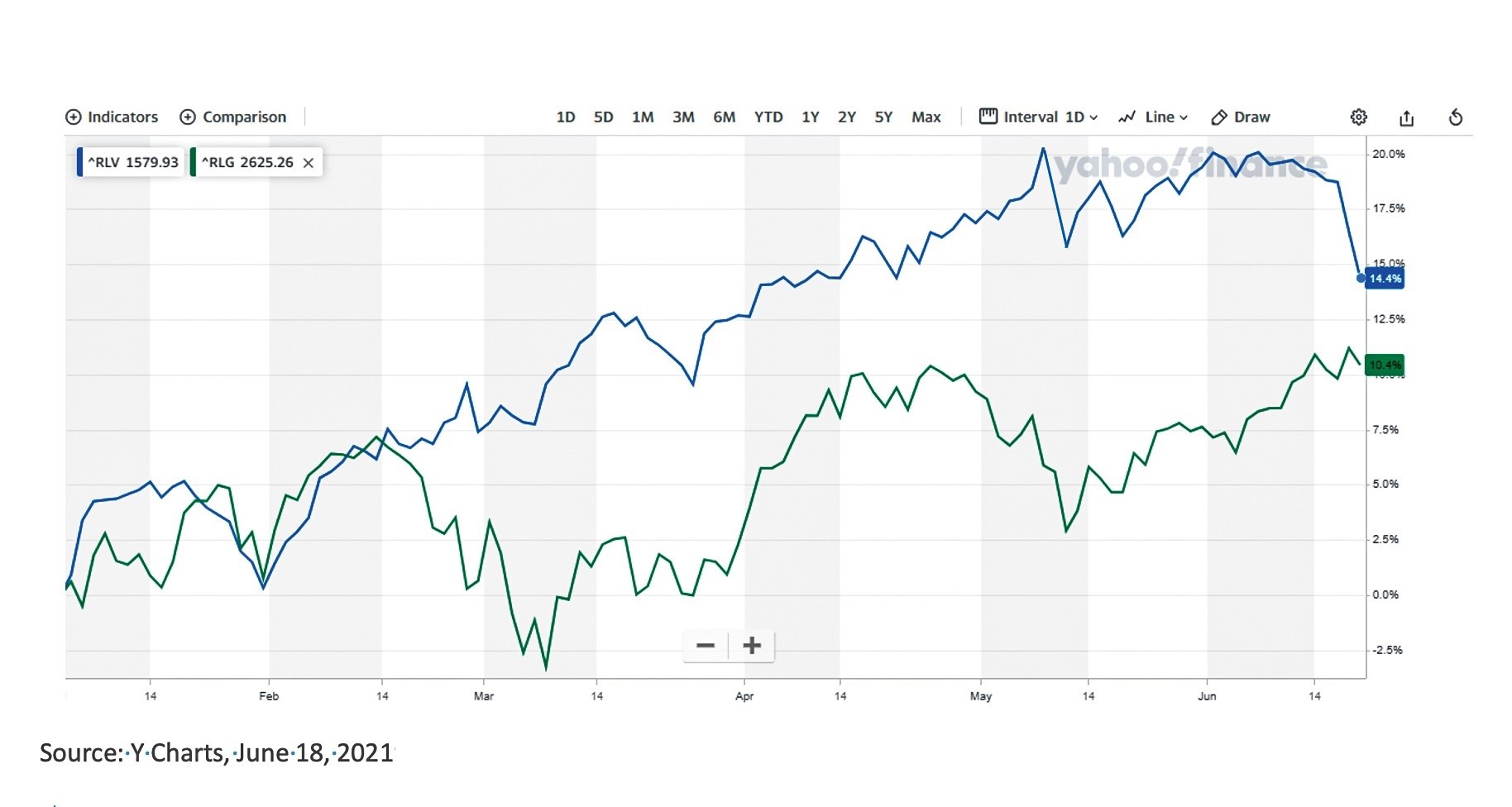

And after years of growth stocks consistently outperforming value, the tables have turned on that front as well. On a year-to-date basis, value stocks are now outperforming growth stocks.

YTD Returns of Russell 1000 Value (RLV) and Russell 1000 Growth (RLG) Indexes

As the U.S. economy gets back on track, a variety of positive economic signals are flashing green:

The elephant in the room: inflation

Anyone who’s ever watched a police procedural knows the three things every detective always looks for: means, motive, and opportunity. Thanks to widespread vaccination efforts, Covid-19 restrictions in most parts of the country have been greatly relaxed or removed. After sixteen months of being hunkered down at home, we’re finally able to emerge and re-engage with society.

Fortunately, many of us are also financially able to spend. As a country, we’re now saving at an annualized rate of $2.8 trillion—more than double the pre-pandemic rate.6We have the means, motive, and opportunity to put those savings to work in the economy by going out to dinner, shopping at the mall, or taking a vacation! It’s also important to keep in mind that the U.S. economy was in good shape right before the pandemic hit. As a result, the U.S. economy appears set and ready to pick up where it left off in early 2020.

Still, the resulting speed at which the U.S. economy has effectively transitioned from ‘recovery’ to full-on ‘growth’ mode has caught many off guard. Both the supply chain and the employment situation have yet to catch up. And, inflation is clearly brewing.

You don’t have to look hard to finds signs of inflation. For example, since January 2020, food prices are up nearly 5%, used car prices are up 21%, and energy prices have climbed 7.5%. In total, consumer prices rose 3.5% between January 2020 and April 2021.7The just-released Producer Price Index (PPI) data for May indicated producer prices up 6.6% on an annual basis—another strong signal of mounting inflationary pressures.8

Commodity prices are also soaring. Both heating and crude oil prices have risen more than 40% since the start of 2021, while unleaded gasoline is up over 55%. Industrial metals are also sharply higher—with copper up more than 29%, aluminum up 22%, and tin up 60% year-to-date. Corn is up 44%, soybeans are up 22%, and coffee is 26% higher while sugar is up 14%.9

In the most recent (June 2021) meeting of the Federal Reserve, officials signaled a likelihood of raising interest rates sooner than previously expected. Just 3 months ago, in March, they forecasted holding rates near zero through the end of 2023. Now, however, with inflation brewing and the economy in growth mode, they project several interest rate increases in 2023. In fact, almost half of the Federal Reserve Open Market Committee members now predict an interest rate increase could be needed as early as 2022. Various Fed officials have also begun publicly discussing an eventual tapering of the central bank’s aggressive bond-buying program. There is even some discussion this could begin as early as the fall.

A key question is whether the inflationary pressures we are now experiencing are transitory or something that could take hold for a while. For now, it appears that supply chain issues and other Covid-19 related difficulties are at least partially responsible for the rising prices we all now see across many categories of goods and services. Retail sales dropped by 1.3% for the quarter as supply chain disruptions (particularly in the automotive sector) temporarily restrict product availability.10 If goods aren’t available to be sold it’s hard for retail sales data to improve.

As these supply chain issues resolve in the coming months, we would normally expect inflation pressures to ease. Whether that actually occurs, however, remains to be seen. Although we’re not yet seeing any credible predictions of runaway inflation, some economists are already forecasting an extended period of higher than 2% inflation.11

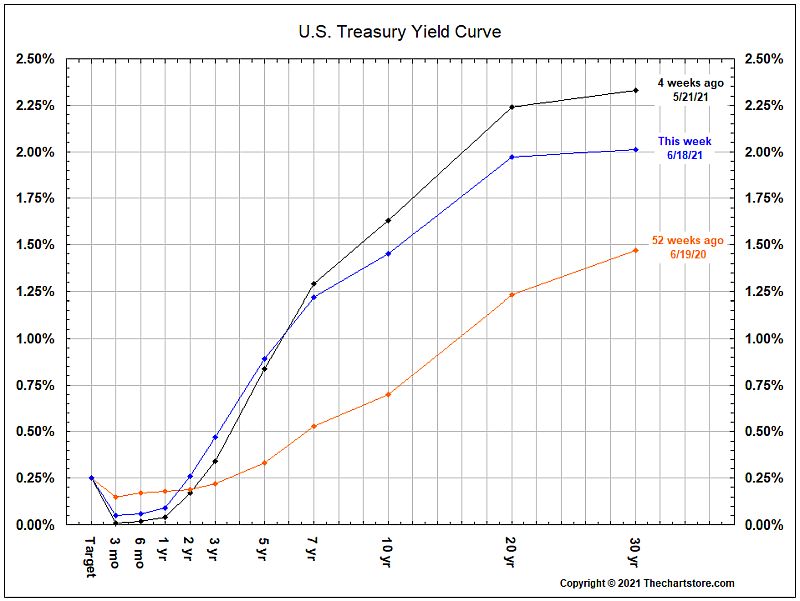

Not surprisingly, as inflation concerns mount, yields on longer-term bonds continued to drift higher for much of this quarter. As you can see in the below graph, the yield curve is significantly steeper than it was a year ago. While shorter-term bond yields (which are closely tied to the fed funds rate) remain mostly unchanged, the farther you move out on the yield curve, the more sharply yields climb. This is partly in response to inflation concerns as well as an acknowledgment that interest rates will not remain this low forever. You can also see that the yields on longer term bonds have dropped over the last month or so. This seems counterintuitive as you would expect rising inflation would also result in rising yields – as it did earlier in the quarter. However, the increased demand for U.S. Treasuries, particularly from overseas investors, is also a key variable in the equation right now. As bond prices have risen, over the last month, the yields on these bonds have fallen slightly.

Unemployment: adding fuel to the inflationary fire

While the Fed has already indicated its willingness to allow inflation to rise well above 2% and possibly even 3% before taking any action to cool off the economy,12the extremely tight labor market and the resulting wage pressures could add considerable fuel to the inflationary fire.

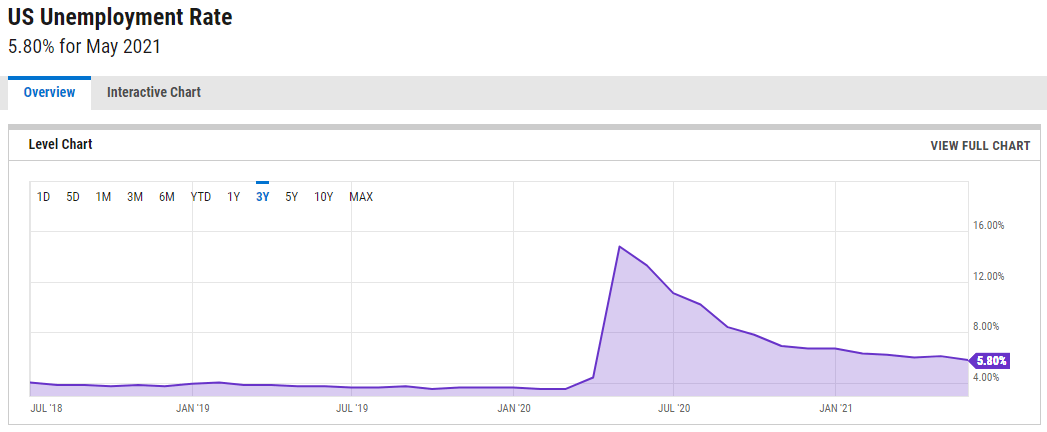

The U.S. unemployment rate currently stands at 5.8%; higher than the pre-pandemic rate of 3.5% recorded in February 2020, but far below the 14.8% rate reached in April 2020. Yet the number of job openings in the U.S. are higher than ever—registering 9.3 million in April.13Recent wage increases at Chipotle, Costco, Target, McDonalds, and Disney suggest rising prices may not be far behind. Indeed, Chipotle just announced it will hike its menu prices by roughly 4% due to rising employee wages.14

Why so many unfilled jobs? The reasons are many and varied:

As always, the Fed has the incredibly difficult job of managing inflation and unemployment, complicated by the reality that they must rely on backwards-looking economic data to predict future economic activity and trends. Additionally, the tools and economic levers at the Fed’s disposal don’t typically have an immediate impact—often requiring months to gauge the effectiveness of a particular action.

As a result—especially during periods of swift economic change— the Fed runs the risk of acting too quickly or too slowly which, in turn, can inadvertently stifle economic growth or allow inflation to escalate unchecked.

Looking ahead

While it’s encouraging to see the economy once again firing on all cylinders, the markets responding positively, and a number of favorable economic trends emerging, we’re watching developments very closely—not just for the specter of inflation, but because a number of factors all have the potential to significantly impact the U.S. economy over the balance of the year.

Among these are the continuing deep political divide, ongoing social unrest, and prospect of higher personal and corporate taxes here at home. Internationally, the spotlight will be on this summer’s report from President Biden’s China Task Force and its impact on U.S.-China relations, as well as the upcoming election for Angela Merkel’s successor as German Chancellor. Concerns are growing over a recent spate of Russian cyber-attacks and the potential for future attacks to cripple key U.S. infrastructure. A surge of the new Covid-19 Delta variant in southern China is now impacting two of the world’s major seaports, and further disrupting the global supply chain. And of course, all eyes will be watching closely to see whether too much stimulus will come back to haunt the U.S. economy in the form of lingering inflation.

We remain optimistic that the growth we’ve experienced thus far in 2021 will continue to take root and flourish. But we also remain ever-vigilant of the potential headwinds on the horizon. If you have any specific questions about our views for the balance of the year, or if you would like to talk about your personal financial situation, please reach out to your BLBB financial advisor at 215-643-9100.

1 “Broader Stock Indexes Slip as Nasdaq Hits Record,” Wall Street Journal, June 24, 2021

2 “Performance 2021; S&P 500 Sectors & Industries,” Yardeni Research, June 24, 2021

3 “The Startup Surge? Unpacking 2020 Trends in Business Formation,” Economic Innovation Group, February 2021

4 New York Fed Consumer Credit Panel / Equifax, April 2021

5 “Millions of Workers are Quitting Their Jobs…” Washington Post, June 17, 2021

6 “The Economic Recovery is Here,” Wall Street Journal, June 2, 2021

7 “The Economics Daily,” U.S. Bureau of Labor Statistics, May 19, 2021

8 “Wholesale prices jump again in May,” Morningstar, June 15, 2021

9 “Commodity Price Surges Add to Inflation Fears,” Wall Street Journal, June 7, 2021

10 “May Retail Sales Slow,” Forbes, June 15, 2021

11 “Bank Economists See Robust Economic Recovery Leading to Full Employment,” American Bankers Association, June 3, 2021

12 “Fed Under Pressure As U.S. Inflation Climbs,” Seeking Alpha, June 10, 2021

13 “Job Openings and Labor Turnover,” U.S. Bureau of Labor Statistics, June 2021

14 “Chipotle increasing menu prices to offset rising employee wages,” Fox Business, June 9, 2021

©2024 BLB&B Advisors, LLC. - PRIVACY POLICY – SITE USE POLICY – DISCLAIMER – ADV Part 2A – FORM CRS