Considerations When Leaving an Inheritance - Part II

In the first part of this series, we looked at the massive looming intergenerational wealth transfer (an estimated $72.6 trillion over the coming 25 years) from the perspective of future inheritors. But it is not just recipients who need to plan and prepare to ensure they are ready to manage the challenges of considerable wealth. There are also various things the older generation—as givers— can do to better prepare themselves and their families to make the impending wealth transfer easier, more streamlined, and tax-efficient.

The lifetime gift exemption clock is ticking

Currently, you are allowed to transfer up to $12.06 million ($24.12 million for a married couple) without triggering any federal estate or gift taxes. But this large exemption amount—part of the 2017 Tax Cuts and Jobs Act—is scheduled to sunset at the end of the 2025 tax year. Unless Congress acts, the lifetime exemption allowance will revert back to $5 million adjusted for inflation. Also, over the last year or so several estate tax proposals were introduced in Congress that, among other things, recommend reducing the lifetime exemption amount.

Given the uncertain future of this tremendous wealth transfer opportunity, you may want to consider various strategies to help remove assets from your taxable estate:

- Annual gifts – you can gift up to $16,000/year ($32,000 for married couples filing jointly) to any number of individuals, without incurring any gift taxes or having the gifts count against your lifetime exemption. For larger extended families, this can be an opportunity to move a significant amount of money out of your taxable estate during your lifetime.

- Accelerate 529 Plan gifts – did you know that you can give five years’ worth of gifts ($80,000) all at once to as many family members and friends as you want, as long as the gifts are made to 529 Plan education savings accounts? Essentially, you and your spouse together can make a lump sum gift of $160,000 to each individual to help them save tax-free for future qualified educational expenses while significantly reducing your taxable estate.

- Fund a dynasty trust – dynasty trusts offer you a way to provide for multiple future generations of your family (for as long as state or federal law permits the trust to exist). If you have considerable wealth and a sizable portion of your lifetime exemption available, a properly structured dynasty trust can transfer any future appreciation and income earned by trust assets between subsequent generations without any estate or gift taxes.

- Irrevocable life insurance trusts (ILITs) – one of the most tax-efficient ways to leverage and transfer wealth is to purchase a life insurance policy inside an ILIT. Using an ILIT, the death benefit your beneficiaries receive is both income and estate tax-free.

Why use trusts?

Parents often worry that putting assets in trust for their family members might seem too controlling or indicate a lack of trust in the beneficiary’s judgment. But in reality, trusts are usually far more of a help than a hinderance. By putting a trust structure in place, you’re empowering beneficiaries to focus on their passions, without having to worry about all the inheritance rules, regulations, and required tax management. Furthermore, it is fairly easy to structure a trust in a way that allows a beneficiary to gradually assume increasing responsibility for managing their trust (if they wish).

The following are just a few of the many valuable benefits which can be achieved through the use of a properly structured trust:

- Motivate certain behaviors or place conditions on a beneficiary’s inheritance by establishing requirements that must be met (such as completing college) before funds can be disbursed

- Provide for a family member with special needs without jeopardizing their ability to qualify for government benefits under the Supplemental Security Income and other potential support programs

- Equalize inheritances in situations where a family business is involved (and one or more children will take over the business) or in blended families where there may be a minimal age gap between a surviving spouse and adult children from a previous marriage

- Remove future appreciation from your taxable estate of assets that may highly appreciate (e.g., commercial real estate or a family business)

Communication is key

The transfer of family wealth can be an amazing accelerant—helping your loved ones take great strides towards the achievement of essential and important life goals. But sudden wealth can also derail beneficiaries who aren’t adequately prepared to handle the associated challenges and responsibilities. Which result ultimately prevails will not only depend a great deal on how thoughtful you are in creating the right wealth transfer structures—but also on how well you educate your beneficiaries and instill in them strong financial skills and values.

Be transparent with your heirs. Do not avoid having an open and honest inheritance conversation with them out of fear that it may be uncomfortable or cause family friction. If beneficiaries do not know the magnitude and expected timing of their inheritance, it complicates their own life planning. For example, you may have an adult child who would love to start their own business but is unwilling to take the risk because they are unaware of the financial safety net you have set up for them.

Finally, keep in mind that wealth transfer planning is an evolving and ongoing process rather than a one-time task. Your financial picture will change. Children will grow and family composition will shift through marriages, births, divorces, and deaths. Also, various tax laws and regulations will inevitably change.

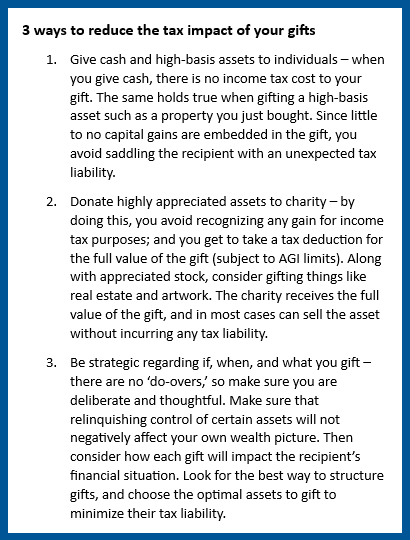

Make sure you carefully consider both the income tax and estate tax implications of your overall gifting strategy— whether it is deciding on the most tax-advantaged approach to gifting assets to your spouse, children, and grandchildren, or choosing the optimal structure (e.g., a donor advised fund, a family foundation, or a charitable trust) to facilitate your charitable giving.

Have questions or want to discuss specific strategies for the tax-efficient transfer of wealth to the next generation? Sit down with your BLBB Advisor (215-643-9100) and your tax attorney. Together, they can help you craft a plan to achieve your goals.

If you are not yet receiving our newsletters, subscribe here.

If you do not have a BLBB Financial Advisor, click here to connect with us.