Founded in 1964, BLBB is an independent, employee-owned, multi-custodial financial advisory firm. We provide fiduciary advice, planning, and investment management services to individuals and families, nonprofits, and business owners.

From the beginning, founders Frank Burke and Nick Lawton were devoted to “helping people build tomorrow’s financial security through sound investments today.”

Founded in 1964, BLBB is an independent, employee-owned, multi-custodial financial advisory firm. We provide fiduciary advice, planning, and investment management services to individuals and families, nonprofits, and business owners.

Today’s BLBB team continues this legacy, providing the same high level of service we were founded on.

Founded in 1964, BLBB is an independent, employee-owned, multi-custodial financial advisory firm. We provide fiduciary advice, planning, and investment management services to individuals and families, nonprofits, and business owners.

We take pride in our work with our clients, their children, and grandchildren, helping them enjoy success across generations.

We are driven every day by the desire to help our clients feel confident about their financial future. It’s about meeting you where you are—understanding your aspirations, and perhaps even helping you achieve goals you didn’t realize were within reach. This impact has driven us for the last six decades keeping our focus on what’s most important: your success.

In his capacity as an advisor, Ed quantifies, prioritizes, and creates plans and investment strategies to help clients successfully achieve their financial goals – as well as structuring solutions to create wealth for future generations. An ERISA 3(38) fiduciary, Ed also takes a disciplined, well-documented approach to mandated periodic reviews, and formalized plan sponsor fiduciary duties to minimize liabilities associated with overseeing a qualified retirement program.

Prior to joining BLBB Advisors, Ed was President and CEO of the Gwynedd Company for 24 years – growing the firm to more than $100 million in assets under management. He also brings years of corporate compensation and benefits experience acquired in large companies in the Philadelphia area.

Outside of the office, Ed enjoys spending time with his wife, Pam, and his family, spoiling his twelve grandchildren, and playing golf.

Laura specializes in helping her clients successfully navigate periods of transition and proactively address financial concerns and challenges through careful planning. She works closely with each client to develop a sound asset management approach incorporating their specific personal needs, circumstances, and financial goals. As the primary financial provider in her own family, Laura is keenly attuned to the unique issues women face as they build, manage, and transfer their wealth to the next generation – particularly women who suddenly or unexpectedly find themselves in charge of their family’s financial life.

Outside the office, Laura is the mother of two girls and an active volunteer at their school. Like many of her clients, Laura is also an avid traveler and is always ready to plan her next adventure.

Nick specializes in working with complex family groups and nonprofit institutions – developing and maintaining financial plans and providing ongoing asset management that aligns with each clients’ personal circumstances, challenges, and goals.

Prior to joining our firm in 2019, he spent 11 years as a Client Portfolio Manager with Hirtle, Callaghan & Co., working directly with high-net-worth family groups, business owners, retirement plans, endowments, and foundations.

Nick enjoys spending time with his wife and two young children hanging out at home cooking on the smoker or at a local park in Phoenixville when not spending time at the beach.

Brian leverages his 25+ years of experience to deliver financial planning, strategy development, and investment recommendations to the mission of helping his clients meet their stated goals. He is also responsible for overseeing our firm’s ETF Model Program.

Prior to joining our firm in 2015, Brian served as Associate Director of Reporting and Operations at Threshold Group, LLC and was a Senior Financial Analyst at Ashbridge Investment Management.

Outside of the office, Brian is an active volunteer in his community, a lifelong Philadelphia sports fan, and an Eagles season ticket holder.

Mike collaborates with our advisors to oversee portfolios and directly manage client relationships. He also serves on BLBB Advisors’ Investment and ETF Committees.

Before joining our firm, he worked for both Janney Montgomery Scott and Boenning & Scattergood in equity research, sales and trading (with a focus on financial institutions) for individual and institutional clients.

Mike lives in the Fairmount neighborhood of Philadelphia alongside his wife, two children, and dog. During his leisure hours, he enjoys such activities as golf, tennis, basketball, culinary pursuits, and family getaways to Ocean City, NJ.

Clifford specializes in helping individuals, families, and nonprofits identify and address complex financial and strategic challenges – from addressing multi-generational family governance issues to helping nonprofits overcome critical transition and growth. He is especially adept at planning, implementing, and executing asset transfers such as succession planning, intergenerational wealth transfers, and charitable gifting.

Previously, Clif served as President, CFO and CCO of Rutherford, Brown & Catherwood, and CFO and CCO of Walnut Asset Management. Throughout his career he has served on various securities industry and regulatory committees.

Clif is married to his best friend, Kristen, and is an avid gardener, traveler, oenophile, and bibliophile.

Whether transitioning to retirement, selling a business or looking for help to better understand a financial situation, Dean and his team of financial planners can provide the confidence needed to make well thought out and informed decisions. While appropriate investment management and wealth planning are the foundations of any strong financial plan, it is the individual nature of his process that resonates with clients and leads towards success and lifelong relationships. From individuals to nonprofits and foundations, Dean has extensive experience to assist.

Prior to joining our firm in 2004, he served as President and CEO of Rutherford, Brown & Catherwood, LLC and Chief Financial Officer of Walnut Asset Management, LLC.

Dean and his wife, Maria, are the parents of two grown children. In his free time, he enjoys traveling, skiing, and playing golf.

John works with families, foundations, and nonprofit organizations to grow, protect, and manage their assets – specializing in developing and implementing creative investment management strategies and innovative solutions to address their unique challenges. He is passionate about helping clients seamlessly manage financial transitions throughout the course of their lives; particularly as individuals plan for, and move into, retirement and as nonprofits face financial turning points.

He brings 25+ years of financial services industry experience to his role at BLBB Advisors. Prior to that, John served as an officer in the United States Army Corp of Engineers – spending most of his tour in Germany.

His compassionate spirit is evidenced in the many nonprofits and charitable foundations he serves – both in an advisory and volunteer capacity.

In his free time, John enjoys golf, tennis, paddle tennis, and skiing with his family.

Through wealth advisory and education, Brianna strives to connect with clients on a deeper, personal level to help them better understand their full financial picture so they can grow and protect their assets through every stage of life. By translating complex concepts into smaller manageable action steps, she can help individuals and families better understand how to plan for retirement more effectively.

Also, as a 3(38) plan financial advisor and Director of Retirement Plans, she manages the investment decisions of a retirement plan acting in the best interests of the plan participants and beneficiaries. Prior to joining our firm, Brianna spent 5+ years with the Gwynedd Company.

Brianna and her husband enjoy spending time with their daughters and their dogs, Dublin and Zoe. She is also an avid traveler, with some of her favorite destinations including Portugal, Thailand, Italy, and Ireland.

Robb works with individuals, families, and institutional clients to identify their financial goals and develop investment strategies and options. His experience with security selection and portfolio construction is surpassed only by his ability to build long-standing client/advisor relationships based on trust and mutual respect.

Prior to joining our firm in 2013, he served nearly 20 years with Turner Investments as a partner and senior portfolio manager. He also was an equity/fixed income portfolio manager at PNC Bank.

Robb enjoys spending time with his family enjoying golfing, skiing, and hiking.

We are always looking for creative, caring, innovative, and engaged individuals to join our team.

If you are interested in being a part of a dynamic financial advisory firm that is committed to providing best-in-class wealth management and financial planning services to our clients, check out our openings to see if we might be the right landing spot for your next career move. Even if we do not have any current openings posted, we would still like to hear from you.

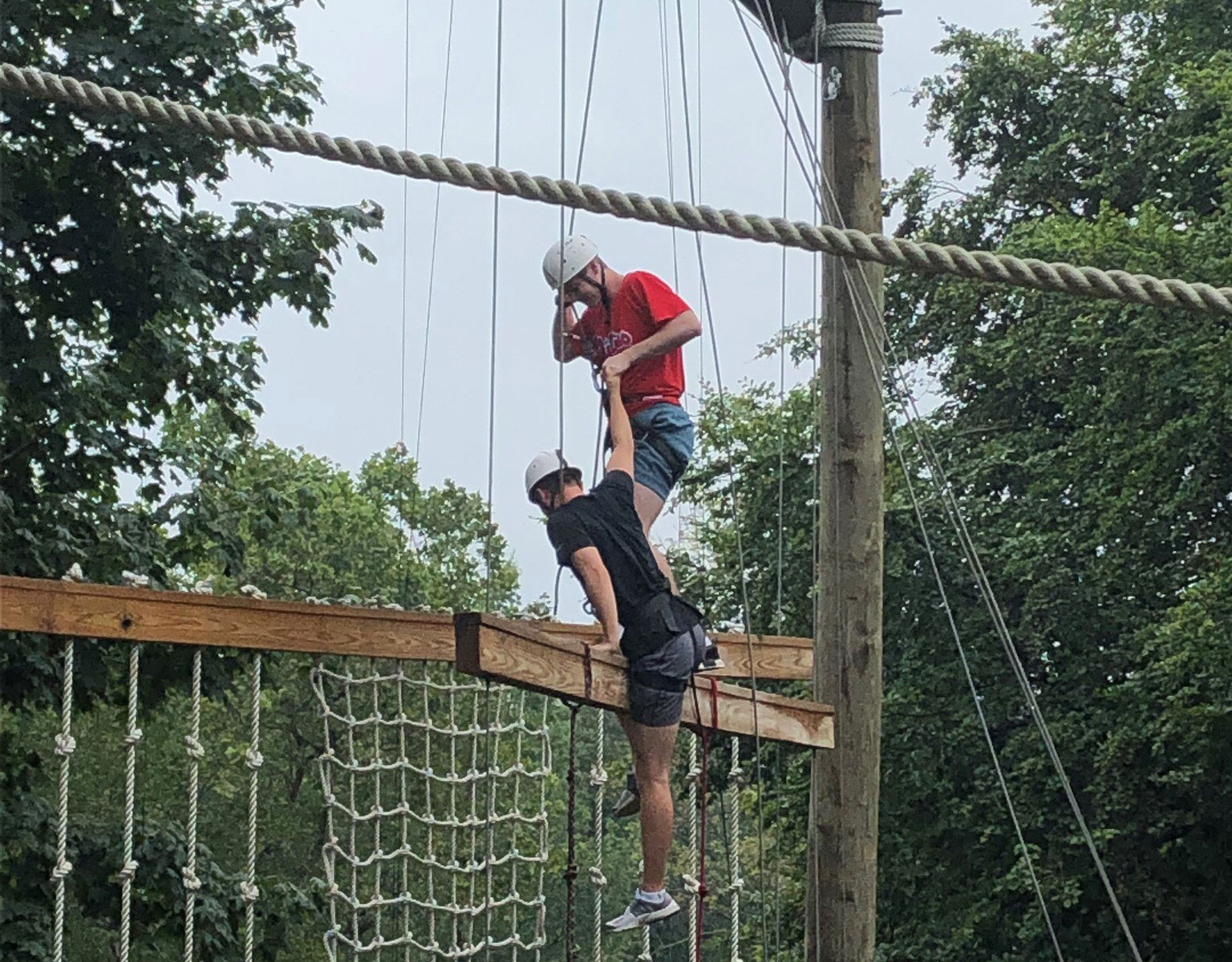

We are proud to positively impact our community, whether through serving on nonprofit boards or supporting individual causes with our time and talent.

BLBB Charitable, the Giving Arm of BLBB Advisors, supports initiatives that help people discover their potential through educational and leadership opportunities. Click the link below to learn more about BLBB Charitable.

©2025 BLB&B Advisors, LLC. - PRIVACY POLICY – SITE USE POLICY – DISCLAIMER – ADV Part 2A – FORM CRS