Quarterly Economic Review 2nd Quarter 2025

Tariffs & Turbulence: Q2 2025 Market Volatility and Policy Impacts

Just two days into the second quarter, the Trump administration announced plans to impose a barrage of U.S. tariffs on imported goods, sparking tariff-related market volatility. Dubbed “Liberation Day,” the measure included a blanket 10% tariff on all imports along with more punitive tariffs (up to 50%) on countries deemed to have exploited the U.S. (including Canada, Mexico and China – our three biggest trading partners). This marked a sharp shift in U.S. trade policy.

Not surprisingly, the stock market did not react positively – quickly experiencing the steepest decline for U.S. equities since the start of the COVID pandemic five years ago. In the ensuing days and weeks, however, the situation became increasingly clouded, with the administration shifting back and forth between imposing and then reducing tariffs.

As a result, April saw historically large swings in equity prices accompanied by heightened bond market volatility:

- Both the DJIA and the S&P 500 fell into correction territory, while the Nasdaq Composite entered bear market territory for the first time in three years1

- On April 3rd and 4th, the S&P 500 logged its fifth-largest two-day percentage decline since 19501

- It also recorded its 12th largest four-day percentage drop (April 3 – April 8) in 75 years1

But much like the COVID correction, investors who weathered the storm were quickly rewarded for maintaining their asset allocation.

- On April 9th, the DJIA, S&P 500, and Nasdaq Composite all registered their largest single-session point gains in history1

- As of market close on June 20th, the S&P 500 has climbed back into positive territory for 2025 (up 1.5%) and currently sits less than 3% off its all-time high2

S&P 500 Performance (Past 6 Months): Trade Policy Uncertainty

Source: Advisor Perspectives, June 20, 2025

One key lesson to take away from this quarter is considering the dynamic nature of how quickly tariffs can be reduced or removed (as we’ve seen repeatedly in recent months), making any portfolio management decisions based on rapidly shifting trade policy is neither a sound nor sustainable investment approach.

Economic Uncertainty Lingers: Fed Policy, Stagflation, and Consumer Sentiment

While the U.S. economic outlook has somewhat dimmed since the start of the year, all eyes are carefully watching key early Q3 indicators in hopes of getting a better directional read on where the market may be heading over the remainder of 2025.

At its June 2025 meeting, the Federal Reserve exercised interest rate caution:

- Opting to maintain a steady Fed Funds interest rate of 4.25% to 4.50%3

- Slightly lowering its already modest projection for 2025 GDP growth (from 1.7% to 1.4%)3

- And moderately increasing the expectation for core Personal Consumption Expenditure (PCE) inflation from 2.8% to 3.1% [Note: PCE is the Fed’s preferred inflation measure rather than CPI] 3

Similarly, consumer confidence fell 5.4 points in June, falling to 93.0 from 98.4. J.P. Morgan Research is predicting a 3.0% increase in consumer spending for the second quarter. Gauging the health of consumer spending, however, has become especially challenging in this current environment as many Americans accelerated major purchases ahead of Trump’s tariffs taking effect, skewing retail sales data. Whether or not consumers will continue to maintain this level of spending or pull back remains to be seen.

Retail sales slid nearly 1% in May, underscoring a soft real time demand, and the most recent housing market data shows a significantly cooling market (with new home starts falling to their lowest level in five years).

Despite all these conflicting economic data points, the current administration is lobbying hard for rate cuts to help boost economic growth. Yet policymakers are opting for extra caution. Federal Reserve Chairman Powell recently noted “it takes some time for tariffs to work their way through the chain of distribution to the end consumer.”6 He further emphasized “if the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment,”6 (i.e., stagflation).

For well diversified portfolios, however, the good news is that the modest slowdown in U.S. growth has been offset by a stronger start to the year across a wide range of European and Asian economies. And the consensus estimate still suggests the Fed will implement two 25 basis points rate cuts before the end of the year.

A Mixed Market Performance: Equity Strength vs. Bond-Market Caution

As noted above, the S&P 500 has rebounded strongly from its 6% plunge in March. Year-to-date, the index has climbed back into the green (up 1.5%) after rising nearly 6% thus far in Q2. The rolling 12-month return of the index is still an impressive 9.5%.

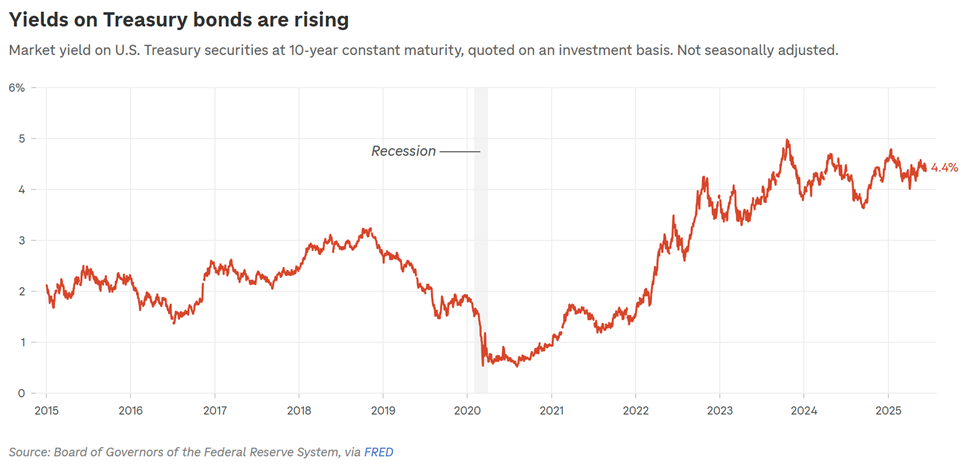

Not to be outdone, the bond market offered its own set of mixed signals in Q2. Overall, a notable flight to quality is underway – with higher quality bonds generally performing better as investors seek safety amidst economic uncertainty. The ‘on again / off again’ nature of tariff announcements has served to heighten volatility and shift investor focus to the longer end of the yield curve, contributing to bond market volatility:

- 10-year Treasuries are currently yielding around 4.5% and 30-year Treasuries are touching 5% yields

- Long-term bond yields are likely to trend lower over the next six months

- Investment grade corporate bonds continue to maintain stable fundamentals while facing some widening of spreads due to uncertainty

- Municipal bonds have been experiencing especially strong demand (with shorter duration munis performing particularly well)

- And high-yield bonds are seeing increased volatility – with wider spreads in some segments, but strong underlying fundamentals still in place

Towards the end of May, however, Moody’s downgraded the U.S. Treasury credit rating from AAA to AA1. While not a four-alarm fire, the downgrade serves as a reminder that if left unaddressed, persistent fiscal imbalances will inevitably become a drag on economic growth. As Zachs Investment Management recently noted:

“If deficits continue to widen and debt service takes up a growing share of federal resources, it could begin to crowd out productive private investment, strain fiscal flexibility, and gradually undermine the foundations of U.S. economic leadership. In that sense, the downgrade is less a shock event and more a warning sign for policymakers on the road ahead.”7

Yet according to UBS, there is currently more than $7 trillion in money on the sidelines – held in cash equivalents such as money market funds and CDs. As those rates drift lower (money market yields have shrunk from the low 4% range to the high 2% range), we expect a lot of that money will begin finding its way into both the fixed income and equity markets as rate expectations shift.

While bond market volatility and uncertainty will likely persist, the rise in long-term yields and improved valuations in certain sectors may offer opportunities for carefully positioned portfolios to lock-in higher yields.

Tax policy and spending ambiguity: TCJA Extensions, Budget Cuts, and Fiscal Impact

Recently the administration’s sweeping tax reform and spending legislation (the ‘One Big Beautiful Bill Act’) was passed by both the House and U.S. Senate. It is too early to tell exactly how much this bill will add to our federal deficit. Notably the bill will:

- Permanently extend most of the tax cuts introduced in 2017’s Tax Cuts & Jobs Act (TCJA), currently scheduled to expire after 2025 – a shift in U.S. Tax Policy

- Call for major cuts to Medicaid and SNAP food assistance programs

And lastly, the U.S. recently initiated airstrikes on Iranian nuclear facilities – a major escalation in the recent Israeli-Iranian clash, and another variable that could further cloud an already murky economic landscape.

2025 Economic Outlook

Although we certainly had hoped for greater clarity and direction at this point in the year, we will instead reiterate the three certainties we alluded to in our Q1 commentary:

- The current uncertainties, and thus periods of heightened volatility, will likely be with us for a bit longer as changes underway in Washington proceed and international geopolitical events dominate the headlines

- Eventually, these uncertainties will ease and be replaced by greater certainty

- There will always be something unexpected waiting in the wings to inject new uncertainties into the mix

The key is to trust in your asset allocation and avoid the temptation of reacting too quickly to the latest headlines. Rest assured, BLBB is closely monitoring economic and geopolitical developments as they unfold and will inform you of any critical issues that we feel could impact your investment portfolio. Of course, if you’re on the cusp of retirement or simply feeling concerned or overwhelmed, we encourage you to reach out to your BLBB financial advisor (215-643-9100).

We can help you update and/or stress test your financial plan and explore whether any adjustments to your asset allocation may be warranted. Or perhaps you simply want to talk with a voice of reason who can help you understand your current financial situation and how you are positioned to withstand these kinds of market events. We are here for you!

1 https://www.theguardian.com/us-news/2025/may/17/trump-liberation-day-tariff-walk-back

2 FactSet Data, June 20, 2025

3 https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20250618.htm

4 https://www.bls.gov/news.release/pdf/empsit.pdf

5 https://www.conference-board.org/topics/consumer-confidence

6 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250618.pdf

7 https://zacksim.com/blog/how-big-a-deal-is-the-moodys-downgrade-of-u-s-credit/

Investment advisory services are provided by BLBB Advisors, a Pennsylvania-based investment advisor registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Additional information about BLBB is available in our current disclosure documents which are available on BLBB’s website (www.blbb.com) or the SEC’s public disclosure database (IAPD) at www.adviserinfo.sec.gov.

This content is intended for informational purposes only and should not be construed as personalized investment advice. Please consult with your financial adviser before making any investment decisions.

Certain information contained herein may be historical in nature while other responses may represent forward-looking statements. There are no guarantees that historical events will or may, repeat themselves. Forward-looking statements reflect the judgment of BLBB Advisors as of the date of publication and are subject to change without notice. They are not guarantees and involve risks, uncertainties, and assumptions that are difficult to predict.

BLBB’s investment approach incorporates, among other things, asset allocation and portfolio diversification. While these strategies are designed to limit risk, there is no guarantee that such strategies alone, or in combination, will guarantee against a loss of principal.

[View Quarterly Economic Review]