8 Things You Should Know About Social Security

As you approach retirement age, you will have some important decisions to make about when you (and your spouse, if applicable) should claim Social Security. These decisions should not be taken lightly as they can impact – positively or negatively – your ability to maximize the amount of money you receive from Social Security during your lifetime.

Set forth below are some of the items you will need to factor into your Social Security claiming decisions. As you begin to evaluate your retirement plans and the role Social Security will play in your post-retirement financial life, your BLBB Advisor is ready to help you explore the options available to you and the impact each may have on your ability to generate sufficient retirement income.

- It is more money than you may realize

No matter how much you earn or how much you have already set aside for retirement, Social Security benefits will still play a key role in providing you (and your spouse) a guaranteed income stream in retirement. For example, if you reach full retirement age in 2024 and are also planning to retire this year, your maximum monthly Social Security benefit would be about $3822 per month.1 If you live to age 90, you will end up collecting over $1 million from Social Security! Also, keep in mind this figure does not include the annual cost of living adjustments you may receive from Social Security along the way (e.g. between 0% and 8.7% a year over the past 10 years).1

[box] How are your benefits calculated?

First, the Social Security Administration (SSA) averages your highest 35 years of earnings (indexed for inflation). If you worked fewer than 35 years, missing years are counted as $0. The SSA then applies a formula to this average which determines the primary insurance amount for your age.[/box]

2. The age you start taking benefits makes a big difference

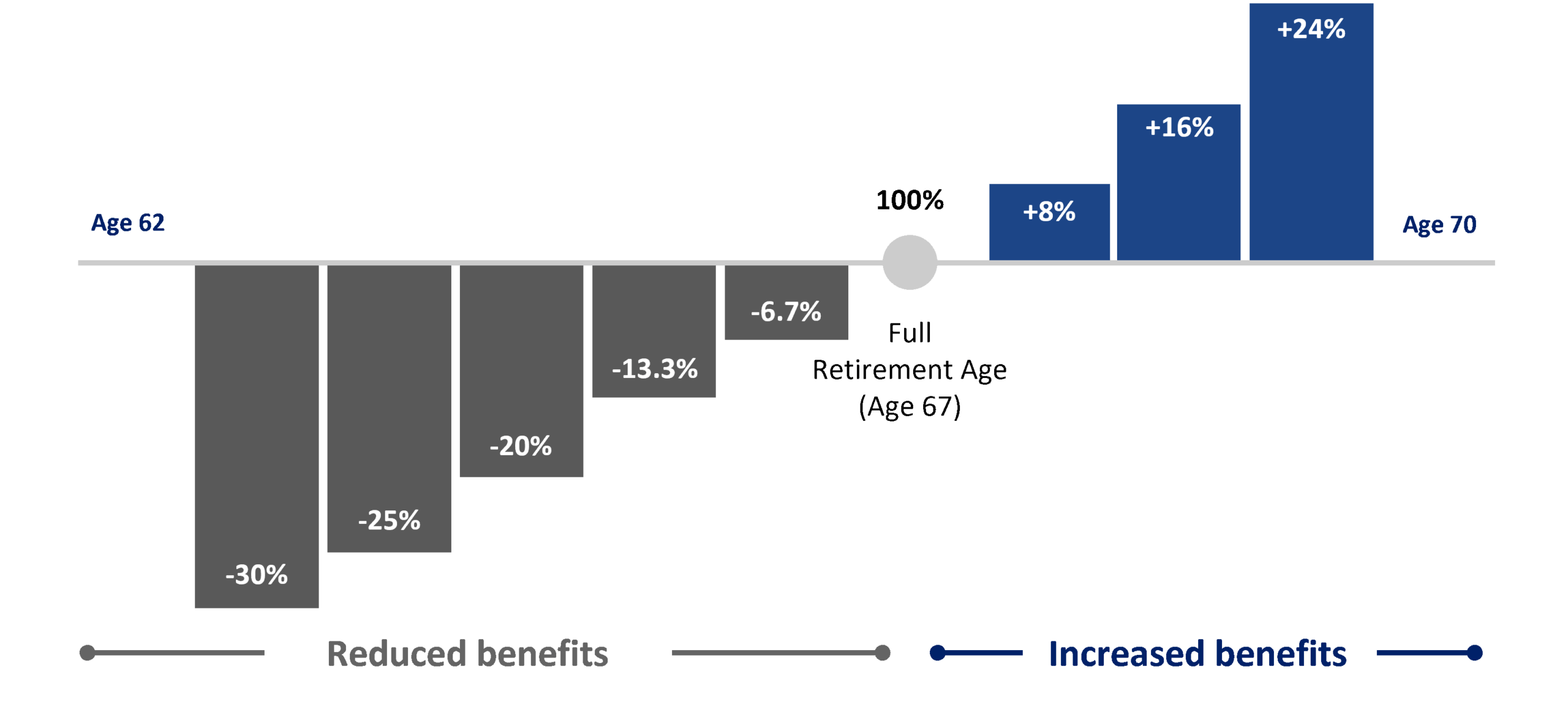

While full retirement age is age 67 (for those born after 1959), you may claim Social Security benefits as early as age 62 or delay them up until age 70. As you would expect, the older you are when you claim Social Security, the larger your monthly benefit will be.

If you opt to begin taking Social Security prior to reaching your full retirement age, this will result in a permanent reduction (by as much as 30%) to your full retirement monthly benefit. On the other hand, for each year you defer beyond your full retirement age up to age 70, you will receive an additional 7-8% increase to your monthly benefit (plus cost of living adjustments). In other words, waiting to age 70 to claim Social Security will maximize your monthly benefit amount while claiming earlier than 70 will reduce your monthly benefit amount.

At first blush, it may appear that waiting to age 70 before claiming Social Security is always the “right” decision, but, there are certainly instances when it is not. For example, if you suffer health issues that could shorten your lifespan, then it may not be a good idea for you to delay claiming Social Security. Your BLBB financial advisor can help you evaluate various claiming strategies and understand where your breakeven point is if you were to delay claiming benefits.

You may also find you do not have adequate financial flexibility in retirement to wait until 70 to claim Social Security. Should you find yourself in this position, your BLBB financial advisor can help you develop an appropriate Social Security claiming strategy that still helps you maximize your lifetime benefits to the best extent possible. For example, it may make better sense for the lower earning spouse to claim benefits prior to age 70 while the higher earning spouse waits as long as financially possible to claim. This type of strategy increases monthly retirement income earlier on in retirement and also allows the larger Social Security benefit to grow more thereby ensuring a larger monthly benefit will be available for the lifetime of the remaining spouse should one predecease the other.

- Spousal benefits can be complex

On the surface, spousal benefits are fairly straightforward. Anyone who is age 62 or older and whose spouse has already filed for benefits may be eligible for a spousal benefit. If you wait until full retirement age to claim a spousal benefit, you will be entitled to up to 50% of your spouse’s benefit (benefits are reduced if taken earlier). Of course, this option only makes sense if the spousal benefit amount is higher than the benefit you would receive based on your own work record.

Even if you are divorced, you still may be eligible to collect spousal benefits based on your ex-spouse’s earnings history assuming you were married for at least 10 years and did not get remarried. In some cases, an ex-spouse may qualify for benefits even if the earning spouse is not yet receiving them.

- Survivor benefits offer more flexibility

Surviving spouses have the choice of claiming the benefit based on their own work history or their survivor benefit. If survivors wait until they reach full retirement age, they can receive 100% of a higher-earning deceased spouse’s benefit. If income is needed, surviving spouses can opt to start collecting as early as age 60—but the benefit amount they qualify for will be reduced for every year short of full retirement age (a 33.5% reduction if benefits begin at age 60). Additionally, even if you remarry after you reach age 60 (age 50 if disabled), this will not affect your eligibility for survivor benefits.

In general, survivor benefits allow for considerably more planning creativity than spousal benefits. For example, you might opt to claim reduced survivor benefits starting at age 60 and then switch over to your own maximum benefit at age 70; or begin receiving your own reduced benefit at age 62 and then switch over to a full survivor benefit at age 67.

Keep in mind too that the greater the age difference between 2 spouses, the greater the potential for survivor benefits to be paid over a longer time period. Couples with a considerable age gap will want to factor this into their claiming decisions.

- Continuing to work will impact your benefit

If you choose to begin collecting benefits before reaching full retirement age and while you are still working, some or all of your benefits could be withheld up until the month you reach full retirement age. For any years prior to full retirement age, if you earn more than the allowable amount ($22,320)1, $1 of your benefits will be withheld for every $2 earned above that amount. During the year in which you reach full retirement age, the earned income threshold rises (to $59,520)1 and the benefit reduction formula also changes. $1 in benefits will be withheld for every $3 in earnings that exceed the allowable amount.

It’s important to note, however, that these benefits are withheld not forfeited! Not only are they all credited back to you after you reach full retirement age, but also those extra working years might enhance your overall benefit calculation if they replace lower earning years in your benefit calculation. Once you reach full retirement age, no benefits will be withheld regardless of how much income you earn.

- Don’t forget your benefits may be taxed

Your Social Security income will be taxed at differing rates depending on your overall combined income (Your adjusted gross income + any non-taxable interest + half of your Social Security benefit). As shown in the table, up to 85% of your benefits may be subject to federal income taxes. Additionally, individual states have differing approaches for treating the taxation of Social Security benefits.

For federal income taxes, you can choose to pay the IRS directly or opt to have applicable taxes withheld from your monthly payments.

- There is a little known 6-month lump sum option

At any time after you reach age 67½ without starting your benefits, you may be able to claim up to six months of benefits to be paid in a single lump sum.

For example, suppose you are eligible for a monthly benefit of $3,000 at age 67½. By opting to claim six months of retroactive benefits, you would get a nice initial check for $17,280, but you would effectively be rolling the clock back to six months earlier for your start date—permanently losing 4% of that $3,000 monthly benefit which would be reduced to $2,880.

While adversely impacting future payments, this may be a viable option for clients with serious health issues, or those who need to pay off high cost debt or satisfy an immediate financial obligation.

- Others may be able to collect on your earnings record

In addition to spouses and ex-spouses, there are other select individuals who may be able to collect on your earnings record. Minor children (or any children over age 18 who are disabled) are eligible for benefits if they have a disabled or retired parent, or are the surviving child of a deceased parent who earned enough credits to qualify for benefits. Additionally, parents caring for children who qualify for benefits may also be entitled to receive some benefits themselves; and parents age 62 or older who received at least 50% support from a deceased child can also apply to receive benefits.

Armed with a deeper insight into the idiosyncrasies and particulars of Social Security, you will be better able to understand the long-term financial impact of taking benefits early, as well as the pivotal role Social Security can play in helping you achieve your retirement goals. Your BLBB advisor (215-643-9100) can work with you to model various Social Security ‘what if’ scenarios to identify the choices and decisions that will help you to maximize your retirement income.