These are two of the critical retirement goals every investor should be thinking about:

- Ensuring that you’re able to generate enough income throughout your life, without running out of money, and

- Protecting your savings from being depleted by healthcare costs.

Also, as retirement nears, the decisions you make concerning Medicare and Social Security benefits are likely to have a profound impact on your ability to successfully meet those essential goals.

Why are Medicare and Social Security so important? The answer lies in our increasing longevity.

People today are living longer and more active lives than ever before. In fact, there’s a 50% likelihood that at least one partner in a healthy 65-year-old married couple will live beyond age 92. The days of a 10-year fairly sedentary retirement are far in the rearview mirror. Often, people are traveling, pursuing passions and living fully for 30+ years or more in retirement—bringing considerably higher lifetime expenses.

That same healthy couple can also expect to pay an estimated $285,000 in out-of-pocket healthcare expenses over the course of their retirement.1 It’s the double-edged sword of longevity—as we live longer, our costs of care invariably rise. And that price tag doesn’t include the considerable costs of long-term care—costs that are NOT covered by Medicare and which statistics show 70% of us will need at some point in our lives.

Navigating your Medicare choices

Too often, people tend to wait until the last minute to begin researching their options and selecting their Medicare coverage. Even if you’re still 5 – 10 years away from age 65, the time to start planning is now. First, make sure you familiarize yourself with the various components of Medicare coverage:

- Part A: covers inpatient hospitalization, skilled nursing facility care, hospice and home health care (requires both deductibles and copays);

- Part B: provides coverage for doctors’ services, outpatient home health care, medical equipment and other preventive services. Along with deductibles and copays, it requires monthly premiums;

- Part D: includes optional prescription drug coverage that requires both monthly premiums and deductibles/copays. You need to opt in by filling out a form, enrolling in an approved plan, and having coverage from Medicare Parts A and B or Medicare Advantage;

- Medigap: offered by private insurers as a supplement to Medicare Parts A and B. It’s designed to fill gaps in coverage such as copayments, coinsurance and deductibles; and

- Part C (Medicare Advantage): a private alternative to Medicare that covers all the services associated with Parts A, B and possibly D. Coverage and costs vary by plan and insurer.

Your coverage begins the first day of the month in which you turn age 65. If you’ve already begun receiving Social Security benefits, you’ll automatically be signed up for both Medicare Part A and Part B. If you haven’t yet started claiming Social Security benefits, you’ll need to submit a Medicare application during the 7-month enrollment period (beginning 3 months before the month you turn age 65)

Even if you’re still working and covered by an employer’s plan, it’s a good idea to sign up for Medicare as soon as you’re eligible. Otherwise, when you eventually make the transition to retirement, there’s a chance you could experience a gap in coverage as well as potentially higher premiums.

And when selecting coverage, make sure to factor in your expected future healthcare needs. If you have pre-existing conditions or a family history of certain chronic diseases, you may want to consider opting for more robust coverage (such as purchasing a Medigap policy). Switching to a more comprehensive policy later on could also trigger higher premiums or result in a delay in coverage.

Social Security planning

No matter how much you’ve saved for retirement, don’t make the mistake of underestimating the financial importance of Social Security. In 2021, the maximum monthly Social Security benefit for someone retiring at their full retirement age (FRA) is $3,148. Over the course of a 25-year retirement, that benefit will total nearly a million dollars ($944,400)!

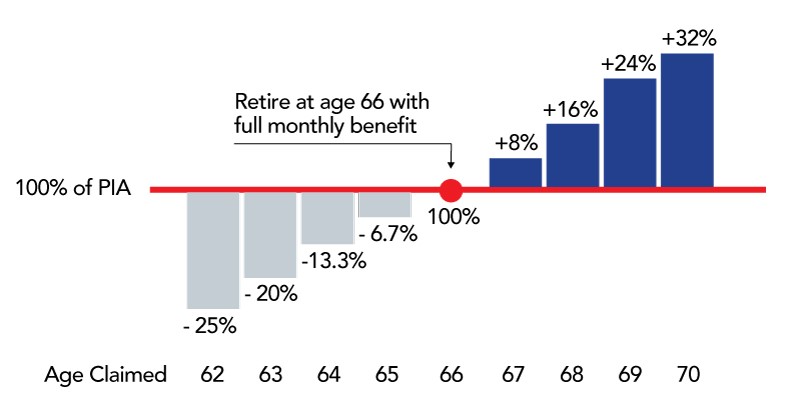

Deciding when and how to claim benefits, however, will have a tremendous impact on your total lifetime benefit. Normal benefits are earned when you reach FRA (either age 66 or 67 depending on the year you were born). You can choose to start collecting early benefits any time after you turn age 62. But in exchange for the earlier start date, your monthly benefit amount will be permanently reduced. Alternatively, for every year you delay receiving benefits (up to age 70), the amount of your future monthly benefit will be increased. The following chart shows the impact on your monthly lifetime benefit amount based on the age you begin claiming benefits:

When deciding on a claiming strategy, it’s important to also consider whether or not you plan to work while receiving benefits. Social Security has earnings limits which could significantly reduce your monthly benefit amount. For the 2021 tax year, for every $2 you earn in excess of $18,960, $1 will be deducted from your total Social Security benefit if you’ve yet to reach your FRA.2

Other Social Security decisions you’ll want to explore include:

- Whether you or your spouse wants to claim spousal benefits based on the other spouse’s earnings record. Spouses can choose between their own benefit or up to 50% of their spouse’s Full Retirement Age benefit (35% if they opt to collect starting at age 62). However, they cannot begin collecting spousal benefits until their husband or wife files for benefits;

- Surviving spouses are eligible to collect benefits based on their deceased spouse’s earnings record; and

- Similarly, divorced individuals (who meet certain criteria) may also be eligible to collect benefits based on their ex-spouse’s earnings record—as may your minor or disabled children

You can access your Social Security statement online at ssa.gov. In it, you’ll find specific information about your expected future benefits, as well as estimates for family and survivor benefits.

Aligning decisions with your financial plan

As you can see, there’s considerable complexity involved in Medicare enrollment and Social Security claiming decisions. Any missteps could be costly, result in coverage gaps, and have significant income and tax implications. That’s why it’s important to consult with your BLBB advisor in advance. Together, we can review your various options, explore their long-term impact to your retirement income plan, and make any necessary adjustments to your overall financial plan to align with whatever choices you make.

1 Fidelity Workplace Consulting, April 2019

2 Note that earning limits increase considerably ($50,520) for the year in which you reach FRA