Thanks to vaccination efforts around the country and the world, ‘slowly getting back to normal’ is one of the overarching themes for the first quarter of the year. At the time of writing this update, the U.S. had just surpassed the 100 million vaccination milestone and is now vaccinating more than 2 million people daily. While some major public health challenges still exist, and probably will continue to do so for the remainder of 2021, there are also bright spots on the horizon. The recent approval of the Johnson & Johnson one-dose vaccine is expected to further expedite the pace of vaccinations around the country—moving us closer to a point where herd immunity can be achieved. Herd immunity makes it difficult for the virus to replicate and spread between humans because enough people are immune to the virus.1 Historically, we’ve already benefited from the concept of herd immunity via vaccines with other once prevalent viruses (measles, polio, chicken pox). The goal now is to achieve worldwide herd immunity from COVID as quickly as possible. While medical experts are not in complete agreement as to when this goal will be attained, typically herd immunity exists when 50% – 90% of the population is immune.2 Some of the less populated states in the U.S. (such as CT, SD, ND, HI, IA, AK) are already closing in on 60% herd immunity when you add together the percentage of the population with COVID antibodies due to prior infection and the percentage that is fully inoculated.

As you might expect, the generally positive tone of this news helped to ignite economic activity this quarter. Some states are relaxing their public health restrictions while others have begun to eliminate their restrictions altogether. With businesses reopening and economic activity heading back towards more normal levels, unemployment continues to fall—currently at 6.2% with some economists projecting a further decrease to around 5% by year end. In fact, the most recent jobs data surpassed expectations to the upside—as more people reentered the workforce. Even the travel industry is showing signs of life, with airline capacity levels and bookings for future trips both on the rise.

Reaction of the markets

Not surprisingly, equity markets have taken their lead from this resurgence. Major U.S. equity indices are now at or near all-time highs and many analysts and market commentators are fairly bullish on equities for the time being. The recently passed $1.9 trillion Biden stimulus package has further buoyed U.S. financial markets as has the prospect of an imminent multi-trillion-dollar infrastructure bill.

As the market advances, we are also experiencing a significant sector rotation as investors continue to reduce their appetite for technology and other high-growth sectors that led the market for much of last year, and move into ‘epicenter’ stocks (e.g., financials, energy, materials, and industrials) which have lagged the broader market for a while. In addition to a sector rotation, value stocks (as a group) are now outperforming growth stocks and small- and mid-cap stocks are outperforming large-cap stocks. These are trends that began last fall following vaccine efficacy announcements and have continued to accelerate in 2021.

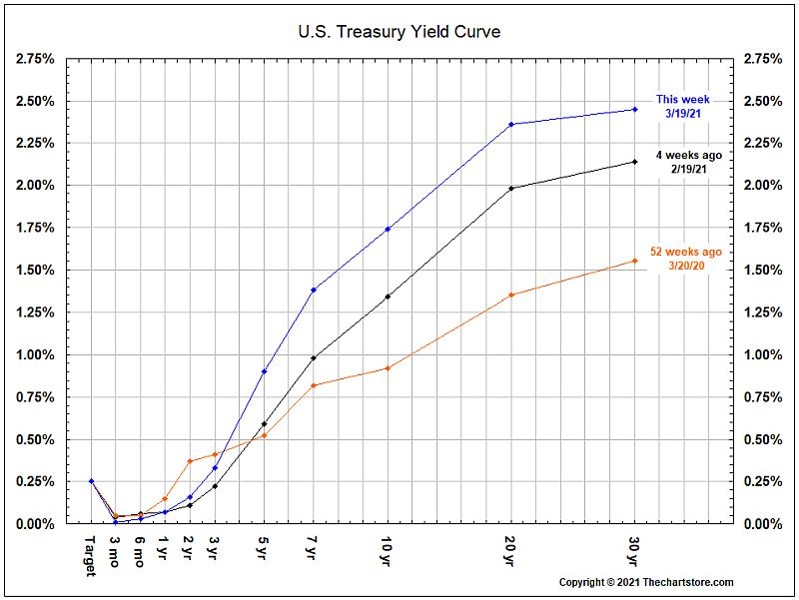

Over in the bond market, the yield curve has been steepening—with intermediate and longer-term bond yields rising. As you can see in this U.S. Treasury yield curve chart below, longer-term yields are significantly higher than they were a year ago. The yield curve has also returned to a more “normal” shape with longer-term bonds rewarding their owners with higher yields. Although inflation is not yet problematic, there is some concern that rising bond yields may be the bond market’s way of signaling some concern that inflation could be coming.

The broader economic impact

The Federal Reserve recently noted:

Following a moderation in the pace of the recovery, indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. Inflation continues to run below 2%. …With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well anchored at 2%.3

For now, the federal funds rate remains pegged at 0% – 0.25%. Also, the Fed continues to buy bonds—one of its other key monetary tools—to inject more money into the economy.

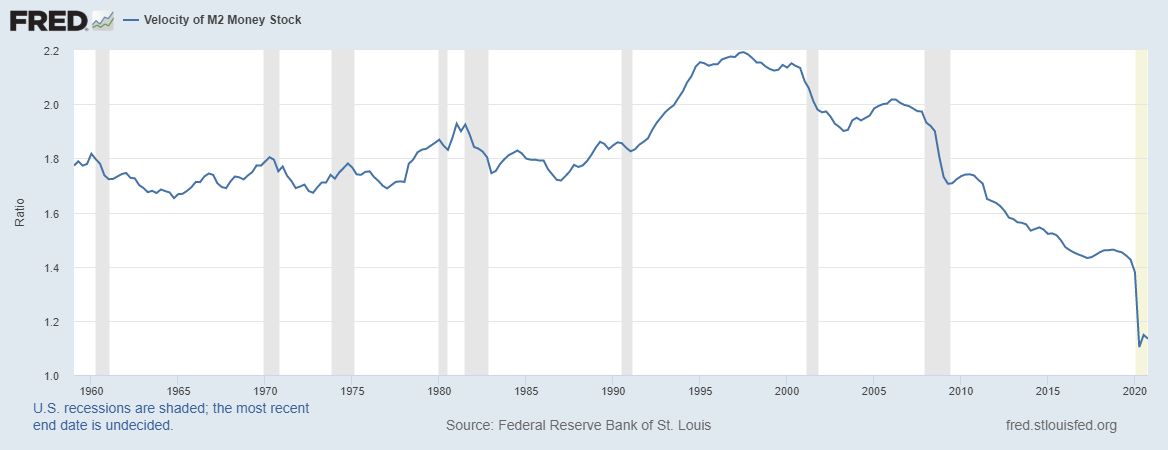

At the moment, however, much of this money appears to be sitting in bank accounts rather than circulating through the U.S. economy. In fact, much of the prior stimulus money paid out in 2020 is also sitting in bank accounts and not circulating through the economy as intended. As you can see in the velocity of money chart below, the velocity of money (i.e., the frequency with which a dollar passes through the U.S. economy) has remained uncharacteristically low since last March.

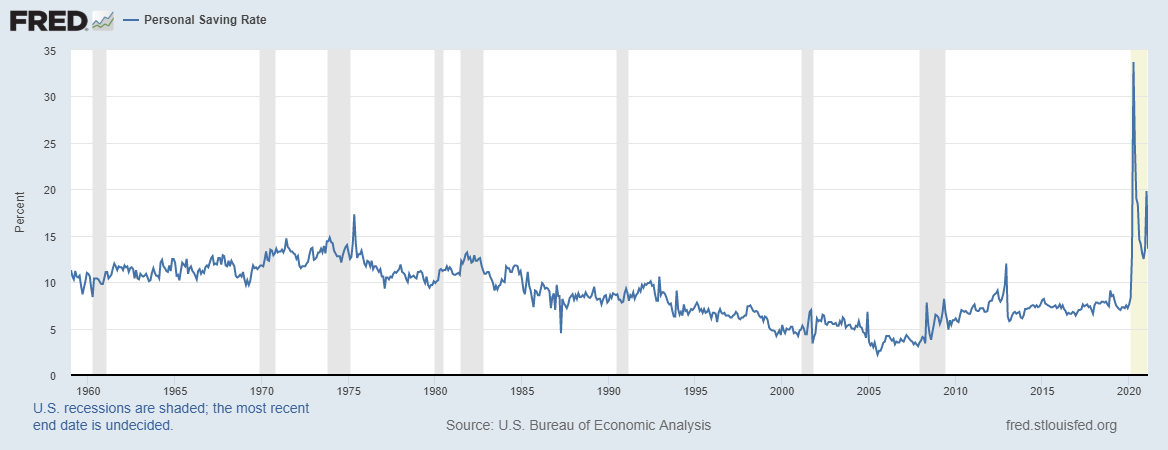

While the velocity of money is low, the personal savings rate in the U.S. is quite high. As you can see in the chart from the St. Louis Federal Reserve, the personal savings rate in the U.S. is significantly above the 5% – 15% range where it has been since the late 1950s.

This suggests people are saving some, if not all, of their stimulus money and have not maintained, or resumed, their prepandemic spending. It is possible that as the U.S. and the world reopen and the pandemic eventually fades away, this saved money will quickly flow into the U.S. economy and create inflationary pressure. Will inflation be an inevitable outcome—especially given the huge amounts of stimulus injected into the U.S. economy and economies overseas during the past year?

As the economy continues to reopen and consumers begin to revert to their usual spending habits and activity levels, expectations and estimates for GDP growth are being steadily revised upward. The Organization for Economic Cooperation and Development just doubled its estimate for 2021 U.S. GDP growth to 6.5%. A recent Wall Street Journal survey of 60 economists revealed a consensus estimate of 5.94% growth.

While these estimates are encouraging, the cost and impact of COVID can’t be swept under the rug. The International Monetary Fund recently determined that global GDP contracted by 3.5% in 2020 as a direct result of the pandemic. This translates into roughly $28 trillion of lost global output for the year. At the same time, massive and worldwide fiscal and monetary stimulus programs were implemented at a cost of more than $13 trillion.4

Here in the U.S., on top of the $3.9 trillion deficit increase during the previous administration, the recent passage of Biden’s $1.9 trillion American Rescue Plan Act of 2021 has added more fuel to growing deficit/debt/inflation concerns. This is especially true in light of evidence suggesting that much of previous COVID-related stimulus money is still unspent. Since the start of the pandemic, individuals have managed to save an additional $1.6 trillion—an indication, as previously mentioned, that rather than circulating through the economy, much of those funds are sitting in bank accounts.5

Add to this the potential for a major $2 trillion infrastructure package (which is currently being discussed), and it’s difficult not to wonder how all the recent stimulus won’t be inflationary over time or how the mounting debt burden won’t require higher taxes to offset it. At present, inflation remains fairly low (1.7% as of February 2021) but may begin to rise over the next year or two as the velocity of money accelerates.

Looking to the future

It may be years before we fully grasp the economic, political, and social ramifications of the pandemic. What will be the long-term damage wrought by a year of school closures and far less structured remote learning? Some estimate that as many as 3 million ‘missing children’ aren’t actively participating in public school education across the country. Already, economists are trying to calculate the long-term economic impact of this chronic educational absenteeism combined with significant regressions and backsliding. A recent Brookings Institute study estimates that COVID will likely result in the average student experiencing a lifetime earnings loss of more than $21,000.6

Similarly, it remains to be seen how businesses will reassess their commercial real estate needs post-COVID. Will the ‘new normal’ involve a far greater acceptance of remote work arrangements, and will this translate into a major reduction in corporate/commercial space needs and a resulting real estate market glut? Similarly, the demand for residential housing in many suburbs and smaller towns is mounting as city-dwellers look to escape the high population density of larger cities.

On the home front, post-election political tensions remain on edge. From a geopolitical perspective, U.S.-China relations continue to be on delicate footing, and questions surround both the political and economic future of Germany (as well as the stability of the EU) after Angela Merkel steps down as German Chancellor later this year. Combined with the inflation/deficit/debt unknown, it all adds up to a considerable amount of economic and geopolitical uncertainty that needs to be factored into investment decisions.

As always, there are many uncertainties here and overseas that have the potential to impact financial markets and the economy both positively and negatively. While the uncertainties themselves change over time, the existence of uncertainties is a constant. Fortunately, we seem to be gaining more clarity around COVID—the biggest unknown of the last year. COVID infection and death rates are steadily falling. Vaccines are being rolled out and more effective COVID treatments are underway.

Overall, as the COVID pandemic eases, economic activity is accelerating. US financial markets seem to have endured a once-in-a-generation stressor with minimal projected adverse consequences to date. However, the U.S. economy and the economies of many other nations may be left to grapple with yet to be seen longer-term ramifications of the pandemic. Higher taxes and inflation may be an unintended outcome of the stimulus injected into economies around the world.

It’s been an unbelievable year in many ways. We recognize that for many of our clients this has been a stressful and unpleasant 12 months. We are hopeful that better days lie ahead for all of us. The resilience and adaptability of the American economy should prove highly beneficial as we look to the future. If you have any questions about what we think might happen this year or if you would like to talk about your personal financial situation, please reach out to your BLBB financial advisor at 215-643-9100.

1. & 2 https://www.jhsph.edu/covid-19/articles/achieving-herd-immunity-with-covid19.html

3. https://www.federalreserve.gov/monetarypolicy/files/monetary20210317a1.pdf

4. “World Economic Outlook Update,” International Monetary Fund, January 2021

5. “Personal Income and Outlays,” U.S. Commerce Department Bureau of Economic Analysis, January 2021

6. “Wages and GDP lost due to COVID-19 school closures,” Brookings Institute, August 2020